Victorian Energy Efficiency Certificates (VEECs)

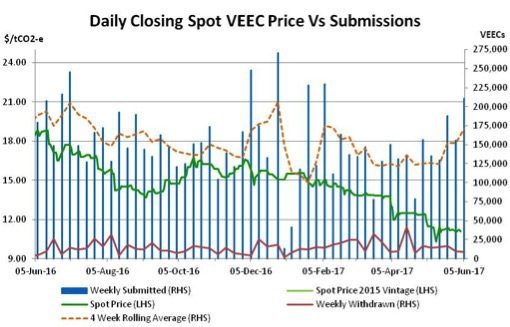

The commercial lighting juggernaut rolled on in Victoria across May with installation activity continuing at a rapid pace and VEEC supply actually managing to grow. Further price softening has been the result with a 7 year low reached during the month.

Often, though sometimes less often that seems rational, the laws of supply and demand prevail in markets. During May in the VEEC market this was certainly the case as the surprising strength in VEEC supply pushed prices south into territory not seen since mid 2010.

From the get-go in May the market lost ground, with the spot opening at $12.20, $0.15 below April’s close and softening steadily across the first half of the month to at one point reach a low of $10.30. From there a recovery of sorts ensued that saw the market once again reach the mid $11s before again softening to $11.20 to close the month, a drop of 9.3% on April’s close.

The ongoing softening in the VEEC price is a direct response to the strength of VEEC submission numbers which, contrary to what many had thought would happen as little as 3 or 4 months ago, once again began to grow across May. For the 4 full weeks of May, the average weekly submission rate was 152k, a considerable step above that which had been seen for the 3 months prior, which sat at 129k.

The reason for this resurgence? A significant reduction in the cost of lighting in particular for high bay technology has lead to an increase in activity despite the considerable drop in VEEC prices and the further reduction in creations from non commercial lighting based activities.

The presence of forward hedges means that the majority of what is being produced currently is not being sold into the market at prevailing prices but instead is being delivered into forwards set previously at higher levels.

If VEEC submissions continue at their current rate for much longer it is hard to see why prices should recover in the short term. However one thing that may have an impact is whether or not there continues to be forward selling interest at the prevailing prices.

By late May forward selling interest had reduced, which can be a leading indicator for medium term VEEC supply. If participants can no longer make money off current prices then they are unlikely to enter into forward deals unless they absolutely have to. Watch this space.

New South Wales Energy Savings Certificates (ESCs)

Following a generally stable month the ESC market ultimately lost ground again in May, with registration figures lower across the month, but perhaps not low enough to avoid further contribution to the surplus. The cut-off for 2016 vintage registrations as well as another midyear compliance crackdown may yet have an impact in the coming months.

The spot ESC market began May positively; opening at $15.40, a $0.25 improvement on April’s closing level. The advance, however, proved short lived with the market softening to trade in the $15.00-15.20 range through the middle of the month. Later on the spot eventually breached the $15.00 level, with a steady flow of activity taking market to a close of $14.75, a drop of 2.6% on April’s close.

The gradual price decline appears to be a reflection of the ongoing resilience of ESC supply, which despite moderating across May, was perhaps not low enough to compensate for the very high levels seen in April. There is also the issue of the cut-off date for 2016 vintage ESC creation which comes on 30th June and which in recent years has led to a sharp increase in registration figures.

While the situation in the ESC market is not as stark as its Victorian counterpart, the ESC surplus continues to grow, leaving the door open for buyers to exercise patience. There has however been some suggestion in recent weeks that the scheme regulator will have another compliance push which – perhaps coincidentally – was something that also occurred around the same time last year. Apart from potentially finding any breaches, the crackdown may also result in an increase in audit times and could therefore impact ESC registrations over the coming months.

Marco Stella is Senior Broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services, across all domestic and international renewable energy, energy efficiency and carbon markets.