New data has illustrated how the shift to large- and small-scale renewable energy in Australia is starting to chip away at the country’s infamous market oligopoly, the one that has seen a handful of companies wield nearly all of the market power and rake in windfall profits.

The data, contained within the Australian Energy Regulator’s 292-page State of the energy market report, shows the transition from a system dominated by large thermal generators to one with an increasing amount of distributed renewables is gradually changing the dynamics of the market.

Where once there used to be virtually no competition in the generation markets of any of Australia’s states or territories, there is now at least some, and particularly in the high renewables-advanced states such as South Australia.

This is good news, as the AER report points out, because this “slightly reduced market concentration” makes it less likely that big players can engage in “uncompetitive behaviour” like opportunistic bidding.

As the report describes it, “opportunistic bidding” happens when generators deliberately rebid capacity late in a trading interval to capture high prices, while giving competing generators little time to respond.

As RenewEconomy has reported, both the Australian Competition and Consumer Commission and the AER are in the process of investigating various generators to determine whether some of their behaviour might amount to uncompetitive market gaming.

Under the spotlight is the federal government owned Snowy Hydro’s Colongra gas generator, which effectively withheld its capacity from the energy market over the course of multiple days in May of this year when high prices led to a New South Wales aluminium smelter shutting down for a short period.

Along with changes to market rules that will make it harder for this kind of practice to take place, the AER notes that the “dilution” of ownership in the market – and in particular the entry of new, fast-response resources such as big batteries – is starting to change the game.

“The transformation of the market from a system dominated by large thermal generators to one that incorporates an increasing volume of widely dispersed renewable generators is having an effect on competition dynamics,” it says.

“The transformation has also affected how participants offer their capacity, price signals for new investment, and markets for managing fluctuations in system frequency.”

But change remains slow, and much work still needs to be done: “Significant entry of new large scale solar and wind generation has slightly reduced market concentration,” the report says.

“Despite this, the output of a few large generators is necessary to meet demand in most regions a significant proportion of the time, particularly during evening peaks.”

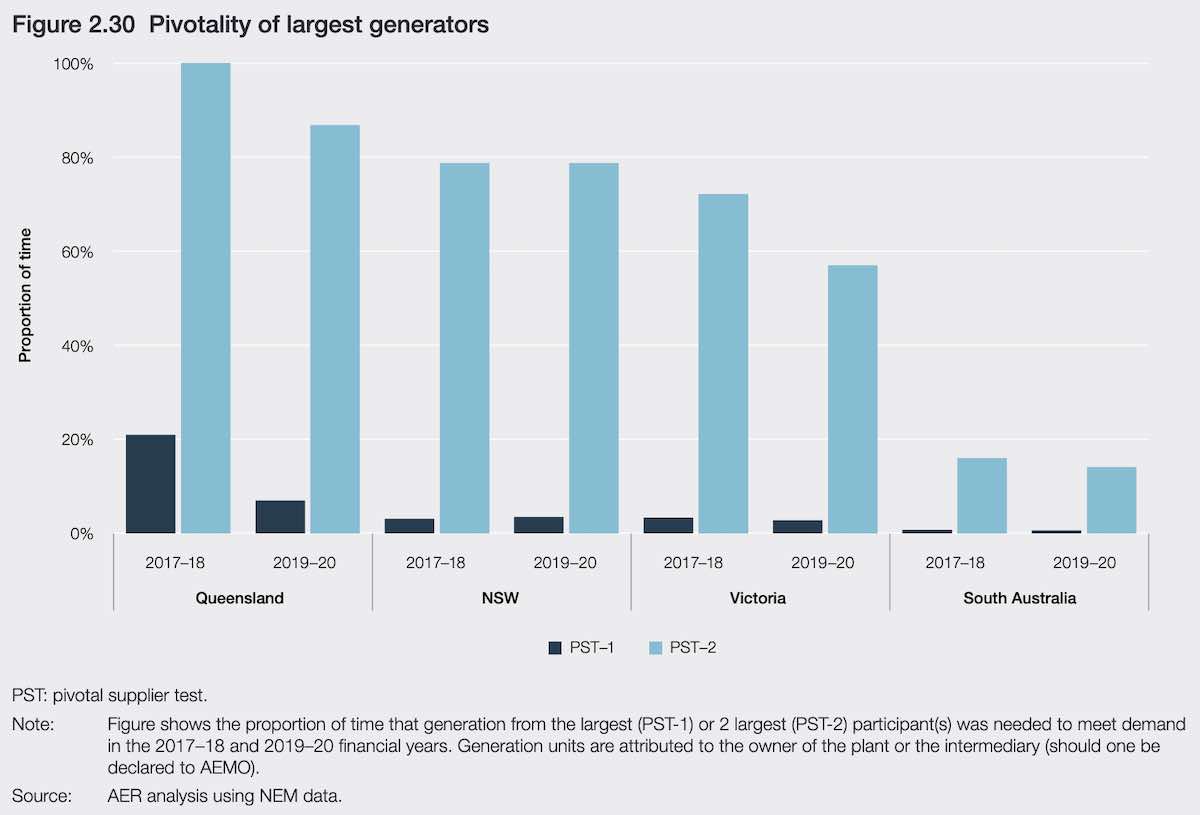

The chart below measures the extent to which one or more market participants is “pivotal” using the “pivotal supplier test” or PST.

“A participant is pivotal if market demand exceeds the capacity of all other participants, accounting for possible interconnector flows,” the report explains.

“In these circumstances the participant must be dispatched (at least partly) to meet demand. Measuring the extent to which the largest (PST‑1) or 2 largest (PST‑2) participants are pivotal is a useful indicator for identifying the structural elements of market power.”

The chart also shows, however, that in most states – with the notable exception of NSW – some progress is being made.

In Queensland, for example, CS Energy and Stanwell Corporation are shown to have been jointly pivotal around 87% of the time in 2019–20 – down from 100% of the time in 2017–18.

“The entry of large scale solar and the creation of CleanCo meant that this change occurred during daylight hours,” the report notes. “In the evening peak, when demand is highest, these generators remain pivotal 100% of the time.” (As can be seen in the jump in prices since the Callide C coal explosion).

In Victoria, generation from the two largest participants was needed to meet demand 58% of the time in 2019–20 – down from 72% in 2017–18. Depending on availability, the largest suppliers were most likely to be AGL, Snowy Hydro, Alinta Energy and EnergyAustralia.

In South Australia, the poster child for renewable integration, generation from AGL and Engie was needed to meet demand just 14% of the time in 2019-20 – down only slightly from an arleady impressive 16% in 2017-18.

“Significant wind resources in the region mean there is large variability in what other participants can provide. As a result, these generators are most needed at times of low wind output,” the AER says.

Meanwhile, in NSW, the report shows outcomes were unchanged from 2017-18 to 2019-20, with generation from the two largest participants needed 79% of the time.