Dispatchable generation is much in the electricity news these days. Increasingly, we are debating what are the requirements for a “reliable” electricity supply as the variable renewable share increases.

The general public are always concerned with what happens “when the sun doesn’t shine and the wind doesn’t blow” As we’ve remarked, the intermittent nature of wind and PV has been of concern to system operators and the general public since the first wind turbine.

So far electricity grids have shown that the can cope with wind and PV levels of say 20 per cent without any drama. Central Europe (Germany, France, Italy, Spain and the Nordic countries), California and Texas are all examples we regularly point to.

Those regions are all ahead of Australia’s National Electricity Market (NEM) in terms of the current level of wind & PV penetration, but it’s fair to say they all have better levels of gas and or hydro than the NEM. So there is a particular risk in the NEM.

However, we’ve also shown that in the NEM demand on average swings around by more than 30 per cent from peak to trough, and on some days by much more than that. So far, the NEM’s mostly coal based system has coped with that as a matter of course.

So for us we don’t think grid reliability and flexibility in the NEM would be much of an issue for the next few years except for the fact that the coal generation fleet is getting very old, and the number of coal generators is reducing.

The main risk in the next few years is the physical reliability of the coal generators in Victoria and NSW. There are only 8 coal generation stations, two of which share one coal supply. However, each station does have more than one unit.

So for the past decade the question has been what to replace these coal generators with and how fast to do it?

Everyone knows they need to be replaced, but partly because of ideology and perhaps partly because of fear of the unknown there has been a reluctance to get on and design a system that phases these generators out in an orderly manner and replaces them with a largely VRE system backed up by dispatchable renewables and perhaps a bit of gas.

A couple of ramping examples

If we look at South Australia since Hazelwood closed it breaks into a high wind phase and a low wind phase:

The thing that jumps out is that on average South Australia has since July been a net exporter of electricity.

That’s possible because Victoria’s prices are high because gas and hydro are the price setters in the State these days. Victoria is the new South Australia, and actually it’s the new South Australia but without, yet, the low variable cost renewables.

So if we look at what’s happened since July (the high wind period) even into November (lower wind again) what we see is that Pelican Point has been a huge beneficiary of the Victorian prices, and at the same time the ramping required in South Australia is now being managed by Tips B (Torrens Insland unit B) and by exports.

Exports go up in the middle of the day and Tips B output goes up and down. Pelican Point, a mid merit, not particularly flexible, combined cycle generator has been holding its output relatively steady.

Tips B, being a steam fired gas generator, is we think more flexible and suited to ramping than Pelican Point. At the same time Pelican Point’s heat rate is lower than Tips B minimizing gas use.

We’ve also noted, as have others, that South Australia’s hot water tariff should be adjusted to the middle of the day from midnight. This requires as we understand it replacing a bunch of meters, but meter replacement is all the go now anyway.

On average gas goes from 660 MW minimum to about 1100 MW max. This doesn’t seem to challenging now that Pelican Point is operating.

We’d add it’s Origin Energy that supplies some of the Pelican Point gas and it’s Origin Energy that benefits from South Australia’s exports to Victoria as Origin doesn’t have the generation in Victoria to cover its load.

Its only power station there, Mortlake, is open cycle, and quite a bit of gas has to be burnt there to defend its position.

California and its duck curve

We don’t usually admit defeat in working our way around electricity data bases but in the case of CAISO’s Oasis system we admit we need some help. Despite couple of hours of effort we can find that part of the data base that shows generation by fuel by hour of day.

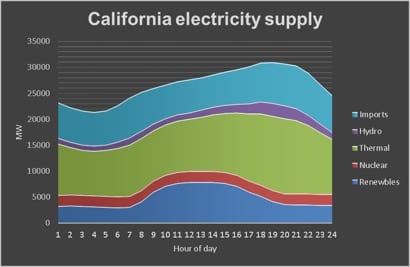

So we had to reply on one file we could obtain that only goes up to March 2016. The duck curve (generation other than by solar) will have become more pronounced over the past 18 months, and will be more again in another couple of years. Still as of the 12 months ended March 2016 the gas, hydro and exports seem to be coping with it reasonably well.

Most of the 5 GW, probably over 6 GW today, ramp requirement is carried by gas, with small adjustments to imports. The gas generation has, on average, about 10 hours to increase output by about 5 GW, so it seems that most of the time gas is well suited to this role.

What it shows is the advantage of a larger grid where multiple gas units can gradually come on an off line.

There are plans to phase out the California nuclear supply. As California moves on towards its 50% renewable target (including renewables share of imports) and because electricity demand in California is not growing it will be gas that is forced out of the system.

Demand management may have some impact as well. So even in California there is going to have to be some thinking about dispatchable renewables to replace gas. If anyone can point to some more up-to-date data on California I’d be grateful.

David Leitch is principal of ITK. He was formerly a Utility Analyst for leading investment banks over the past 30 years. The views expressed are his own. Please note our new section, Energy Markets, which will include analysis from Leitch on the energy markets and broader energy issues. And also note our live generation widget, and the APVI solar contribution.