The two biggest solar farms in South Australia were switched off for long periods this week as wholesale market prices fell below zero – the result, apparently, of new “zero price clauses” in power purchase contracts.

As RenewEconomy reported on Tuesday, and updated on Wednesday, wholesale prices in South Australia fell below zero for extended periods on Tuesday (nearly six hours), and on Wednesday (nearly four hours).

This was the result of high wind and solar output, as well as relatively low demand, and export limits (down to 50MW) on the main link to Victoria because of maintenance works, which meant that excess renewable production could not be traded interstate.

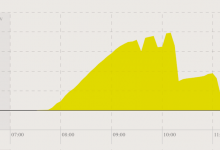

As Dylan McConnell, from the Climate and Energy College in Melbourne, points out, and illustrates with the graph above from the OpenNem resource, the state’s two biggest solar farms both switched off power on Wednesday.

The Bungala One and the semi-complete Bungala 2 projects cut output from around 1030am, ahead of the anticipated zero pricing event, while the newly-complete Tailem Bend solar farm cut power off on both Tuesday and Wednesday from around 11am as the prices hit zero. Both projects were offline for nearly six hours on Wednesday.

Both the 220MW Bungala projects and the 95MW Tailem Bend projects have long term power purchase agreements with Orign Energy and Snowy Hydro respectively.

But a new feature of PPAs being signed in Australia these days is a “zero price” clause that means that the off-taker will not pay for the output of the solar farm at the contracted price if the market price falls into negative territory. This is considered a major risk in states like South Australia, and Queensland.

This is because the off-taker does not want to pay twice – once for the contracted price to the solar plant owner, and secondly the market price for the output. As a result, the solar farm is switched off.

In the case of Tailem Bend, that must have been frustrating because the solar farm only reached full commercial operations, and permission to operate at full capacity, on April 29, the day before the zero pricing events.

The first 110MW stage of the Bungala solar farm was completed last year, but the second 110MW stage has been working slowly through its permissions. It only reached its next stage of permissions, which allows output of around 30MW, in recent weeks, but also had to switch off when prices fell below zero and to lows of minus $120/MWh.

In any case, negative prices should not be a long term phenomenon, even if the growth of rooftop solar matches periods of minimum demand, an event that the market operator says could start to occur within a few years.

The addition of more battery storage and pumped hydro will be able to soak up the excess wind and solar output, and act as a “solar sponge”, even when the links to other states are constrained. Certainly, more solar farms will be looking for storage of one to two hours to soak up the output in such events. Being switched off is not part of the business model.

For the moment, installations like the Tesla big battery operated by Neoen at Hornsdale have been having a party this week, getting paid to top up when the prices go negative, and then selling into the grid when prices rise again. As some industry analysts have noted. this is a great opportunities for household solar and “visual power plants”, as well as charging electric vehicles.