The world’s first liquid hydrogen shipment departed from Victoria, Australia on Monday, on board the world’s first liquefied hydrogen carrier, the Suiso Frontier. It is destined for Japan, in what will server as a vital test for the viability of global liquid hydrogen supply chains.

That it is landmark shipment is not new. And nor is the controversy around the source of the hydrogen it is carrying – gasification from brown coal.

But just to highlight how new and uncertain the technology is, S&P Global Platts – in a detailed analysis of its implications – felt obliged to add the rider “Do note that the vessel has not successfully completed the voyage”.

Still, the 116-metre vessel – with a capacity of 1,250 cubic metres of liquid hydrogen – is on a voyage of “historical significance”, according to S&P Global Platts, because shipping hydrogen could be the key to decarbonising Asia’s largest economies, and a cornerstone for Australia’s plans to become a global supplier of hydrogen, hopefully green.

“The symbolic value is huge, because until now moving hydrogen from country to country by vessel was just a theoretical possibility,” said Anton Ferkov, a pricing specialist on hydrogen content at S&P Global Platts.

“This is all connected with the price of producing hydrogen itself, with the potential to see lower prices in the future for hydrogen produced via electrolysers and renewable electricity.”

Ankit Sachan, a hydrogen and energy transition analyst with the same company, says the project will determine the feasibility of liquid hydrogen supply chains in the long term and will also help in studying the technical and commercial aspects of liquid hydrogen trades.

These markets could be significant. Sachan estimates that by 2030, South Korea plans to consume around 3.9 million tonnes a year of hydrogen in transportation, domestic use and power production, but will likely only be able to produce around 1.9 mt/year.

“Similarly, Japan plans to consume around 2-3 million mt/year by 2025 and 20 million mt/year by 2050. Given the proximity of Australia and availability of large renewable resource, it is well placed to cater to this clean energy demand.”

But there is still a long way to go before any potential liquid hydrogen supply chain can evolve far enough to become both environmentally friendly and cost effective.

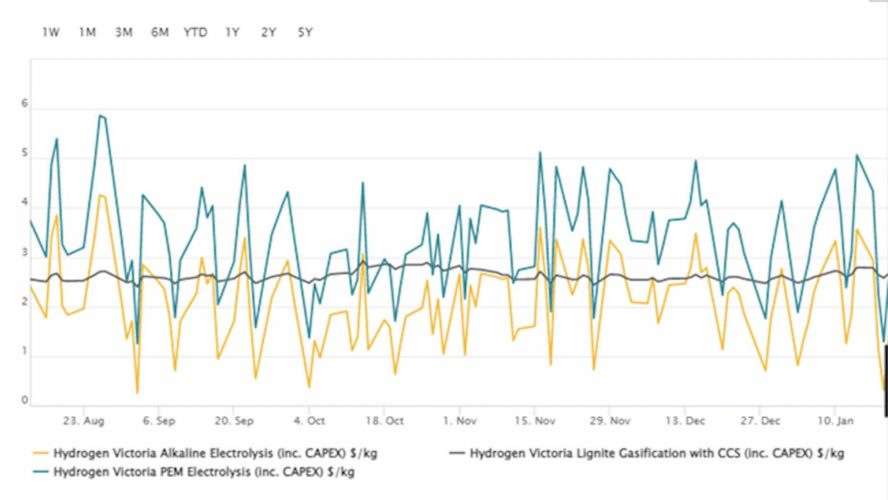

As can be seen in the graph below, provided by S&P Global Platts, the current cost of hydrogen produced through gasification from coal and using carbon capture and storage is much more stable than electrolysis options.

That’s because electricity prices tend to be more volatile, although that might change when and if production at the scale being considered by the likes of CWP Global and Andrew Forrest’s Fortescue are delivered.

There are also questions about the potential scalability of transporting liquid hydrogen that must be addressed as well.

“The temperature at which hydrogen liquifies (-253°C) is much lower compared to natural gas (-160°C) which means energy consumed to liquify hydrogen is also higher compared to LNG,” said Sachan. “However, the energy density of hydrogen is around 40% of natural gas (on volumetric basis).

Because of this, long-distance transportation of hydrogen will be expensive compared to LNG. It is seen as the achilles heel of the technology.

“To liquify hydrogen at minus 253 degrees Celsius an enormous amount of energy is being used, which would add to the costs of liquified hydrogen as well,” he said.

“Hence, it will take some years to see commercial scale vessels of this very special type being used. The final costs of building and operating such a vessel are still largely unknown, but this pilot ship might shed more light on that.”

The transportation costs could be brought down by transporting ammonia, a derivative of hydrogen, with 35% more energy density than hydrogen and much lower liquefaction temperatures (-33°C). However, transporting ammonia will require a conversion facility at the source and a cracking facility at the destination.

Similarly, according to Ferkov, “liquified hydrogen would compete with ammonia and methylcyclohexane as a carrier to transport hydrogen molecules.

“However, there are additional costs associated with taking out the hydrogen molecules from ammonia and methylcyclohexane as well. Some industry experts are of view that we might have several different methods of hydrogen transportation emerging at the same time.

“However, when used for power generation, the option being widely considered now is the use of ammonia, with no need to convert it back to hydrogen as ammonia can be burnt as a fuel on its own without releasing any carbon.

‘The cost of transporting ammonia is far below liquified hydrogen as the temperature to liquify ammonia is only minus 33 degree C, with a global infrastructure to move and trade ammonia already in place.”