There were some in Australia’s coal generation industry that thought the market operator was kidding itself when it suggested all brown coal generators could close within a decade, and that the remaining black coal generators would all be gone within another ten years.

But another six months of feedback from its more than 1,500 stakeholders has failed to shift the modelling from the Australian Energy Market Operator in its Integrated System Plan.

Its most likely scenario, “Step Change”, still assumes 83 per cent renewables by around 2030 and the exit of the last brown coal generators by 2032.

The step change scenario is still well ahead of what has been formally announced by the coal asset owners, but these seem to be hanging around waiting to see the lay of the land, particularly if states and territories approve so called “capacity payments” for existing fossil fuel generators.

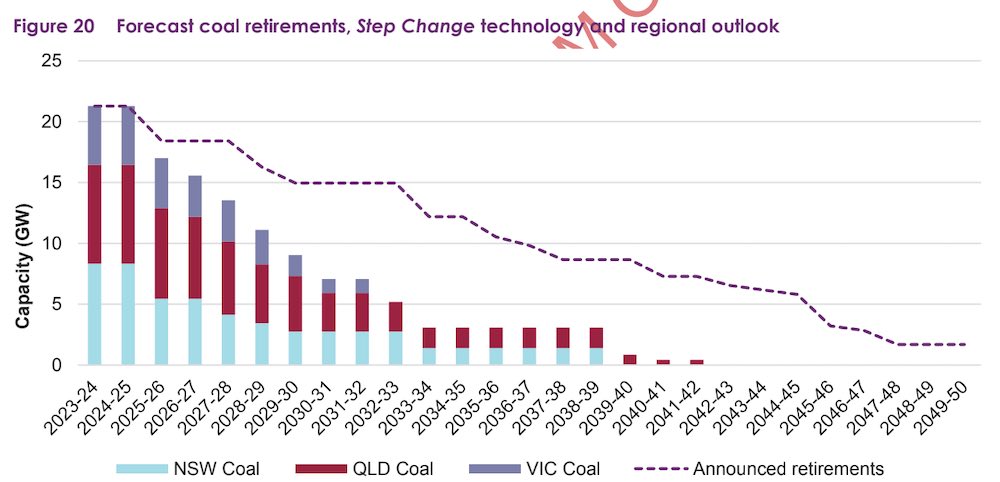

The step change scenario assumes all brown coal gone by 2032, all NSW coal generators by 2038/39, and the last Queensland generators by 2041/42.

Some coal boosters had rubbished such predictions, but AEMO boss Daniel Westerman says the assumption stands, given the huge amount of consultation with more than 1,500 industry stakeholders over the past two years, and in the six months since the draft.

But the exit of coal could be quicker than “step change” in the scenario considered by most to become the “most likely” the next time the ISP is updated by 2024, the so-called “hydrogen superpower”.

That modelling, as per the draft released in December, assumes that Australia’s coal generators are all gone within a decade, and that the share of renewables by the early 2030s is in the high 90s (per cent of generation).

According to the AEMO ISP, just over 50 per cent of stakeholders agreed that the step change scenario was the most likely, but a further 17 per cent went further, saying that “hydrogen superpower” is more likely.

Many more believe that within a few years hydrogen superpower will displace step change as the most likely scenario as the pathway to green hydrogen becomes clearer.

The current step change scenario assumes minimal green hydrogen production connected to Australia’s main grid by 2030 – a tiny amount for domestic use and nil for export – but that is likely to be superseded by developments.

Granted, the biggest projects – such as the Asia Renewable Energy Hub in the Pilbara, the Western Green Energy Hub in south of W.A., and the 20GW Sun Cable project in the Northern Territory will not be connected to the main grid.

But there are plenty of other green hydrogen projects, albeit on a smaller scale, being proposed around the main grid, in all states.

The hydrogen superpower scenario assumes around 46TWh of green hydrogen consumption, including green steel, by 2030.

That encourages significant amounts of new wind and solar into the grid – assuming the grid connections are available – and pushes out coal, which is reduced to just six per cent of generation by 2030, and is completely gone a year or two later.