The proposed Victoria to NSW Interconnector, called ‘VNI West’, is the subject of considerable debate and controversy. The issuing of a suite of consultation reports by AEMO and Transgrid on 23 February 2023 resulted in more than 500 submissions, many quite critical of the project.

The proposed 500 kV double-circuit overhead transmission line would be one of Australia’s biggest transmission projects, traversing 600 km from near Melbourne to Wagga Wagga via a semi-circular route through western Victoria and southern NSW (Figure 1).

Route options and integration with the proposed Western Renewable Link are still being assessed. VNI West is planned to be built by 2028 at a cost likely to exceed $4 billion.

One of the claimed reasons for building an additional interstate connection is so that Snowy 2.0 can supply Victoria, through to Melbourne. This objective was embodied in the original naming of the interconnector as ‘SnowyLink South’ (AEMO 2018 ISP).

Now called VNI West, the interconnector is claimed “to harness cleaner, low-cost electricity from renewable energy zones in both states and unlock the full potential of Snowy Hydro 2.0”. (AEMO/Transgrid VNI West Update Dec 2022).

VNI West will make no difference to Snowy 2.0’s utilisation

But now it has been revealed in one of the reports issued in February, the VNI West PADR Submissions Report (“Report”), that VNI West will not increase Snowy 2.0’s transmission capacity to Victoria at all.

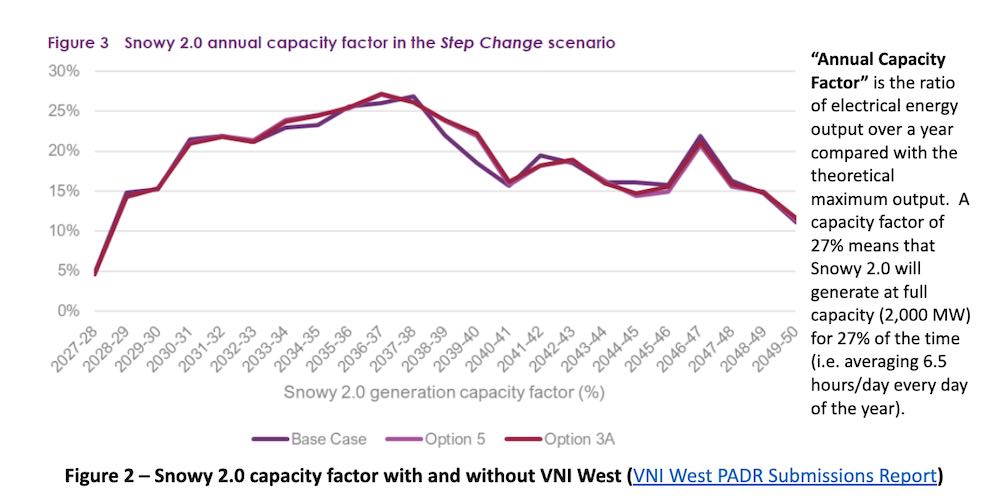

This revelation is depicted in Figure 2, copied from the Report, showing the utilisation of Snowy 2.0 to be virtually the same over the next 25 years irrespective of whether VNI West is built and irrespective of Snowy 2.0’s capacity factor.

The purple line shows Snowy 2.0’s capacity factor in the base case (no VNI West), whilst the pink and red lines show the capacity factors if VNI West is built (two route options) – all three lines are essentially contiguous.

It is telling to see that VNI West makes no difference to Snowy 2.0’s utilisation, no matter what the capacity factor (from 5% to 27%).

Clearly, VNI West will not unlock any Snowy 2.0 ‘potential’.

It is interesting to note that the previous modelling in the VNI West PADR, issued last August, forecast “a marginal increase of Snowy 2.0 capacity factor with VNI West” of a few percent, but this latest Report forecasts no increase at all.

The Report claims that VNI West will increase the efficiency of Snowy 2.0, rather than its utilisation, but has not quantified such efficiency ‘benefit’:

“In this updated modelling, market benefits of VNI West associated with Snowy 2.0 are related to more efficient utilisation rather than increased utilisation of Snowy 2.0. However, these benefits have not been isolated and quantified separately.”

Delving further into Figure 2, reveals two more significant issues.

Snowy 2.0 usage plummets 60% by 2050

The first additional issue is the substantial rise and fall of Snowy 2.0’s utilisation from its commissioning to 2050.

The capacity factor starts at 5% when Snowy 2.0 is commissioned in 2027, though that date has recently been delayed to 2029, and will inevitably be delayed further. The capacity factor rises to a peak of 27% in the late 2030’s, but then declines to 15% in the 2040’s and to 11% by 2050.

That is, the capacity factor of Snowy 2.0 is forecast to plummet from 27% to 11% in just 15 years. What happens thereafter has not been modelled, but the trendline is declining and there is no indication that Snowy 2.0’s usage might rise again after 2050.

This dramatic decline in utilisation, by some 60%, was not forecast in Snowy 2.0’s Business Case and will have a significant detrimental impact on the predicted revenues.

Exaggerated forecasts for Snowy 2.0 operation

The second additional issue is the unrealistically high capacity factors forecast for Snowy 2.0, which I and colleagues have been criticising for years.

Simply, it is impossible for Snowy 2.0, or any pumped hydro station for that matter, to attain a capacity factor of anything like 27% for generation.

At such a level the combined cyclic capacity factor becomes an astronomical 63% after adding the associated pumping capacity factor of 36% (calculated by applying the pumping/generation cyclic efficiency of 76% submitted by Snowy Hydro to the 2020 ISP).

That means that every day of the year Snowy 2.0 would be pumping for 8.5 hours and generating for 6.5 hours at full capacity (2,000 MW). This equates to pumping or generating at an average of 1,260 MW for 24 hours a day, 365 days a year.

Even Snowy 2.0’s Feasibility Study, Dec 2017 didn’t make such exaggerated claims, stating that “in any given year prior to 2040, the Project will be operated at full capacity for less than 87 hours/year”.

Such sustained operation of what is essentially a battery is implausible from both a technical and commercial perspective.

Technically, there will be times when some or all Snowy 2.0’s 2,000MW capacity is not available or is restricted:

- planned and unplanned outages of part or all the plant

- limited pumping when the upper reservoir is near full or the lower reservoir is near empty; likewise, limited generation when the reverse

- limited generation when downstream releases from the Tumut Scheme are constricted during wet periods

- other Snowy Hydro generators have priority to generate at times to comply with Water Licence requirements for downstream supplies, for both the Murray and Tumut systems

- integration constraints with operation of Talbingo Reservoir for both Snowy 2.0 and Tumut 3

- transmission outages and constraints

- allowance for the time to start, stop, ramp up and ramp down

Commercially, there will be times when partial or full capacity operation is not economic:

- the electricity purchase price is not low enough to warrant pumping

- the sell price is not high enough to warrant generating

Also, during periods when it may be economic for Snowy 2.0 to pump or generate, it will be competing with other energy storages, particularly chemical batteries. Batteries will outcompete Snowy 2.0 due to higher efficiency (85+% versus 76%), faster response rates (milliseconds versus minutes) and lower transmission costs and losses (closer location to generators and loads).

It is noted that the 1,800 MW Tumut 3 pumped hydro station has been operating for 50 years at a pumping-mode capacity factor averaging less than 2%. This may well increase in future years with the transition to renewables, but Tumut 3 also could never attain a pumping-mode capacity factor anywhere near 27%.

Clearly, the modelling assumptions for Snowy 2.0 need to be revised. And it is apparent that VNI West will not increase Snowy 2.0’s transmission capacity to Victoria or unlock any of its ‘potential’.

Ted Woodley, former MD of PowerNet, GasNet, EnergyAustralia, China Light & Power Systems (Hong Kong)