To meet the Paris climate goals of limiting global warming to 2°C requires a complete global decarbonisation of all energy use by around 2050.

Reading these columns and elsewhere of recent times one could almost be excused for thinking that electricity is the only way we use energy.

It has reached the point that in common discourse the word ‘Energy’ has started to be used when the meaning is ‘Electricity’. Many references to ‘Energy Storage’ for example turn out to mean exclusively ‘Electricity Storage’.

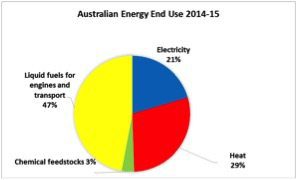

To put things in perspective, it is interesting to examine Australia’s energy ‘end use’ by type. Interpreting the 2014-15 Australian Energy Statistics data by sector and end use fuel type gives the following picture:

In this view the really big end-use sector is transport energy, it can also be seen that heat as an end use is also very significant. However, for the Australian economy a major ‘Use’ of energy is that we sell it as one of our major sources of export earnings. If we add exports as a ‘Use’ to the pie chart we get the following results:

So Australian energy ‘use’ is actually 79% about selling it. We sell large amounts of energy in the forms of Coal (11,063PJ in2014_15) , LNG (1,363PJ ) and Uranium oxides (3,053 PJ) .

To understand how important this is in financial terms, it is interesting to sort and rank Australia’s trade data, both imports and exports, as follows:

We see that coal is our number two largest source of export income after iron ore. In previous years it has been number one. We see that LNG took the number 4 spot and as we are reading a lot lately, that export earner continues to grow.

Looking at the import side we see that we very much need those exports to balance our major imports, cars and electronic / electrical goods are way up the top. Oil and petroleum products (petrol and diesel) are sitting at number three and growing fast both because our demand is growing and our local production is shrinking.

Note that uranium does not even make it into the top 18 exports shown in the figure. The relative market values of the energy commodities are very important as well as the volumes of energy. In 2014-15, our average value of coal sold was around $3.40/GJ, for LNG it was $12.40/GJ and Uranium just around $0.30/GJ.

Refined oil product imports on the other hand cost us $19.50/GJ even with the prevailing low costs of oil at around $50 per barrel. Thus swapping fossil fuel exports for uranium exports GJ for GJ would be a disastrous financial outcome for the Australian economy.

So who buys our coal and LNG? The DFAT trade data shows the breakdown of coal sales by value as:

Interestingly, for some reason our Australian government agencies feel that the destination of LNG sales is confidential. However, the US government’s Energy Information Administration is happy to suggest to the world that it looks like this:

What this makes clear is that our most important energy customers are in the Asian region and Japan is absolutely on top of the list. It is also of considerable relevance that Japan, South Korea and China are the source of the bulk of our imported motor vehicles and electronic goods.

If the world is to decarbonise, these key trading partners of ours must be part of that shift. It is very apparent that they are already leading.

Reducing coal use will be the first target and we are already hearing of exactly such moves from China, India and Japan in recent times ( Thermal coal use plummet , Japan’s thermal power drop ). LNG is actually likely to be in greater demand in the near to medium term in a decarbonising world.

Noting recent commentary on the cost of gas generation versus renewables in Australia and the availability of renewable electricity options with storage / flexibility (Concentrating Solar Thermal is a key example), it may be that natural gas no longer has the key role as a ‘transition’ fuel for Australia’s own use that it was once thought to. Instead, we should increasingly recognise it as a ‘transition energy export’.

What can be the long term opportunity for energy exports? I and many others argue that it should be zero emissions hydrogen based fuels. Japan and South Korea in particular are putting major efforts into hydrogen fuel cell vehicles. Japan, which imports 91% of its primary energy is planning for major imports of hydrogen from around 2030 onwards.

The Olympic Games in Tokyo are only 3 years away, and investments to make hydrogen a star of this event are well advanced, with the focus on the buses, cars and the fuel cell powered athletes village.

Who better to sell hydrogen to Japan and our other Asian energy customers than Australia. Hydrogen can be made by a variety of methods; electrolysis using electricity, reforming natural gas, gasification of biomass or coal and thermal decomposition of water using solar concentrators as well as more early stage experimental approaches using photocatalysis for example.

In a zero carbon world, it is Australia’s vast and world leading solar resource that seems most prospective, although gasification or reforming processes combined with geo-sequestration of CO2 could well prove very competitive.

Japan is 6,000km away, we are not going connect a DC transmission line to them and they are unlikely to want to rely on connections to China for their energy. Moving an energy dense liquid fuel by ship is the bread and butter of the global petroleum industry.

A tanker can cross the globe consuming fuel that represents about 2% of its payload energy. In other words long distance fuel transport in tanker ships is about 98% efficient in energy terms.

To adapt international shipping to hydrogen, studies in Japan are considering three likely options; as cryogenic liquid analogous to LNG, by combining it chemically and reversibly with toluene as an organic hydride, or converting it to ammonia by combining it with atmospheric nitrogen for either direct final use as a fuel or conversion back to hydrogen.

The cryogenic option is being actively considered by Kawasaki Heavy Industries who have a specific project in mind based on gasification of Latrobe Valley brown coal.

Hydrogen liquefaction is technically feasible and analogous to natural gas liquefaction, however it is considerable more challenging as the temperature is -253°C compared to -162°C for LNG[1]. The organic hydride approach is also feasible however is challenged by a much reduced payload, with the toluene carrier compound having to take the trip in both directions with a limited amount of hydrogen carrying capacity.

Use of ammonia as the transport vector seems to be increasingly favoured. Ammonia synthesis is the second biggest chemical process by volume globally and is very well established. Ammonia is already shipped and traded globally. Liquid ammonia actually contains more hydrogen per litre than liquid hydrogen itself.

The conclusion I offer is that Australia as an energy exporting economy, should be keeping the future of energy exports at the forefront of consideration in all discussions of energy and climate policy and investment decisions. Attention should be given to bilateral / multilateral agreements with our key trading partners, like Japan, that move energy trade towards zero emissions fuels in a win-win manner.

State and Territory governments considering the encouragement of emissions free transport should consider that facilitating use of hydrogen fuel cell vehicles from Japanese and Korean manufacturers will help to synergise a hydrogen use and import market from those same countries.

The Australian Renewable Energy Agency, the Clean Energy Finance Corporation and others should consider future trade in hydrogen based fuels both directly but also via the synergies that may exist as they consider the approaches that can be applied to advancing renewable energy use within Australia.

[1] Note that the work (electricity) required to cool something tends to infinite as absolute zero of -273°C is approached.

Keith Lovegrove is Head of Solar Thermal, ITP Energised Group.