Dramatically higher prices, intermittent liquidity, stronger, yet ultimately below expectations supply figures, major changes to scheme rules and plenty of grumbling on the pace (or lack thereof) of new activity-development have characterised the beginning of what appears set to be yet another extraordinary year in the VEEC market.

When the dramatic shakeup of Australia’s largest energy efficiency market was announced in late 2019, which would begin the phase out of the scheme’s main source of supply (lighting upgrades), the Department of Environment, Land, Water and Planning foresaw increases in the VEEC price would lead to greater uptake of the many hitherto unused activities, which would be needed to fill the gap left by the dramatic reduction in VEEC supply that would ultimately result from lighting’s departure.

With an increase to the scheme targets, significant increases to the shortfall penalty and progressive reductions to the emissions factor all also set to be adopted, uptake of other existing activities along with the development of new ones, have become a critical focal point for market observers.

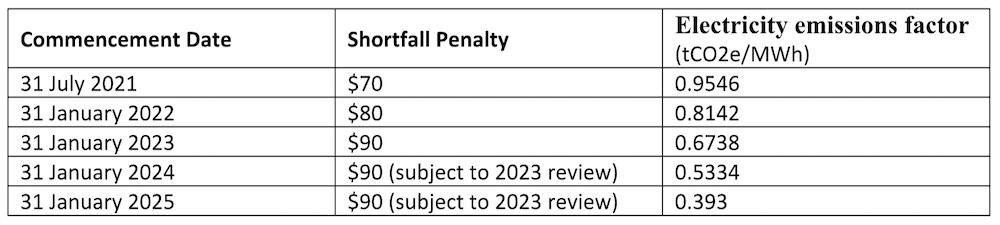

Despite the Minister committing to ‘minimal changes’ to the scheme in 2021 following the stunning impact of COVID on the Victorian economy and the suspension of residential activities under the scheme across most of the year, the full suite of changes originally committed to (with some adjustments) will take place this year. This includes an increase in the scheme’s penalty price from $50 to $70 for 2021, increasing to $80 in 2022, and $90 in 2023, which will ultimately increase the VEEC market’s price ceiling from circa $70 in 2020, to circa $100 in 2021, $115 in 2022 and $130 in 2023.

Along with a major reduction to the scheme’s primary source of supply (Schedule 21 Residential Lighting), which will see a 35% reduction in the number of VEECs per upgrade take effect on 30th June (before the activity is phased out altogether on 31st January 2022), there was also a 15% reduction in the abatement factor for Schedule 34 Commercial Lighting on the 31st March, with a further 33% reduction coming on 31st January 2022 and the full phase out completed one year later.

The emissions factor changes, which reduce the number of VEECs created per install for all methodologies, will proceed with circa 15% reduction from the current figure of 1.09 on 31st July this year, with further reductions to come on 31st January 2022 and each year beyond as per the table below.

These changes are occurring because the figure currently being used to reflect the emissions intensity of the Victorian grid is outdated and inaccurate, set more than a decade ago before the transition to renewable energy had gathered momentum. It needs to be reduced to reflect the fact that emission reductions from energy efficiency upgrades are decreasing as the share of renewable renewable energy in the grid grows. Reducing the emissions factor, however, is akin to increasing the target, because it increases the number of upgrades that need to be undertaken to meet the same target.

So, what of these other existing activities, are they ready to go? The challenge for many of them appears that their uptake is hindered by barriers outside of the VEEC price, namely getting individuals that are operating in the relevant industries (but not currently engaging with the scheme) to opt into a regime which will require onerous compliance requirements in exchange for (often modest numbers of) VEECs.

Certificate creation across Australia’s environmental markets has always been dominated by the lowest hanging fruit. Whether it be energy efficiency or renewable energy markets, the activities with the biggest bang for your buck are where the volume is created. As part of these changes, the Department is intent on trying to alter that, to encourage VEEC supply to come from a broader spectrum of activities.

To some extent, there are signs of this occurring in recent months with creations from hot water, shower heads and in-home displays all increasing. Yet these increases are small in comparison to the vast reductions to VEEC supply that will result from the phase out of lighting in the coming months.

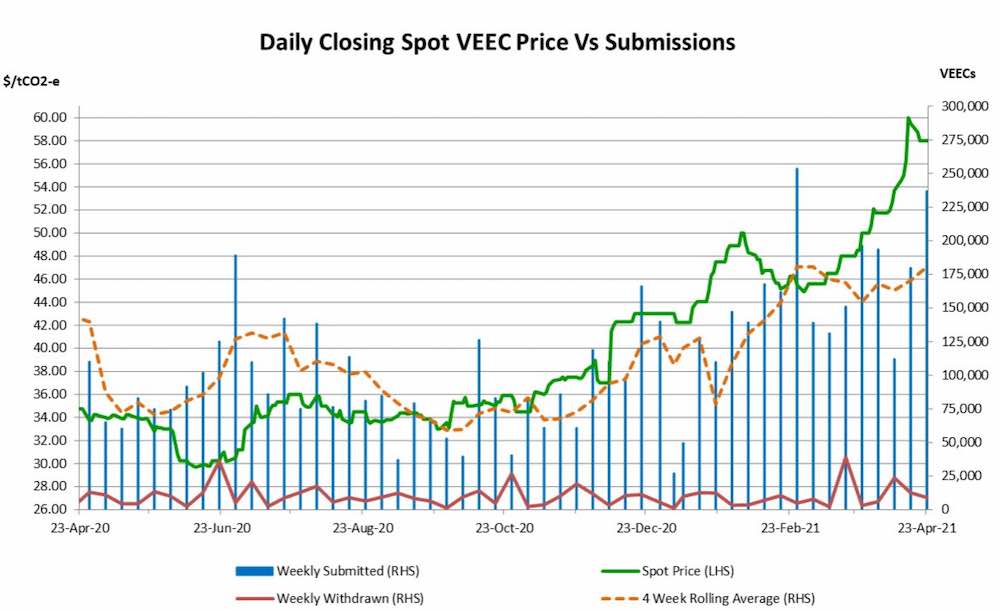

The above synopsis can go a long way to explaining the current situation in the VEEC market, yet as is often the case, a picture speaks a thousand words. And the VEEC price chart above tells a stark tale. With all the above issues swirling around, the spot VEEC price jumped in December from the high $30s to the low $40s and, after a period of consolidation across January, saw another sharp increase, which took the market to an all-time high of $50 in early February.

This circa 20% jump happened on thin liquidity, with sellers very hard to come by at the time. Volume did ultimately emerge at the $50 mark, with forward activity during February accounting for one of the busiest periods of trade in recent times, as the market softened back into the mid to high $40s. Yet once again across March and April, liquidity dried up to some of the worst levels seen in recent years and the price again began to climb, easily clearing the $50 market on its way to a high just above $60.

The repeated periods of low liquidity reflects the fact that most current market participants have already sold forwards for this year, for which they are struggling to create sufficient VEECs. And there have simply not been any new activities, or sufficient uptake in other existing activities, that has provided them the confidence to sell against expected future output.

The Department now finds itself in the unenviable position of needing to find ways of encouraging the uptake of these currently unused activities, whilst trying to fast track the introduction of new ones, the next of which will only come online sometime in the second half of the year. It has not been helped by the slow pace of release of information from Solar Victoria on the heating and cooling rebate that was announced as part of the Andrews’ Governments COVID stimulus plans last year. Whilst the rebate does not relate directly to VEEC creation, should companies undertaking heating and cooling upgrades remove eligible older systems and follow the correct compliance procedures, they will be eligible to create VEECs.

Another challenge presented by this transition is that existing participants looking to gain accreditation under new activities and new participants wanting to get into the scheme, face considerable delays as they work through the process of obtaining those accreditations. In many instances this is taking 6-12 months or more, as the burden mounts on the existing resources that are available to the scheme regulator. It is hoped that the sizeable increase in the budget allocated to the scheme (circa $20m) announced last year will help to alleviate this issue and assist in avoiding a bottleneck if new opportunities in the scheme are to be pursued.

With its Victorian counter-party attempting to manage the challenges of its transition away from lighting, the NSW government has taken a more subtle and prolonged approach, with the release of the future target profile done without fanfare and no further information emerging on the phase out of commercial lighting.

The New South Wales ESC market has always been a more conservative affair than its southern neighbour, with changes generally tending to be more gradual and overall-ambitions more limited. Some view this as a sensible approach to policy making, whilst others view it simply as a missed opportunity.

In recent times, there have been aspects of both approaches in the decision making surrounding the scheme. For starters, the work being undertaken on its new peak demand reduction scheme is pioneering and will likely yield positive results for energy consumers and the grid. The market is eagerly awaiting the detail behind this new scheme and the opportunities it will create.

The announcement that the ESC market’s target would increase from the peak of 8.5% in 2021 to 13% in 2030 was made early last year, but the wait for confirmation of the target’s profile dragged into early 2021 when participants eventually realised the changes had been brought into effect in December, without an announcement. Following the approach previously adopted, the target will increase 0.5% per annum out to the 2030, where it will plateau, interestingly, until 2050. The surprise longevity of the scheme has been welcomed by many.

On the issue of commercial lighting and its phase out, nothing further has been heard since an independent consultant proffered a timeline of mid 2022 to begin the process. The developments in Victoria however, and the challenges arsing from filling the void left from lighting’s removal may be giving decision makers pause for thought. A scheme which is not driving energy efficiency upgrades, but which is increasing prices is not a great look.

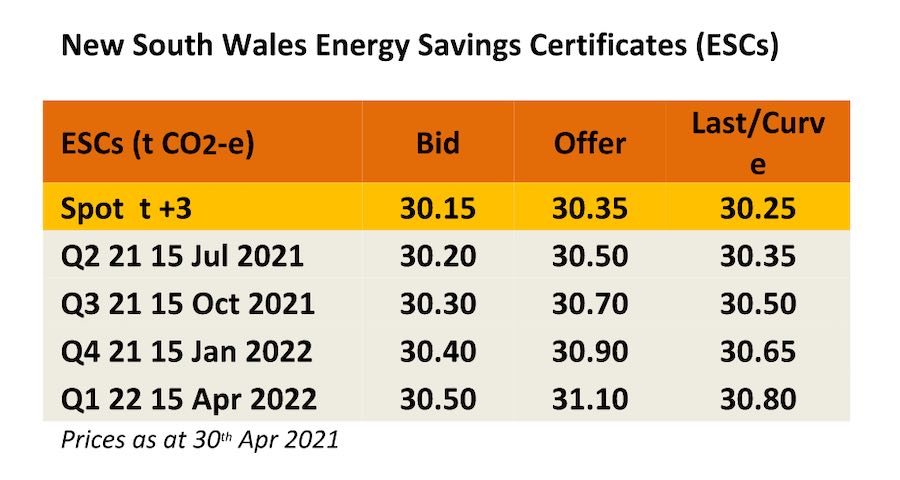

Following an extended period of stability from September to early December, in which the spot ESC price remained closely tethered to the $27.00 level, the market began to climb in the final weeks of 2020. Having surpassed the $28 mark before Christmas, the next leg up came in late January surging to a high of $31.50 in the first of two volatile moves, both of which were promptly undone. From late February stability returned, with the market spending the next two months either side of the $30.00 mark.

As is usually the case, the early part of 2021 has yielded healthy registration volumes with a weekly average of 86k produced at the time of writing. On lookers will however be looking forward to June with the cut-off date for approval of 2020 vintage ESCs, an event that in recent years has seen incredibly large volumes of ESCs emerge.

At the time of writing circa 4.33m ESC had been surrendered against the 2020 obligation expected to be in the region of 4.5m. Assuming that 4.5m is ultimately acquitted, that would leave circa 5.2m ESCs to meet the 2021 target, which is also likely to be around the 4.5m level. Hence there are already enough ESCs in existence to meet the 2021 target, with circa 700k going towards the 2022 target.

Marco Stella is Senior Broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services, across all domestic and international renewable energy, energy efficiency and carbon markets.