Over the past five years, big gentailers (the big utilities with combined generator and retailer businesses) have lost customers, and volumes. And the volume per customer is also down.

This, together with regulatory changes, has led to big falls in gross profits. Yet, despite this, electricity retailing is still quite profitable – if you have enough scale.

The industry has had a terrible image, but in the past two years net promoter scores, a key gauge of the customer relationship, have shown good improvement, and Christine Corbett at AGL Energy deserves a lot of credit for that. It’s the same at Origin Energy, and probably Energy Australia.

In my opinion, none of the Big Three gentailers has a good electricity retail marketing strategy. Certainly, none have moved to selling only green energy or marketing that to attract customers and build brand loyalty, but they are slowly moving in that direction.

On average, Origin Energy charges its customers ($92/MWh in FY21) for the energy component of the electricity bill. This clearly supports, in my opinion, the prospect that a fully renewable portfolio could lead to lower costs and provide margin upside to a large gentailer.

To my way of thinking, the single most astonishing shortcoming of the Big Three gentailers is the way they have turned their nose up at investing in wind and solar, the cheapest form of energy.

We think AGL CEO Graeme Hunt is mistaken in placing confidence in AGL’s low cost position in coal generation. That only matters when there is no carbon cost and makes the business slow to react. Having the last horse when everyone is driving cars is not an advantage, it’s a problem.

Each of these gentailers could have been like NextEra in the USA, but building skills in wind and solar has always been beneath them.

To this day, to my knowledge not one director on the boards of AGL, Origin or Snowy has a deep background in renewable energy development. AGL’s investment in Tilt is as close as it gets.

Electricity volumes per consumer which have been falling for a decade, should double and could treble as households electrify. In fact the volume opportunity to retailers coming from EVs is a potential massive kicker that absolutely is not priced into gentailer shares.

The data continues to suggest that a scale customer base, i.e. at least 1 million customers and preferably 2 million customers, is worth perhaps $1500 each customer, and that’s on today’s volumes. That number could go up a lot with household electrification.

The AER does not collect national data for retailers

Incredibly enough there is no up-to-date official data on the National Electricity Market in terms of numbers of customers, market concentration, or market share.

The AER which regulates networks to within an inch of their lives, does publish an “Annual Retail Market Report,” but it excludes Victoria, historically the most competitive retail state.

Victoria, for reasons best known to Victorians, does not publish actual customer numbers in the annual report of the “Victorian Energy Market Report,” but instead contents itself with telling the few who read the report that Victorians are a bit silly for sticking with large retailers. But in the end that’s their choice, and that nevertheless the HH competition index is at no more than 20% and declining (where 100% is a monopoly).

The AEMC used to publish a retail report but has abandoned the effort due to prioritising its many other reforms, some of which take a long time and have very few, if any, supporters (see locational marginal pricing).

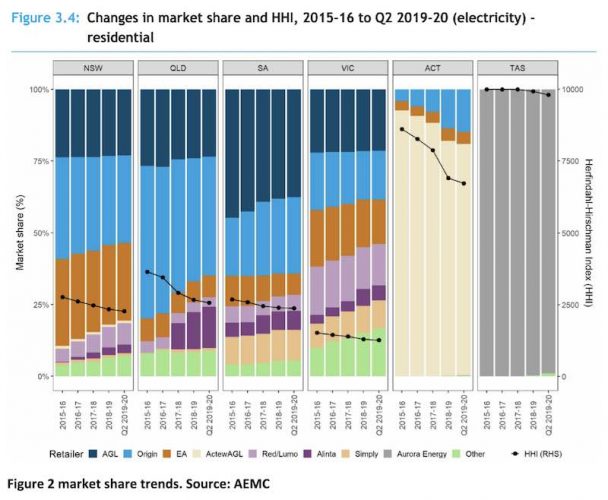

Still, if we were to use the AEMC graph as a broad indicator…

The observations are:

1. The Big Three have lost market share in NSW and Queensland, but had about a 75% market share. In Queensland that likely reflects government ownership of generation and the private sector’s unwillingness to go big in a state where government policy can change and Queensland generators can decide to squeeze retailers any day of the week.

2. In Victoria, thanks to Snowy (Red/Lumo), the Big Three market share is likely under 60%.

3. If you are interested in merger candidates you might observe the large Origin share and small EnergyAustralia share in Queensland, and the reverse in Victoria, and – at a stretch – how the closure of Eraring and Yallourn might make things between those two more possible.

4. Simply Energy (Engie) is also a player in Victoria and South Australia (but South Australia is a small market).

Big gentailers constantly pedalled up hill. No good marketing strategy

The Big Three have lost a combined 4TWh of volumes in mass market retailing in the past five years. All but AGL have seen customer numbers decline and AGL’s customer numbers have only gone up because of some, in my opinion, low quality customer acquisitions.

Volumes per customer have continued to decline and the decline at AGL has been worse.

I don’t show the large customer volumes, but in general the performance is as bad, or worse, than in mass market.

The big gentailers have struggled against new entrants and against distributed energy and, at the beginning, from consumer energy efficiency brought about by sticker shock. Trends such as LED lighting, variable speed pool pumps and in general more efficient appliances partly offset by ongoing electrification.

The gentailers have fought the decline in various ways. One is to build a more efficient IT system, but that is hard and full of pitfalls. The second way, I think adopted by EnergyAustralia, is just to weed out less profitable customers and focus on retaining the more profitable ones. AGL buys customers and tries to widen the range of services it sells. Origin appears to have focused on niches like embedded networks.

All three are also attempting to get into the behind the meter market via virtual power plants. These are gradually gaining traction. Getting a bigger share of the rooftop market which is already 30% of Summer midday power in the NEM might potentially be rewarding.

It boils down to getting the right to operate the consumer’s inverter and then, further down the track, control of the consumer air conditioning, or pool heat pump, or the consumer EV charging controller. But this is a very competitive space lots of players from networks to retailers to VPP entrepreneurs compete in the space.

In ITK’s opinion, networks are the natural managers of the household inverter but retailers are the ones with the customer relationship and that, in the end, may be the dominant factor.

Beyond rooftop, though, the point is that the Big Three gentailers are almost completely undifferentiated. They have sold a “grudge” purchase electricity to unenthusiastic consumers and pretend to compete on price with a lesser focus on customer service and “reliability.”

Even Origin, which has invested in Octopus and done extremely well so far, doesn’t seem to acknowledge the consumer preference for green electricity.

Electrification offers a way forward

The big retailers are not stupid, and they are not ignorant. The Origin and EnergyAustralia CEOs have many years’ experience and background understanding the trends and the problems.

Therefore, they will know that, ultimately, retail electricity can be a big winner from Australia decarbonising. That’s because there is a strong consensus (which Angus Taylor may need to look up in a dictionary, and Angus, it means we agree on the way forward) that the way to decarbonise is to make the electricity system green, and then to use electricity to replace other sources of energy.

Rewiring Australia’s estimates for the household sector

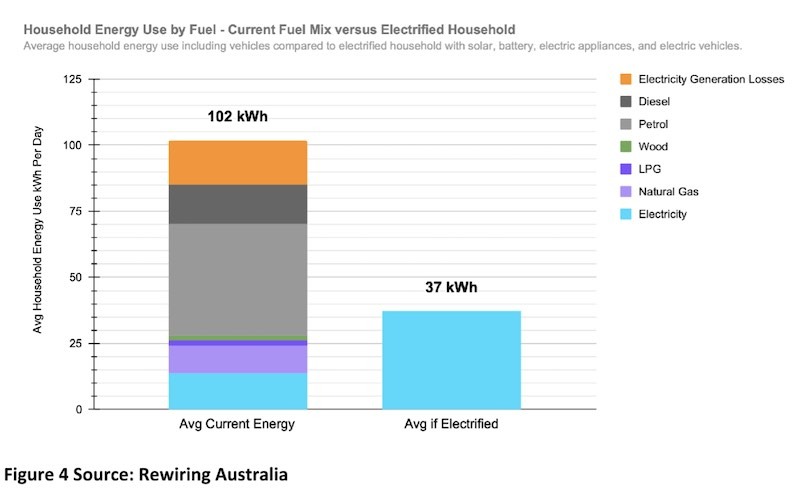

Saul Griffith and team published last year an excellent and detailed report on the potential to electrify household energy consumption. The key graph for the whole of Australia is reproduced below:

Even Angus Taylor and his buddies in the Queensland Nationals should be able to read this chart and appreciate that: (1) Most of the energy Australian households consume is Petrol and Diesel (imported at vast expense to the trade deficit and representing a material national security risk), and; (2) That if we electrify all that household energy, electricity consumption will be close to triple its current level.

And electric vehicles present an immediate and obvious way to do most of the heavy lifting. I mean, it’s so blindingly straight forward. Even if some parts of the Rewiring Australia chart may be harder to achieve than they look, the EV part is very, very doable.

Notwithstanding that a large part of the increase in consumption would be self production from more rooftop solar, a tripling of volumes per household is a wonderful opportunity.

And from the national perspective, think about the energy efficiency gains, and the decarbonisation benefits.

Why talk about retail customers when the Cannon-Brooks AGL bid is about generation?

Whatever value AGL has, it’s not the value of its coal generators, it’s the value of its retail customers. Historically retail customers have been worth about $1500 each and, although that value was reduced by Angus Taylor and his new best friends in the Victorian government when they imposed default tariffs, it remains the case that electricity customers are valuable.

Since the industry started there has been an end-of-rainbow pot of gold for start-up retailers that, if they could just acquire customers for $100-$200 each, build a fancy IT system and not have any bad debts, then the market would value their customers at $1500 and they could sell them when they had, say, 250,000 and go off living happily ever after with their gold star entrepreneur badge.

But the only start-up that actually achieved that was Infratil, which successfully sold the Lumo business it had built from scratch to Snowy. As Darren Miller, CEO at ARENA, can attest, starting your own retailer generally ends in failure.

The only reliable way to get a large retail base is to buy it. Alternatively, if you are a well-funded large generator with previous retail background then maybe you can go from scratch and play a very long game. Alinta and Engie fit into that category.

Retail profitability

Gentailers tend to change their segment reporting every year. AGL is actually king of the re-segmenters and no doubt has a significant head office team with a full time job of segmenting, re-segmenting and reconciling the re-segmentation each year. Despite all its hard work, it still isn’t able to allocate segmented head office overheads between the two businesses to be demerged. However, this likely reflects management trying to allocate costs to meet debt hurdles, etc, rather than any genuine difficulty.

All the big gentailers, including Snowy, sell gas as well as electricity and so admin costs reflect the costs of gas as well as electricity.

And then there is the vexed issue of the transfer price from generation to retail.

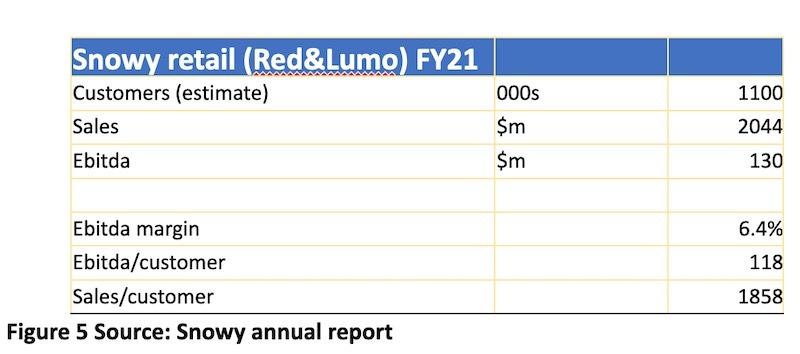

Snowy

In that regard, Snowy’s one-line report in the MD&A of retail ebitda is useful. Snowy states in the formal accounts that “its retailer and generator operate in unison” and therefore are one segment.

This is obvious nonsense, the retail and generation cash generating units at Snowy operate quite separately and that is why the retail ebitda actually is meaningful. Snowy has “over 1 million” customers which we interpret as 1.1m. Still most of Snowy’s customers are in Victoria and even 1.1m customers doesn’t give you the full-scale benefit.

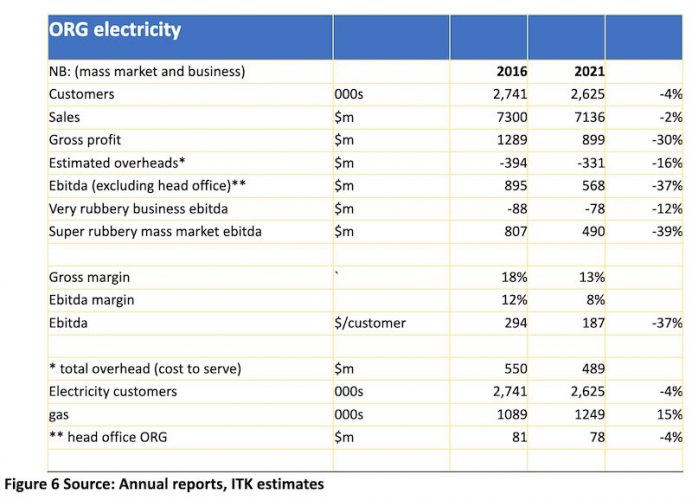

Origin

As near as I can work out, and at the expense of making a few assumptions, Origin, despite a sharp decline, is still making more money per customer and has a higher gross margin than Snowy. In saying that, I have used a rule of thumb based on the historic reports of ERM (now Shell) that suggested gross margin in the business segment of electricity is about $4-$5/MWh.

If it is more than that in Origin’s case then I have overestimated the mass market profit per customer. AGL’s business electricity gross margin is only about $35 million a year.

If however $180-$190 per customer is about right, then it’s easy to see how customers could be worth $1500 or more, each, when they are part of a 2 million strong cohort. According to Origin’s analysis the cost to win or retain a customer is only $36, and having won them they are worth $1500. That is the magic of economies of scale.

Note that these numbers reflect the opex and the fuel costs of Eraring and Origin’s fleet of gas generators, but they don’t reflect the return on capital that these generation investments require, see section 8. If Origin retail bought in all its electricity at a transfer price, margins and ebitda per customer would be lower, but it’s hard to say by how much. In fact, in FY21 for Origin bought in electricity was lower than the cash costs of self generation.

What it means for gentailer strategy

A few years ago the gentailers were quite happy to take advantage of customer inertia to charge “default tariffs” that, in some cases, were just charging what they could.

The federal government and the Victorian government forced gentailers to drop their maximum tariffs down and that’s cost gentailers collectively a few $100s of million of profit.

However, to me, the real message in the prior gentailer strategy was how poorly they thought of their customers.

It was a real life, big business example of the joke my grandfather used to tell me circa 1968 about the shopkeeper that was discussing his ethical problem with his daughter at dinner.

Daughter: What was the ethical problem?

Dad: A customer came in and overpaid $10.

Daughter: What was the problem with that?

Dad: Should I tell my partner?

And the age of that joke suggests businesses won’t learn that true customer loyalty, loyalty given because it has been earned, is a much bigger driver of value that anything else. I am thinking Apple, or Google Maps, or Toyota.

And in my mind, consumers want to be green, they want to do the right thing, they want to be shown how they can benefit from the energy transition, they want a gentailer that represents their values. They want this done at a fair price, but will pay what it takes for the product that gives then what they want.

I haven’t done any focus group research, so I could be well wrong.

My strategy starts with a gentailer, such as “NewAGL,” committing exclusively to green energy, and committing to be the partner of households, encouraging self consumption, but working with them, etc. It’s not a strategy likely to be won in a single year and may well need a takeover of the sort Cannon-Brookes is attempting. But equally the cost of energy and power to the gentailer would be lower than that of competitors, so it’s a low risk strategy.

Why not just buy AGL Australia post-demerger?

In ITK’s opinion Cannon-Brookes might just as well buy the new AGL retail business [AGL Australia] after the demerger and let the coal generation [Accel Energy] die of its economic woes. If you owned New AGL you could in five years get all your electricity from, say, Tilt (PowAR) and make it 100% green.

We know that Tomago aluminium is going green as soon as it can (2028) and that Gladstone Power station will also go green at the end of its current contract, about the same time. Loy Yang A and Bayswater aren’t going to have any customers. Still, that may be too slow and uncertain for Cannon-Brookes.

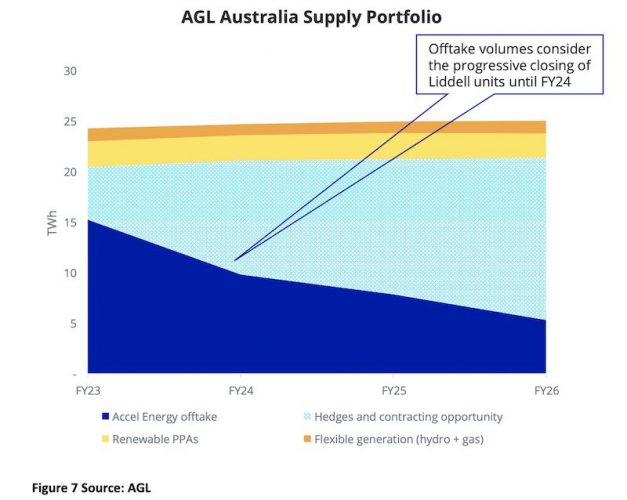

AGL Australia’s obligation to buy from Accel declines swiftly from 15TWh to 5TWh by FY26 and zero a year later. So within the next five years, AGL Australia can source 15TWh of new renewables, or say 6GW of new renewables, or 2GW per year.

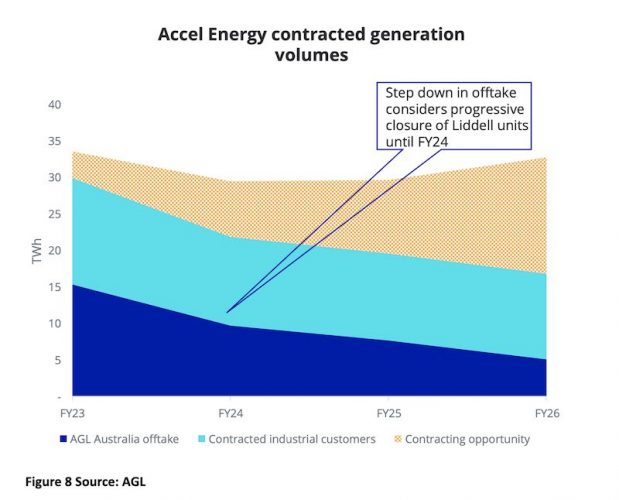

Equally, the potential death of Bayswater and Loy Yang A can be seen from the Accel supply picture:

The majority of the 15TWh of contracted industrial customers is Tomago aluminum (about 8TWh), Portland Aluminium (about 5TWh), and some odds and ends. Rio Tinto has signalled it wants to move its Australia aluminum interests to be largely renewable, although I’m not sure how well understood that is by the market.

Tomago is not controlled by Rio but its shareholders are broadly aligned on this. It will lower Tomago’s costs and maybe attract a price premium, or at least preference. That switch-over will happen from about 2028, if not before.

So an optimist might conclude that within six years there will be no demand for Accel Energy’s coal-fuelled electricity volumes. And that’s before we get to the losses the coal plants are likely to incur in the middle of the day competing against rooftop solar.

Origin is progressing its plans

Meanwhile, Origin and EnergyAustralia are also moving in the same direction.

The sale of Eraring pushes Origin a long way. However, carbon virtue signalling is only part of the reason for Origin to act as it did. Plain economics is arguably just as big a part. Yet without actually presenting itself as a green company, Origin is shifting away from coal and gas as fast as it can.

Origin has invested in a “new age” platform, Octopus (that has tripled in value since ORG investment), has sold Lattice (its gas producing assets), has sold 27% of its APLNG interests, and now is exiting coal generation. That still leaves it with gas exploration in the Northern Territory (but why?) and gas retailing. The remainder of APLNG and its gas peakers.

More to the point, exiting the old world is one thing, finding the way forward in the new world is another. So far Origin has a not insignificant 205MW of VPP, 69,000 demand response customers, 360 EV fleet customers.

Still as Peter Kirby one time CEO at CSR said of the Rinker demerger, Origin is dancing the dance of the seven veils.

Energy costs are high because gentailers won’t own or develop wind and solar

None of AGL, Origin or EnergyAustralia want to own any wind or solar!!!! They are all happy to own pumped hydro, batteries, gas peakers, ordinary hydro; but wind and solar apparently don’t offer high enough returns. Grant King, former CEO of Origin was famous for looking down his nose at wind and solar and then investing in PNG hydro development to be transmitted to Sydney.

But owning wind and solar is, in my opinion, the key to long-term success. Yes, the returns are low, but there is a competitive advantage to be had. A lot of it has to be built and some companies will end up with better sites, will gradually build operational and portfolio expertise and become skilled at the process.

Right now, the big gentailers don’t have those skills. So Origin thinks it’s clever signing up Stockyard Hill, but then can do nothing to have it deliver on time. Meanwhile, Neoen gets all its projects up and running one after another and more or less on time and even on budget. Operational expertise is one thing, the opportunity is another.

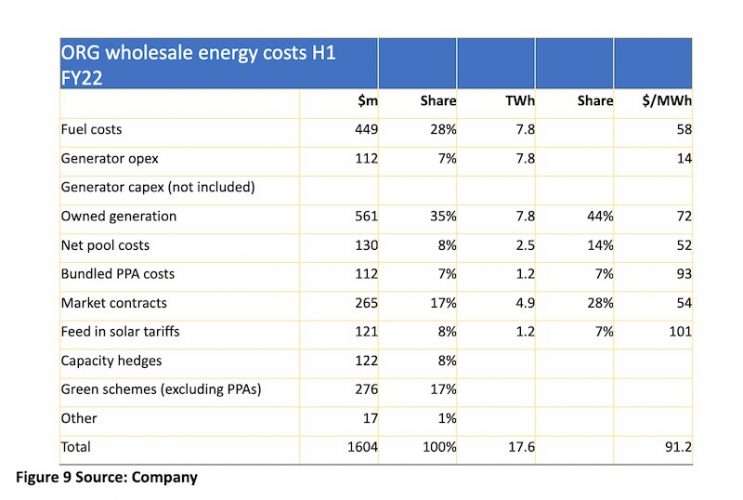

A look at Origin’s purchase cost of electricity, which came to at least $95/MWh, shows the opportunity, in my opinion, to lower the cost of supply through 100% green energy.

The numbers bounce around and fuel costs are high this year.

So Origin is paying $93/MWh for bundled PPAs when the cost of developing new ones is maybe $50/MWh. And if you are 100% green by definition you have enough RECs.

Only 14% of Origin’s electricity actually came from directly sourced wind and solar and half of that was from feed-in solar they are forced to take.

Origin is paying $72/MWh for its coal and gas fuel and opex and that excludes maintenance capex which for ageing coal plants ITK estimates at $10/MWh. Again, bulk renewable energy can be done for less and probably some firming could be thrown in.

In short, there seems to be some opportunity to improve the portfolio.

Although I have called Origin out, the other big gentailers are at least as bad, if not worse. Origin in fact gets a merit certificate for such clear and useful disclosure. It may not have much of a relationship with customers, but it does a great job helping analysts and investors, who then give it credit in their investment decisions.

And one cannot close an Origin section without commenting on how the board, including CEO Frank Calabria, chose not to tell Angus Taylor and his party of the decision to close Eraring. The Origin board would not have taken such a step lightly. Frank Calabria – a careful and very experienced manager, and one who listens – would not have taken such a step lightly.

The fact that they did so shows how much the utility industry, big and small, distrusts the federal government. Why? Because: (1) Networks have no reason to thank Josh Frydenberg for limiting AER appeals; (2) Retailers lost lots of apparent value from the maximum tariff decision; (3) The government’s attempt to socialise AGL’s Liddell power station, and; (4) Snowy’s continued push into peaking generation funded with federal money.

You could argue the state governments are also no better friends, but Matt Kean has demonstrated that a willingness to work with stakeholders in a genuine way will earn you respect and bring you inside the tent.

EnergyAustralia is focusing, it seems to me, more on its peaking generation credentials than its retailing strategy. However as CEO Mark Collette made clear, EnergyAustralia does have retail ambitions, most noticeable in its home storage product and its carbon neutral plan.

It also has, according to its website, 300k or about 205 of electricity customers that have voluntarily signed up for Climate neutral and pay extra. Imagine how many more there would be if they were paying less, as they should be?