Wind output in South Australia has been curtailed for the third time in a month due to new rules imposed by the Australian Energy Market Operator, which restricts wind output to a maximum 12000MW unless four gas units are operating in the state.

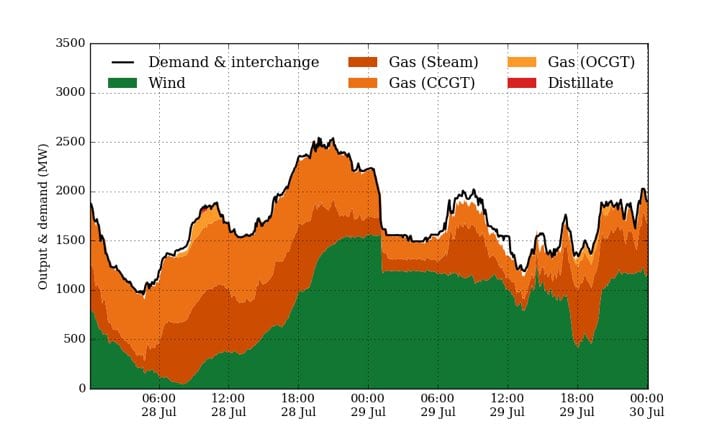

Over the weekend, strong winds in southern states pushed wind generation very near to full capacity, but the withdrawal of one gas fired generator early on Sunday morning meant that wind out had to scaled back by more than one fifth.

The new rules from the AEMO allow for wind to go up to 1200MW without restriction if three gas units are operating, and beyond 1200MW if four are offline.

According to Dylan McConnell, from the Climate and Energy College in Melbourne, even with this constraint,

wind power still managed to provide 72 per cent of South Australia’s grid-based electricity consumption on Saturday.

AEMO also invoked constraints on the interconnector between Victoria and South Australia on Friday night, limiting the export limit to 250MW as a precaution to deal with extreme wind conditions that had been forecast, and the impacts that could have had on local network infrastructure.

The constraints on wind were first invoked earlier in July, the first time it had been imposed since a rule change made with little fanfare in December.

The move is regarded as overly conservative, but given the controversy over recent blackouts and load-shedding, although not the fault of renewables, AEMO is keen to play safe.

Industry participants assume that the rule will be relaxed once AEMO becomes more comfortable with alternatives, such as battery storage, frequency control from wind farms, and demand management.

One of the biggest impacts of the rules is that electricity prices will not fall far as they usually do in high wind conditions because of the need to have three or four gas generators switched on. Gas generators, which are expensive to run, set the marginal price of electricity in the market.

On Saturday, despite wind power providing nearly three quarters of grid demand, the average price for the day was more than $90/MWh – the price set by gas generators.

The wind farms most impacted by the curtailment were once again Waterloo and North Brown Hill, but it also seems that units of Snowtown and Hornsdale wind farms were also affected.