Victorian Energy Efficiency Certificates (VEECs)

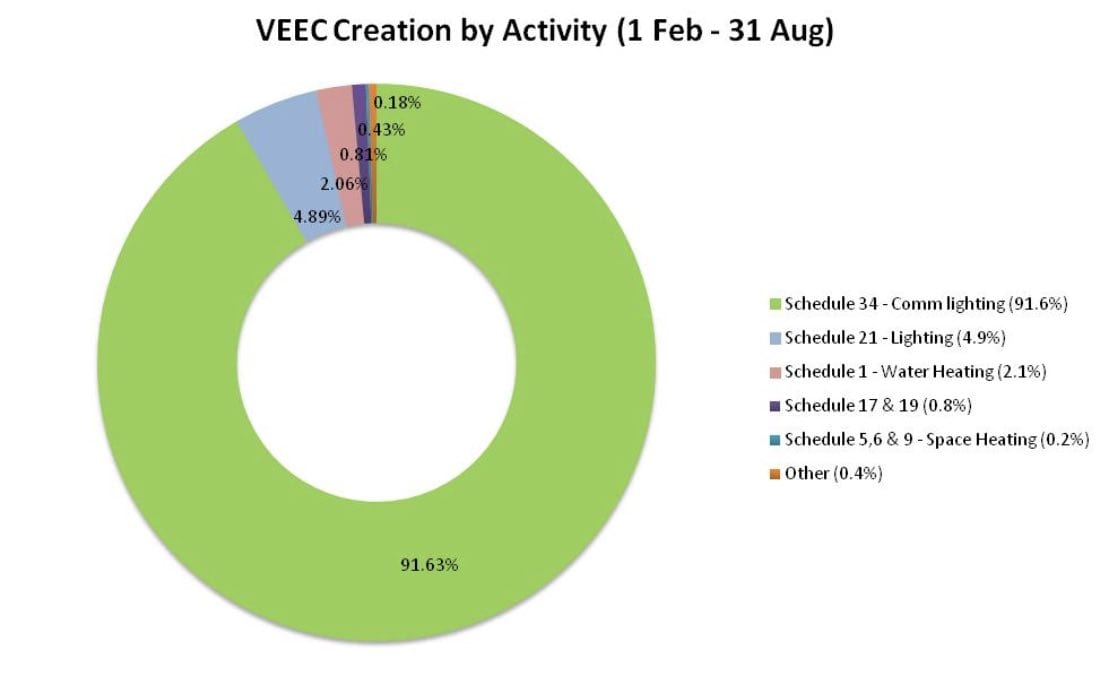

With the hefty oversupply of VEECs continuing to grow on the back of the success of commercial lighting upgrades, speculation escalated in July that the Department of Environment, Land, Water and Planning (DELWP) was considering changes. Having swirled for weeks and encouraged a healthy recovery in prices, speculation was replaced with a consultation paper, though precisely what changes arise from it and when remains unresolved.

By late June, the VEEC market was in the doldrums. The oversupply continued to grow on the back of the success of commercial lighting activity and the spot price had sagged below the $11 mark. The new financial year however brought with it a change in the form of growing speculation that some rule changes may be on the cards.

With the success of commercial lighting – particularly the new high bay technology – both crowding out other forms of activity and continuing to add to the already very large surplus of VEECs, many had suspected that changes to Schedule 34 (commercial lighting) may have been in the offing.

The sharp reductions in the price of LED technology and its transition from a fringe concept to the broadly accepted standard have been among the changes in recent years. As such, the question of additionality is one that had been raised; that is, would some of the installs that are currently being facilitated by the scheme take place even without it?

With the spot VEEC market sitting at levels not seen since the first phase of the scheme, once the rumour mill got turning on the potential for such changes, the impact was significant.

The spot price started to rise in early July, first gradually but then sharply, with the market reaching an intra-day high of $17.00 in mid July on the back of the announcement that the Minister was calling a meeting to explore a discussion paper soon to be released.

Yet as was to be the case over subsequent weeks, it was not all one way traffic with the surge in pricing followed almost immediately with the spot market softening to close the same day at $14.00.

The spot then rallied again in the lead up to the meeting (reaching the high $15s), only to soften back into the mid $13s following the release of the consultation paper with some perceiving it to be light on specifics. Over subsequent weeks the spot market then traded between the low $13s and the high $14.

During this period of volatility in the new financial year, trade activity in the spot was high, with the market particularly busy across August.

Whatever the recent VEEC market volatility may imply, it seems clear that the intent exists within government to bring about change, the question now remains what will the end result be?

The most commonly speculated outcome is for the introduction of a discount factor for schedule 34 (commercial lighting), with numbers such as 20-30% being bandied about. Such a move would be relatively clean from an administrative perspective with the Minister possessing the ability to make such a move.

While the discount factor would not be able to discriminate between forms of commercial lighting (i.e. it will not only impact on the high bay technologies but on all lighting forms under Schedule 34), it would have the corollary of making commercial lighting less attractive relative to other forms of activity, including residential lighting and the newly introduced Project Based Activities, which scheme administrators appear keen to encourage.

While introducing a discount factor for the market’s dominant supply methodology would likely push prices up, it not clear if that is what will happen.

And then there is the issue of timing.

The consultation paper was released in early August and the cut-off date for submissions came on the 18th, with many people speculating that the announcement of any changes would be quick.

Yet it is possible the wait time will be longer allowing an extended period in which participants can continue creating under the old rules, taking advantage of the significant recovery in prices. meanwhile the surplus of VEECs continues to grow with 8.8m VEECs currently registered or pending registration against this year’s 5.9m target.

New South Wales Energy Savings Certificates (ESCs)

Several months of low ESC registration figures, combined with rumours surrounding potential changes to the commercial lighting methodology caused an abrupt turnaround in the ESC market across July and August.

It’s amazing how much difference a couple of months can make in a market.

In late June, on the back of record ESC registration figures, the spot ESC market sat in the $12s. In the early part of July the market reached a low of $11.80; a level not seen since November 2014.

The news was all negative, with supply cranking and the ESC surplus building. Fast forward two months and the market could not have appeared different.

Weekly ESC registration figures, which had averaged 115k across the first 6 months of 2017, had fallen to average 45k for the first 9 weeks of the new financial year. All the talk was about the winding back of the commercial lighting methodology and the market had gone north of $18.00, an outcome that few sellers would have dared to dream of back in June.

The incredible recovery began in the aftermath of the record ESC submission week in late June, which at 729k represented close to 20% of the entire 2017 target.

The rush to create before the 30 June deadline for the 2016 vintage and for the rule changes that were introduced earlier in the year flushed out the a pipeline of ESCs, the magnitude of which amazed almost everyone.

But what it also did was subsequently force creators back into audit, ensuring that registrations over the ensuing 2 months were low.

Beyond this, the rule changes themselves also appear to have been having some effect. A reduction in the air conditioning multiplier is seeing circa 25% less ESCs created per install on eligible jobs (which are not necessarily many), meanwhile the elimination of payment plans and introduction of tougher evidence requirements around proof of customer co-contribution payments are proving challenging for participants to negotiate.

But the ESC Bull Run which saw the spot recover over 50% would not have been possible without the genuine threat of further changes to commercial lighting, and that is exactly what happened.

The seed was planted with rumours of a consultation process in which the Department of Environment and Heritage much like its southern cousin – was considering winding back the level of subsidy to the scheme’s dominant creation source (commercial lighting). Speculation followed and sellers held back, just in case.

What eventuated was a targeted consultation in which the department outlined concerns it had over additionality, and made some suggestions as to what it might do about it.

The approach it appeared to favour was to reduce the deeming period for commercial lighting from 10 years, down to something in line with what its modelling had shown was the average refurbishment period for different building categories. Long story short it appears that should such changes go ahead, the deeming period for retail and commercial installation would be cut to say 5 or 7 years.

The Department also said it was considering the more radical step of benchmarking the number of ESCs created per install based not upon what lighting was being replaced but instead upon minimum performance standards.

Importantly it was flagged that the changes would not be immediate, with the rule change period of late April mooted as the earliest possible date, though a delayed roll out potentially later in 2018 or beyond may also have be possible. A consultation paper for broad release is expected toward the end of 2017.

While the ESC market climbed across August it was in the $17+ range that liquidity in the forwards really returned on en masse. Late in the month the spots reached a high of $18.20, with forwards for settlement in late 2017 agreed at $18.50.

At circa 55% up on its lows, that however, was as far as the rally went, with seller emerging and the spot market softening back to close August at $17.50, with forwards at a cost of carry premium to that.

Marco Stella is Senior Broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services, across all domestic and international renewable energy, energy efficiency and carbon markets.