Cast your mind back to early September and the big public debate about the market power of generator bidding, and the protests from the big incumbents that they were innocent, your honour, of exercising any undue market power.

But it seems that as they were protesting their innocence in public, in the oblique arena of electricity markets, the big generators were busily creating “scarcity” again and profiting once more from surging prices in the South Australian market.

Two new reports from the Australian Energy Regulator illustrate how – like on many previous occasions – the big gas generators used their dominance of the market to force prices up 10-fold on two occasions in late August and early September, pocketing a bonus $14 million on the way.

See our previous stories: How Tesla’s big battery can smash Australia’s energy cartel; Gas generators hold South Australia consumers to ransom, again; How the fossil fuel industry screwed energy consumers; and AER details extraordinary price gouging by gas generators in South Australia.

Both of these new events took advantage of a network repairs, which force the Australian Energy Market Operator to impose market constraints, and request a minimum 35MW of so-called frequency control and ancillary services (FCAS) while the repairs are under way.

These FCAS services are provided – at the moment – uniquely by the owners of the big gas generators – AGL, Origin and Enegie.

Their capacity is actually have more than 10 times that ever needed by AEMO, but it seems that every time AEMO imposes that constraint, and calls for 35MW of FCAS, the big generators jack up their prices.

As we reported previously, the tactic is usually to provide only 34MW of FCAS and then charge whopping prices – usually in excess of $10,000/MW – for the last megawatt needed.

It’s breathtakingly cynical, but merely part of what the Australian Competition and Consumer Commission admiringly calls the “exercise of market power,” which is no comfort to consumers.

On August 28 and September 14, the tactics were varied slightly. Available capacity on August 28 was 33MW, and on September 14 it was 30MW.

On August 28, the AER notes: “On the day before the planned outage, AGL shifted (rebid) capacity from low prices to above $5000/MW at its Torrens Island power station for 28 August.”

That meant only 33MW of “low priced” capacity was now available. The high cost for that last 2MW sent prices into orbit, with “high prices of around $10,000/MW or above for the duration of the outage (approximately eight and a half hours, or 102 dispatch intervals).”

Likewise, on September 14, the AER noted, that not enough low priced capacity was made available,”resulting in prices of around $10,970/MW and above from 8.35 am until 4.30 pm inclusive, after which time the price for both services fell to significantly lower levels.”

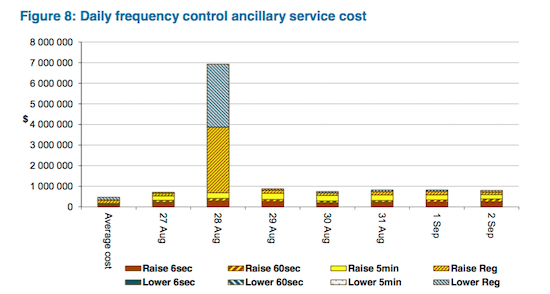

The result, a total bill of $7 million on each day, more than 10 times the daily average. (See August 28 above).

Little wonder the South Australian government is sick and tired of this market extortion and is seeking a change of rules to encourage battery storage operators, and opportunities for wind and solar farms, to play in this market.

Energy minister Tom Koutsantonis last week lamented the fact that private owners of energy assets were wanting to make sure that they got their maximum return – through monopoly rents – and cited this “deliberate policy of scarcity” in order to increase prices.

To change the rules, however, means getting past the Australian Energy Market Commission, which sets the market rules, but has been slow to adopt them – under enormous pressure from the very same generators that benefit from the current arrangements.

The proposed 5-minute rule is one example. Under the 30 minute settlement currently in place, it is generally recognised that the generators are able to game the price by creating scarcity at certain intervals. But the change has been punted until 2021, under pressure from the generators.

But it also goes to the heart of concerns about the National Energy Guarantee, which critics say will simply reinforce the market power of the incumbents and make it more difficult for new competitors to enter the market.

The lead author of the NEG? The AEMC. The chief supporters? The Business Council of Australia and other bodies that represent the big generators. Truly, it is cynical beyond belief.