Large-scale Generation Certificate (LGCs)

The LGC market has previously endured periods of significant volatility with wild swings in the value of the forward curve.

In recent times this volatility has diminished and in March a spell of especially stable pricing and subdued trading volumes enveloped the market, with the only contract to see significant price movement being the Cal 20s. Late in the month the 2018 Renewable Power Percentage was released.

Having closed February in the low $84s, the spot LGC market strengthened gradually across the early part of March reaching a high of $84.75 on moderate trade volumes.

From there the market softened across the middle of the month to return to a low $84.10. Another modest bounce then ensued before the spot ultimately closed the month at $83.90, a drop of 0.5% on February’s close.

In the forward markets the Cal 18s traded between $85.75 and $86.50 in modest volume, ultimately closing at $86.00. The Cal 19s’ trading range was even tighter with all reported activity taking place between $77.20 and $77.50 with the last trade at $77.35.

The big mover for the month however was once again the Cal 20 vintage which gapped sharply lower from the $38.50 last trade level in February to trade between $36.50 and $34.00 across the month, ultimately closing at that bottom end of the range.

Trade volumes were low across all vintages implying a period in which few participants had a pressing urge to engage. In part this may simply be a reflection of the time of year; not long after the 2017 compliance period and before the release of the 2018 target.

It may also reflect a differing of opinions on the likelihood of pricing outcomes and a confident resolve amongst those who hold them, with some participants believing the passage of time will bring increases in the value of the LGC curve, particularly in the Cal 19s and 20s, while others believe there may yet be further softening.

The period leading up to the end of the financial year is often an active one for contracting of commercial and industrial customers and can bring about an increase in activity, and may yet prove the catalyst for change.

Late in March the 2018 Renewable Power Percentage (RPP) was released. Coming in at 16.06% the figure is expected to bring about the surrender of 28.6m LGCs for the 2018 compliance year.

As flagged by the Regulator in January the 2018 RPP was calculated to achieve a surrender result roughly 1.1m LGCs below what was previously expected as a result of over surrender in previous years.

Small-scale Technology Certificates (STCs)

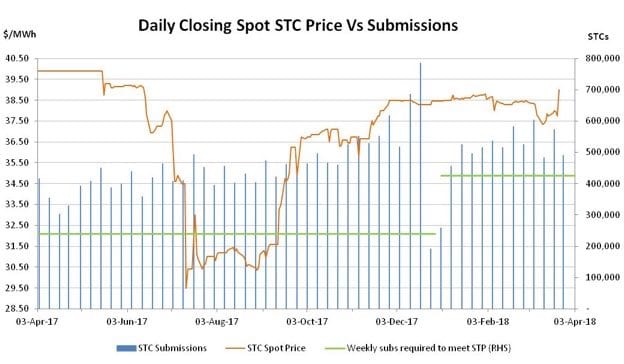

On a bumpy voyage across March on the way to the release of the 2018 Small-scale Technology Percentage, STC prices moved around, volumes remained large and submissions continued to power ahead. As has so often been the case in previous years, the market was ultimately forced to wait till the 11th hour for the target to come.

The STC market is always a bountiful source of rumour and speculation, but in the lead up to the release of the Small-scale Technology Percentage (STP) participants go into overdrive.

And so it was across March as the market waited with unrewarded optimism for the early release of the target.

Activity in the forward market remained strong in the early part of the month with contracts for deliveries across 2018 and 2019 trading in the mid to high $38s in large volumes, while the spot market ticked over in the low to mid $38s.

As time passed however, buying interest became increasingly hard to come by, precipitating several sharp drops in the spot price, with the low for the month coming in at $37.30. All the while the wait for the STP and the speculation surrounding its level continued.

At one point, on the Friday afternoon before the final week of March, the Clean Energy Regulator caused pulses to rise when it emailed out a notification which everyone initially thought would contain the much anticipated figure, only to realise upon closer examination that it was just a reassuring note letting the market know that the process was in train and that the target would be released before the 31st March, the legislated deadline.

When the STP eventually arrived on the Thursday afternoon before the Easter long weekend, it came in at 17.08% or equivalent to 29.3m STCs to be surrendered across 2018.

The figure was comprised of a base component of 22.1m STCs (the number of STCs the Regulator expects to be created in 2018) plus a surplus calculation of 7.2m STCs carried forward from 2017.

The market’s initial reaction to the STP release was a tight trading range, with the spot market bouncing around within the $37.70-$37.90 interval on large volumes.

The sentiment eventually turned bullish though with the spots and forwards creeping up into the $38s and then trading rapidly up to reach a high of $39.00, the level at which the market closed the month.

The 2018 STP came out toward the top end of what participants had been expecting, yet the figure may yet prove to be a mixed outcome.

Firstly the surplus figure calculated by the Regulator is based upon the number of STCs registered across the year and therefore does not include STCs pending registration at 31 December (1.5m).

These STCs are however, available for surrender and thus provide and extra supply buffer.

Looking just at the base component of the target (22.1m), the 2018 STP therefore requires 425k to be submitted each and every week across 2018.

In the year to date, average weekly submissions as at the end of March stood at 505k, with that figure climbing sharply to 540k per week when January is removed from the calculation. In short STC submissions have picked up since late last year when the calculation for the STP was made.

What happens to STC supply from here on in is all important. Should current rates be maintained, then a sizable surplus of STCs will remain un-surrendered after the end of the 2018 compliance year.

While that figure will very likely be less than the surplus rolled forward from 2017, it currently appears set to be in the order of at least 5m STCs. What this also means is that it is highly unlikely that the Clearing House will be used in 2018.

Marco Stella is Senior Broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services across all domestic and international renewable energy, energy efficiency and carbon markets