Despite past efforts to strut its green credentials and calls by shareholders to take more action to combat climate change, Woodside Petroleum on Tuesday left no doubt it sees its future in gas.

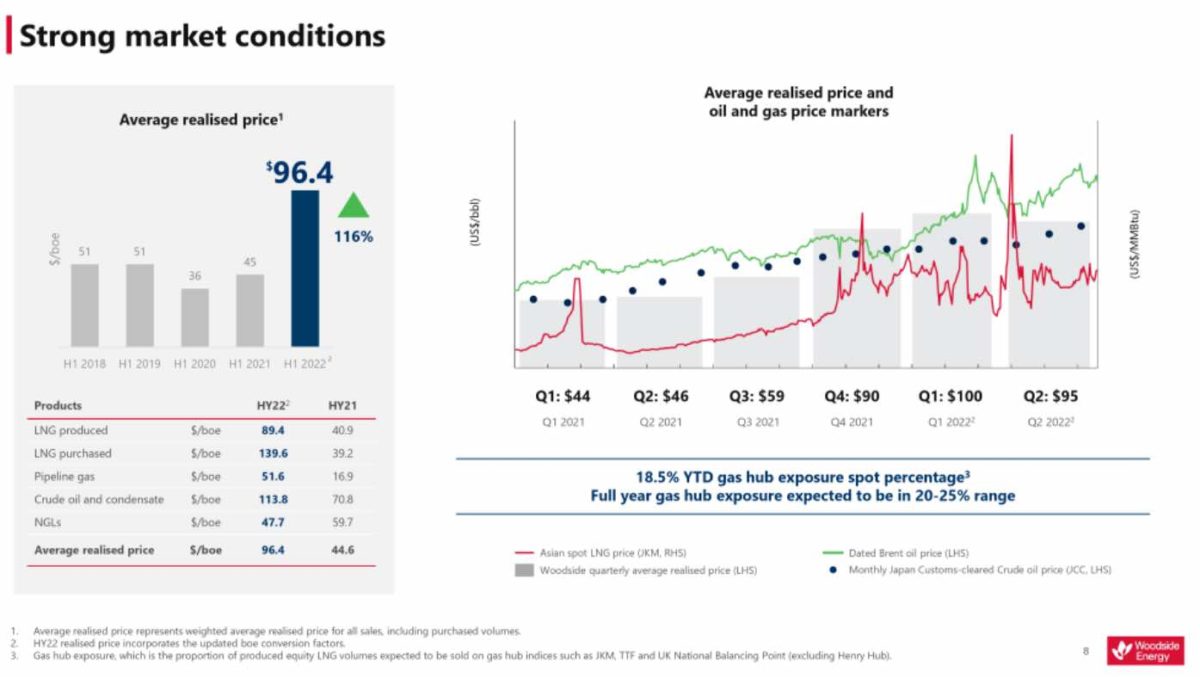

Australia’s largest energy company revealed the massive spike in worldwide gas prices pushed its half-year underlying profit up over 400 per cent to $US1.819 billion from the same period a year ago and steeled its resolve to produce more and more gas.

Rather than invest its fossil fuel profits to transition to renewable energy generation, however, Woodside is doubling down on more oil and gas.

“The upheavals in global and Australian energy markets witnessed over the course of the past six months have shone a spotlight on the importance of gas in the world’s energy mix and underscores our confidence in the longer-term demand outlook for gas, which makes up 70 per cent of Woodside’s portfolio,” Woodside’s CEO Meg O’Neill said.

The only mention of low carbon technology in a corporate presentation and a call with financial analysts was to use carbon capture and storage in an attempt to justify progressing Australia’s massive Browse gas field.

“Despite turbocharged profits, Woodside continues to procrastinate with its energy transition,” Alex Hillman, lead carbon analyst at the Australasian Centre for Corporate Responsibility said.

“This is in contrast to repeated so-called commitments to the Paris target of maintaining warming to well below 2 degrees,” Hillman added.

At Woodside’s 2020 annual general meeting, 50 per cent of investors called for Paris-aligned climate targets.

This month, industry fund NGS Super dumped its $191 million worth of Woodside shares after identifying the company as “at risk of becoming stranded assets as the world decarbonises.”

“Companies whose revenue relies on further oil and gas exploration and production are at risk of becoming stranded assets as the world decarbonises, especially if they are solely focused on upstream4 oil and gas production.,” said. NGS chief investment officer Ben Squires.

“By divesting these companies, we expect to generate higher returns from allocating capital elsewhere,” Squires said.

Woodside remains undeterred.

Construction of its $16.5 billion Scarborough and Pluto-2 gas project in Western Australia is 18 per cent complete, with all major equipment bought and paid for.

Moreover, the company’s Sangomar oil project in Senegal is 63 per cent complete, according to O’Neill.

“Woodside’s aggressive gas expansion isn’t grounded in climate reality, in a world that is racing to decarbonise,” said Greenpeace Australia Pacific clean transitions head Jess Panegyres following the results announcement.

Woodside is the latest in a stream of fossil fuel giants to reap outsized profits from the global energy crisis: ExxonMobil, Chevron and Shell reported a combined $US46 billion in second quarter profits this year.

Such outsized earnings have led to calls in Australia and elsewhere to slap windfall profit taxes on energy companies, possibly modelled on a format used in the United Kingdom.

However, federal treasurer Jim Chalmers has effectively ruled out the imposition of a new windfall profits tax, saying it “is not something that we are considering”.

Making matters worse, Asia’s response to rising energy security worries – exacerbated by the Russia-Ukraine war – is seen by some as a return to fossil fuels, casting doubt on the region’s transition away from polluting fuels and enabling national and corporate backsliding on zero carbon pledges.

“The burgeoning impacts of Russia’s war in Ukraine on energy markets are still playing out in real time, leaving organisations and governments increasingly exposed to a new range of geopolitical risks and environmental realities,” consultancy Verisk Maplecroft warned in a new report.