Australia’s Clean Energy Regulator has taken the extraordinary move of stepping into the market to set “expectations” that any windfall profits to carbon traders from newly announced changes to the government’s main climate mechanism are shared with farmers and landholders.

The changes to the Emissions Reduction Fund will see the regulator facilitate carbon traders to sell their carbon credits, known as Australian Carbon Credit Units (ACCUs), on the potentially more lucrative open market rather than be bound by lower priced contracts to sell the credits to the federal government.

Earlier this week, it was expected that this could deliver windfall profits of around $1.3 billion or more from around the 131 million carbon credits subject to the changes, as prices on the open market were significantly higher.

But in the last two days, ACCU prices have plunged even further, putting the size of any windfall gains in doubt, as the market reels from the shock of the changes and their implications.

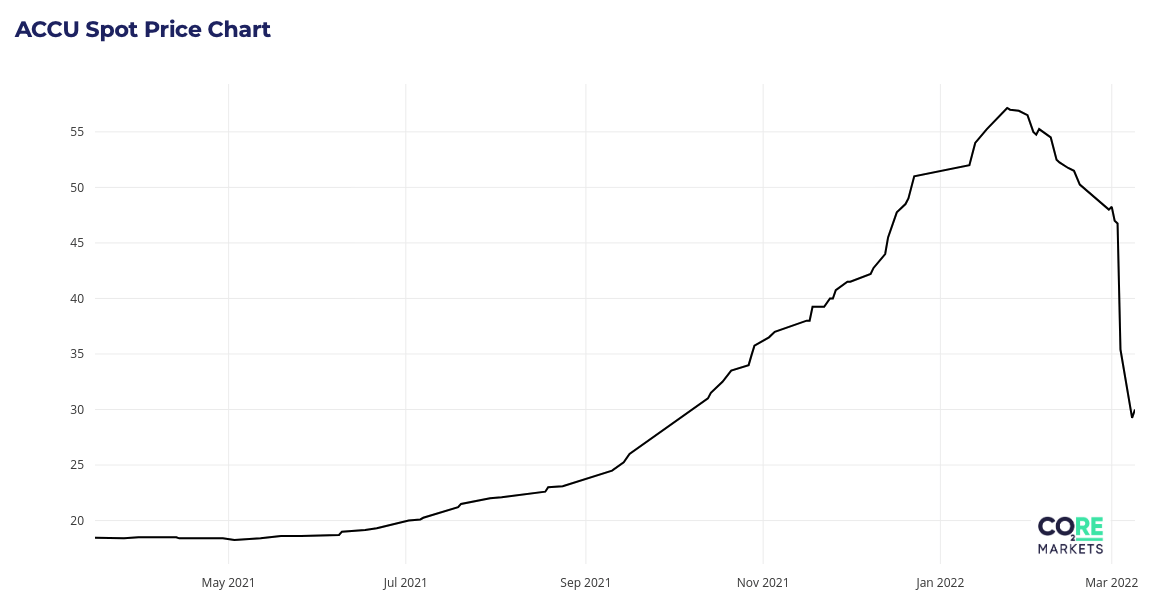

The changes announced last week were prompted by a surge in the price of ACCUs to all-time highs – as much as four-times the price the regulator was set to pay under the ERF contracts.

This led to some abatement projects considering activating a contractual clause that would allow them to instead sell their ACCUs into the open market, taking advantage of the higher prices.

However, the surprise announcement that the regulator would actively facilitate the projects to effectively exit from their contractual obligations – rather than try and hold projects to deliver on their contracts – sent a shock through carbon markets.

On Thursday, the Regulator announced that it will now consult with carbon market participants on “expectations” that they would share any potential windfall gains following its decision to free up carbon abatement projects.

But since the announcement, ACCU prices have plummeted. Having traded at around $47 per ACCU immediately before the Regulator’s announcement, this week their prices slumped to below $30 per ACCU.

This dramatic fall in prices suggests the Regulator, and Angus Taylor may have fundamentally misread, or at least have mishandled, the contract issue – an issue exacerbated by the lack of any consultation with industry before announcing the changes.

The price fall has also come at the detriment of those looking to develop new carbon abatement projects, which have seen their prospective revenues slashed – potentially denting investment in Australia’s fledgling carbon market.

Take, for example, Santos’ Moomba carbon capture and storage project, which the company successfully to be eligible to generate ACCUs for the carbon emissions it stored, and to be able to participate in the Emissions Reduction Fund

Santos has indicated that the financial model for the Moomba CCS project was predicated on a $70 per tonne carbon price. While ACCU prices had yet to hit that threshold, they were much closer to that mark before the Regulator’s recent change in position regarding ACCU contracts.

The change has seen around 40 per cent of the value of ACCUs wiped out in the space of a few days after federal energy and emissions reduction minister Angus Taylor indicated the federal government would facilitate around 132 million ACCUs to be freed up from their contracts.

As RenewEconomy has covered, selling these ACCUs into the more lucrative open market could deliver a windfall gain for carbon traders. Even under the much lower ACCU prices, project proponents stand to gain an extra $5 per ACCU. At current ACCU prices, the total potential ‘windfall’ amount to more than $650 million.

With the prospect of such large amounts being collected by carbon traders, the Clean Energy Regulator has obviously seen the need to set expectations that any such windfall was shared with farmers and landholders that host many of the offset projects.

“The Clean Energy Regulator will consult on an expectation that landholders, project proponents and carbon service providers will reach agreement on how benefits are to be shared,” the Regulator said in an email to stakeholders on Thursday.

“The benefit-sharing arrangement could broadly reflect the agreement parties struck in their service agreements to deliver the carbon abatement contracts.”

However, many analysts believe ACCU prices will remain supressed, and any potential windfall for farmers and landowners should quickly evaporate.

This is because, under the Emissions Reduction Fund, the federal government was to serve as by far the largest buyer of ACCUs, and the ‘voluntary’ market for ACCUs remains comparatively small.

The Clean Energy Regulator has estimated that the voluntary demand for ACCUs – mostly from corporate emitters looking to voluntarily offset their own emissions – was expected to amount to just 1 million ACCUs in the 2021 year.

However, the Regulator has potentially just freed up a supply of around 13 million ACCUs each year for the next seven years.

Carbon analysts believe this flood of ACCUs released from government contracts is set to overwhelm the voluntary market and is the reason why ACCU spot prices have plunged in recent days.

While the voluntary market for ACCUs is expected to grow, as companies strengthen their commitments to climate action and adopt their own emissions reduction targets, it may not achieve the rapid growth needed to absorb these extra ACCUs.

Some market insiders have suggested to RenewEconomy that ACCU prices could ultimately settle around $25, representing the minimum price where a project proponent would consider exiting their government contract.

This floor price represents the value that would be foregone by a project exiting the contract – which averages about $12.50 per ACCU – and the same amount also payable as ‘buyer’s market damages’ to the Regulator for non-delivery on the contract.

If prices were to fall below $25 per ACCU, it would make sense for abatement projects to stick with their government contracts, and the opportunity for a ‘windfall’ gain disappears.

One obvious fix for the current situation is for the federal government to introduce an effective emissions reduction policy – which could significantly increase the demand for carbon abatement projects.

The basis for the Emissions Reduction Fund – which started life as the Carbon Farming Initiative – was to act as a source of carbon offsets for major emitters covered by the Gillard government’s carbon tax.

The re-introduction of some form of carbon pricing could boost demand for carbon offsets while ensuring Australia was also undertaking meaningful steps to reduce its emissions.

Instead, the Morrison government appears content to rely on voluntary commitments from the private sector to cut emissions, which is both evidently insufficient to guarantee any meaningful cuts to emissions while also contributing to the government’s fundamental misreading of the ACCU market.