Victorian Energy Efficiency Certificates (VEECs)

After a brief decline in VEEC submission rates early in July, supply once again climbed across the remainder of the month and so continued the spot price decline. Perhaps most noteworthy across month was the cluster of activity in the options market.

Having closed the financial year at $17.70, the spot VEEC market lost ground rapidly in July, trading down to $17.00 within the first week. The market then spent several weeks trading in the high $16s before once again losing ground sharply late in the month, ultimately closing down 10% at $15.90. The softening has since continued into early August.

Weekly VEEC submissions were down in the first two weeks of July leading some to conclude that perhaps the end of the commercial lighting boom had come. The second half of the month however undermined that position with circa 170k per week again uploaded, taking the market to a point where (depending on how many of the current batch of pending registration VEECs are withdrawn) there are now sufficient VEECs in the system to meet the 2016 target of 5.4m.

The forward market was busy during the month with plenty of activity taking place for settlements from the second half of 2016 to the middle of 2017. For much of the month the forward curve remained flat or even backwardated (a state in which the value of the spot is above the forwards).

July also proved eventful for the most significant period of VEEC options activity in recent years. For the most part, the activity took place in the Put options which provide the buyer some downside protection should the market continue to fall.

The first trade, 50k for expiry Mar 2018 with a strike price at $15.00 was agreed at $1.10. In this case the buyer paid the upfront premium of $1.10 for the right, but not the obligation to sell 50k VEECs at $15.00 in Mar 2018. As the days went past the same option traded again at $1.25, reflecting the softening spot price. There were also a number of trades with expiries in Aug 2017, including 50k at $14 strike agreed at $0.60.

That the buyers were interested in acquiring insurance at such levels and at such tenors can be seen as prudent risk management, yet it also acted as a catalyst, making some ponder whether the current slump in prices will be a short or longer term phenomenon.

New South Wales Energy Savings Certificates (ESCs)

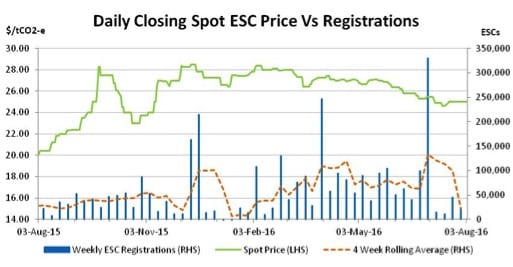

While having softened consistently for over two months, the decline in the ESC market was interrupted in July by, amongst other things, concerns about the crackdown on a specific compliance measure amongst creators.

The spot ESCs closed in June at $25.45, though once again the market began a gradual descent which culminated in the market reaching a low of $24.60 in the middle of July. From there the market promptly recovered to $25.00 before falling quiet toward the end of the month.

The forward market was particularly busy in the first half of the month with transactions for settlement out as far as Apr 2018 taking place at modest escalations to the spot.

With many participants in audit across the month following the rush to ensure that 2015 vintage ESCs were registered before the 30 June cut-off date, ESC registrations across July were always likely to be lower. Indeed, they proved so with a weekly average of less than 23k recorded across the month, less than a third of the weekly average year to-date.

As part of the progressive tightening of compliance rules in recent years, the scheme regulator IPART (Independent Pricing and Regulatory Tribunal) introduced a rule requiring the customer pay a minimum of $5 per MWh for energy saved as a result of eligible energy efficiency activities. Whilst some critics view this rule as an arbitrary measure which artificially restricts the rollout of energy savings activities (by forcing customers to pay for something that would otherwise be free) and thus inflates ESC prices, others counter that eliminating the giveaway model is better for compliance and the longer term stability of the industry. IPART, in its current round of audits has begun asking for additional information from creators in an attempt to further police the rule.

In large part, it appears that concern about the blowout in audit times (which can often take up to 2 months anyway) from the increased and retrospective compliance measures adopted by the regulator to ensure the integrity of the $5 per MWh rule, seem to be behind the recovery in prices.

On the one hand this is because some participants may have needed (or anticipated the need) to come back to market to purchase ESCs to meet forward deliveries. Yet by the same token the situation has also forced many sellers to think twice before selling until they have a firmer picture of exactly how long their audits will take.

In the short term, the ESC market will likely be influenced by whether there are any further impacts arising from the audits should any significant wrongdoing be identified, as well as by what happens to ESC registrations when supply returns to normal.

Marco Stella is Senior Broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services across all domestic and international renewable energy, energy efficiency and carbon markets.