Investment in large scale renewable energy in Australia has hit its highest levels since before the Abbott government was elected in 2013, although it remains well short of the level needed to meet the reduced renewable energy target in 2020.

The latest data from Bloomberg New Energy Finance for the second quarter in 2016 shows investment in large scale wind at its highest levels since 2013, just before the Abbott government was elected and brought investment in large scale renewable energy to a halt.

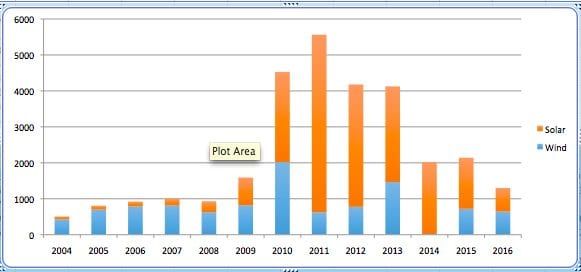

According to BNEF numbers, $645 million was invested in wind energy in the first half of 2016, compared to $721 million for the whole of 2015 and just $8 million in 2014, when the Abbott government appointed climate denier Dik Warburton to head a review of the RET and brought investment to a halt.

The RET was eventually reduced from 41,000GWh to 33,000GWh, but investment has been slow, largely due to the refusal of the biggest utilities to provide long term power purchase agreements, and the absence of any contracts by large consumers, unlike in the US where corporate buyers are contracting solar and wind farms.

Analysts say that investment in large scale renewables needs to ramp up significantly if the target is to be met, with some 3,000MW to 4,000MW committed by the end of the year if a shortfall penalty is to be avoided. The penalty is met by consumers, not by the utilities who fail to make the investment.

The wind data also includes projects commissioned by the ACT under its separate reverse auction scheme, although there are some projects now being built under the RET, albeit by large companies such as Goldwind that can take the merchant market risk.

According to BNEF, solar investment totalled $653 million in the first half. Some of this will include large scale solar but most of it reflects rooftop solar investment. It looks like being the lowest level of investment since 2009.

Part of that reflects the fall away from the boom inspired by generous feed in tariffs, but it also reflects the fact that the cost of solar has fallen by between 60 and 80 per cent over that time.