Australian battery maker Redflow says it is on track to start producing its zinc-bromine flow batteries at its Thailand factory by the end of this year, after starting work on the new plant’s production line equipment this week.

Redflow recently revealed plans to set up the new manufacturing plant at an industrial estate southeast of Bangkok, as part of its strategic focus on the “massive potential demand” in south-east Asia’s telecommunications sector.

In a statement on Thursday, Redflow said it had obtained all required Thai regulatory approvals to operate its factory within the free trade zone, and had this week sent an engineering team from its Brisbane office to Thailand to assist its manufacturing partner MPTS with installing and commissioning the necessary equipment.

Redflow CEO Richard Aird – who filled the role after it was vacated, last month, by Simon Hackett – has reportedly visited the plant to finalise the company’s three-year lease for the 1500 square metre building.

As we reported here, Hackett – who is the company’s biggest shareholder – took on the twin roles more than a year ago, when Redflow was struggling to bring its technology to market and get access to capital.

“During the past year, Redflow has completed a major strategic redirection,” the company said in a statement at the time of the leadership change.

“It is transitioning battery production from Mexico to Thailand, refocusing its sales and marketing on lead-acid replacement cycles in the telecommunications, commercial, industrial and off-grid residential sectors, and has raised an additional $14.5 million in equity – including $4 million from Simon Hackett.”

Its focus now would be on the new manufacturing operations and bringing costs down to ensure that they product is profitable and competitive.

Hackett, who made his fortune in internet software, will continue to help develop the company’s Battery Management System (BMS) that he designed, and simplify and document the interface.

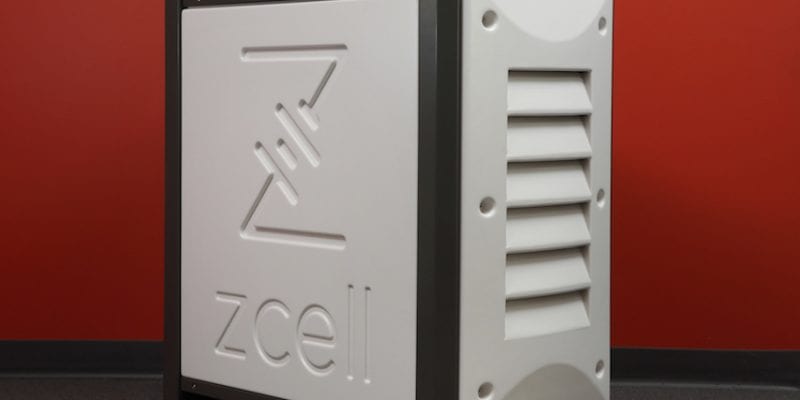

As we reported here, Redflow spent much of 2016 positioning itself as a contender for Australia’s burgeoning residential battery storage market, with its ZCell range – touted for its safety and environmental credentials.

This proved to be somewhat of an uphill battle, with early adopters favouring a growing number of increasingly cheap and well tested lithium-ion batteries, including the much-hyped Tesla Powerwall.