Imagine if one third of Australian electricity consumers decided to take matters into their own hands, and went off-grid – looking after their own production, storage and consumption needs?

Sound fanciful? Well, according to the CSIRO and industry experts, grid operators and generators, it’s actually quite possible, and indeed quite likely. It is one of four scenarios that is painted under the CSIRO’s Future Grid Forum, possibly the most interesting insights into Australia’s energy future that RenewEconomy has come across.

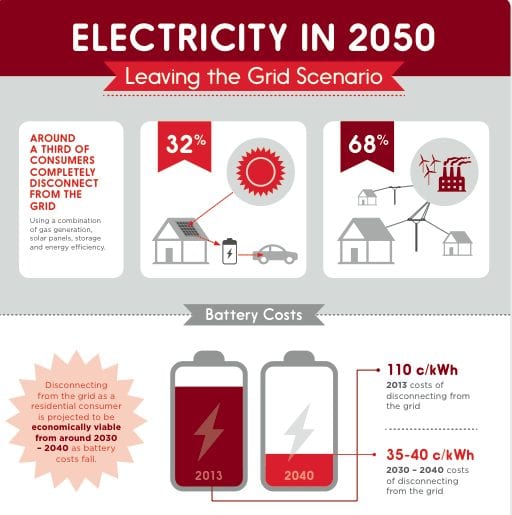

Here’s how it sees the leaving the grid scenario unfolding: “New energy service companies sensing a market opportunity invite consumers to leave the grid, offering an initially higher-cost solution, but one that appeals to a sense of independence. Customers have already become comfortable using small amounts of storage and in their vehicles and a trickle of consumers takes up the offer.

“By the late 2030s, with reduced storage costs, disconnection becomes a mainstream option and the rate of disconnection accelerates. Customers remaining on the system are those with poor access to capital and industrial customers whose loads can’t be easily accommodated by on-site generation.”

And although the report suggests off-grid generation may be the cheapest option in 2050 as a percentage of household income, it may be that its off-grid prediction is extremely conservative. It is based on the assumption that battery storage costs will only halve between now and 2030, and going off-grid will only make economic sense for consumers from 2040 onwards.

This is despite the fact that network operators such as Ergon Energy, in regional Queensland, think that solar and storage could become an economic option to go off-grid and dump the by the end of this decade.

Future Grid Forum project director Paul Graham admits that there is a lot of guesswork involved. “We could be wrong by a decade or more,” he told RenewEconomy. “Battery costs are moving so quickly it’s hard to catch up. We have got them halving by 2030, but others have got them halving by 2020.”

Indeed, still more people – those that predict that battery storage will follow in the footsteps of solar PV, which has plunged in cost by 80 per cent over the past five years – have battery storage costs halving within a few years.

Still, it’s an interesting proposition, and the one big conclusion from the Future Grid Forum is that the future of electricity in Australia will look nothing like the past, despite what some government advisors and middle aged engineers might wish.

Graham said he had no clue about the outcome of the Future Grid Forum when he sat down to organize it. But after a series of workshops with the participants, it was clear that they wanted to explore the “mega-shifts” which are clearly occurring in the electricity industry. (Graham cited the recent passing to the 3GW solar threshold in Australia).

“We wanted to look at more than just high or low gas prices, or high or low carbon prices. We wanted to look at every part of the supply chain. The industry recognises that it is on the crossroads …. Nothing will stay the same. For the past 50 years we had centralised generation with three main fuels – coal, gas and hydro and distribution systems that delivered this to the end user.

Even the scenario most likely to suit the fossil fuel industry and incumbent utilities the most, CSIRO’s “set and forget” – relies on three main assumptions – that solar PV costs will not fall much further, that battery storage costs won’t fall much either, and that consumers will be largely apathetic.

It’s a scenario that suggests that incumbent utilities will take over issues such as demand management and other peak load management options, but otherwise their business will remain largely unchanged. The share of renewables extends barely beyond 30 per cent. It seems like wishful thinking.

The other three scenarios are much more interesting, and it would seem more realistic. There is the leaving the grid scenario (apart from the debate over battery storage costs, you can read more about that here).

Then there is the “prosumer” scenario. This is somewhat similar to the off-grid scenario but for one important point – the utilities wake up to what is happening and decide to deal themselves into the game by offering services and other options that encourage consumers to stay on grid.

In this scenario, some 50 per cent of generation comes on-site, due to innovative financing and product packaging from energy services companies. Electric vehicle adoption is also popular, being used by one quarter of households. The use of on-site generation is also strong in commercial and industrial customer sectors, but with a stronger preference for cogeneration or trigeneration technologies.

Graham says there is a big difference in mentality between the “prosumer” and off-grid scenarios. In the former, there is the willingness to trade with the grid (i.e. sell solar electricity back to the network operators, and to use it as back-up).

But the pricing for both is key, and Graham says, may be difficult to strike, particular for network operators looking to protect their initial investment. If the incentive is not there to trade, then consumers will look to leave the grid, just as they are deciding now that mobile phones mean they no longer need a landline.

“It is within the industry scope to provide a valuable proposition to stay connected to that point,” Graham says. Whether they do so remains to be seen. It is surely one of the biggest issues and challenges for Australia’s network going forward.

The fourth scenario is the high renewables one, the “Renewable thrive scenario.” This is where the delivery of electricity remains largely centralized, but the falling cost of renewables displaces fossil fuel generation, and energy storage is deployed by network operators at grid scale, rather than in homes and behind the meter.

Graham says that if renewables are cheaper than most people think, then renewable ambition can go further. This scenario envisages 86 per cent renewables by 2050. “If we are really ambitious, and we get to an emission free system, we could have our car powered by that as well, than centralized clean energy becomes a real proposition.”

The implication then is that the pro-sumer and the off-grid scenarios will be made redundant, because green energy is already supplied by the grid. That may come to a relief to some, because it is not yet clear how many consumers really want to bother with their own generation and energy management. “May be we have already exhausted the early adopters and the rest of us aren’t interested,” Graham suggests. In reality, he admits, no one knows.

Another interesting conclusion is that in all four scenarios, the CSIRO believes that there will be only a minor different in costs to consumers by 2050. (See graphs below). They range from 2.3 per cent to 2.9 per cent of household income, compared to 2.5 per cent now (and in the 1960s). As mentioned above, leaving the grid is the cheapest option for households (2.3 per cent of household income), although it involves the higher capital costs – but that may depend on the price of batteries.

The other conclusion is that consumers, generators, grid operators and suppliers will all face changes. But those that face the most dramatic change are the fossil fuel industry.

The other conclusion is that consumers, generators, grid operators and suppliers will all face changes. But those that face the most dramatic change are the fossil fuel industry.

Coal is facing abrupt change no matter what happens. interestingly, for gas, the least change comes in the high renewables scenario, supporting a conclusion reached by Citigroup analysts earlier this year, that suggested the future of gas is deeply reliant on the successful deployment of renewables.

Maybe the Australian government should keep that in mind. Indeed, seeing they are doing another energy white paper, perhaps they could base the electricity chapters around these scenarios. It would be a lot more realistic than past efforts.

P.S. CSIRO are hosting a public discussion of the Future Grid Forum on Friday morning at UNSW. We will provide an update.

Meanwhile, here some graphs that illustrate how the scenarios might unfold, and what they entail. The full report is available here.