Queensland has released a first look at draft plans to unlock more than three gigawatts of new renewable energy generation capacity within designated zones across the state, in a critical – if frustratingly small – step towards the goal of 50% renewables by 2030.

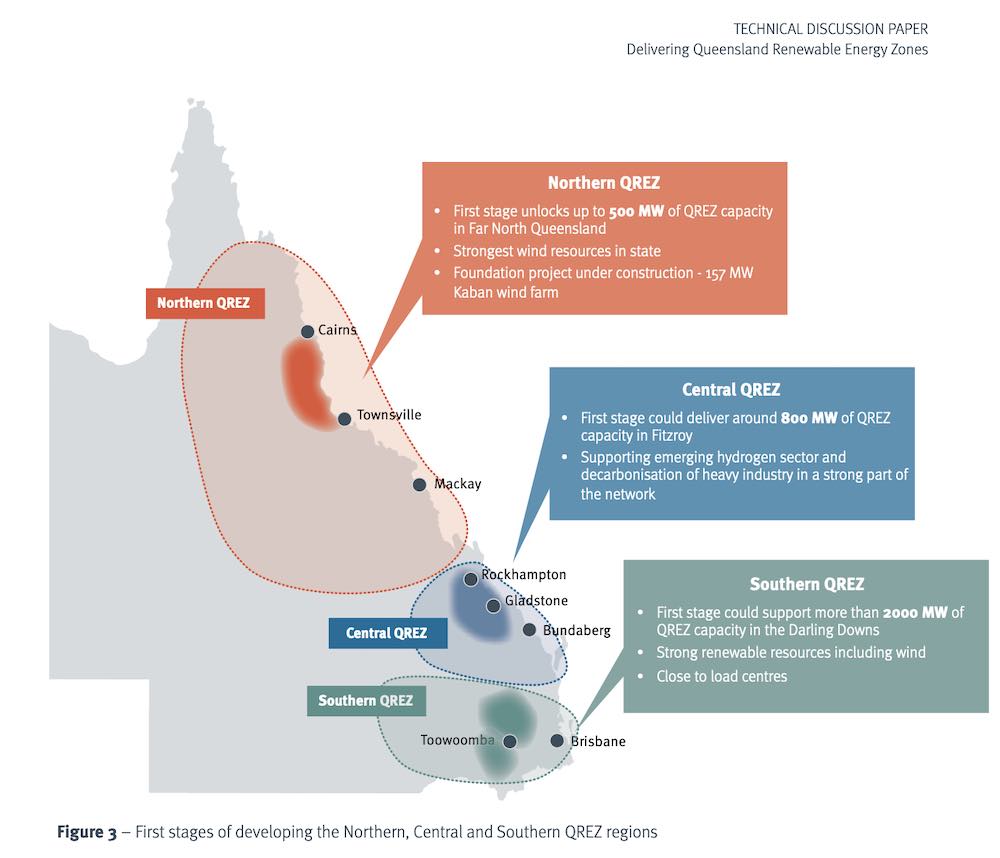

The paper identifies the potential for 3300MW of combined new generation capacity to be unlocked in the first stage of development the of three broad designated renewable energy zones: the Northern QREZ, the Central QREZ and the Southern QREZ.

At this stage of the planning, the bulk of the first round of new capacity – an initial 2000MW – is projected to be rolled out in the Southern QREZ, the smallest of the three designated regions which takes in Brisbane and Toowoomba.

According to the paper, this QREZ will focus on enabling “quality wind resources” across the Darling Downs and adjacent regions, with tailored infrastructure to build on the region’s existing strong network capacity supported by the proposed Borumba pumped hydro energy storage site.

The Central QREZ, which includes Rockhampton, Gladstone and Bundaberg, is earmarked to support an initial 800MW of new capacity, starting with a focus on the Fitzroy region and on the development of resources to support the emerging hydrogen economy.

For the Northern QREZ, which takes in Cairns, Townsville and Mackay, the paper outlines $40 million plans to build on existing transmission infrastructure, to support connection of an initial 500MW of capacity in the far north, with a focus on that region’s “excellent wind resources.”

The paper also paves the way for the establishment of sub-zones within the three established QREZs, based on regions identified by the Australian Energy Market Operator’s Integrated System Plan as some of the best locations for new generation investment in Queensland.

It proposes that the three QREZ regions are developed in stages, by declaring individual zones within a broader QREZ region as a “declared REZ,” which would focus on a specific geographic area where transmission infrastructure would be apportioned via a REZ Management Plan (RMP).

Under this model, the paper says, a hosting capacity limit would be applied to each “declared REZ” with generator connections managed through a coordinated process, providing certainty to investors on the physical capacity limits of the declared REZ.

“Importantly,” the paper stresses, “the combined more than 3300 MW of renewable capacity in these regions form just the first stages of QREZ development.

“In the long-term, further development of the QREZ regions will support the growing demand for renewable energy from emerging sectors like hydrogen, as well as support the decarbonisation and electrification of job-creating heavy industry in Queensland.”

But early feedback on the plan so far is that it falls short of the mark on ambition, both in terms of the capacity it proposes to unlock in the first round of investment and the timelines and frameworks for these early goals to be achieved – particularly in light of the looming 2030 target.

Indeed, 3,300MW seems starkly conservative in light of the 60,000MW-worth of project proposals the government was flooded with just under one year ago, when it tested the water with a call for expressions of interest.

Renewable energy advocacy group Solar Citizens said 3.3GW also looked “measly” compared to the REZ plans of the other major NEM states, Victoria and New South Wales, and called for at least 2GW of new capacity to be added to each of the QREZs by 2025.

“Both New South Wales and Victoria have announced Renewable Energy Zone targets that will propel them towards becoming clean energy and hydrogen superpowers,” said Solar Citizens energy strategist, Stephanie Gray, on Tuesday.

“The Sunshine State has all the right ingredients to kick-start new industries in areas like renewable hydrogen production and battery manufacturing for electric vehicles,” Gray said.

“We’ve got critical mineral resources needed for clean technology, a skilled workforce and the possibility for abundant and cheap renewable energy.

“But unless we at least match the ambition of other Australian states, we risk investors taking their funding elsewhere.”

The Queensland Conservation Council also took issue with the lack of ambition in the Queensland government’s initial plan, saying it failed to approach the level of urgency required to meet the state’s renewable energy goals and transition away from coal.

“The early indications of how the Queensland government will manage access, declare REZ and create REZ Management Plans is … much needed,” said QCC director Dave Copeman in a statement on Tuesday.

“Unfortunately, the REZ Technical Paper still leaves Queensland at the back of the race. All other states within Australia’s National Electricity Market have set more ambitious and clearer renewable energy pathways than Queensland.”

The QCC also wants to see a minimum target of 2GW in each of the three QREZ regions by 2025, which it argues can be achieved by setting a timeline to declare REZ and REZ Management Plans, setting capacity targets and planning a timeline to develop this capacity within each REZ.

Under the current QREZ model, the government proposes that a designated planning body, currently nominated as the state’s transmission network service provider, Powerlink, will identify “investigation areas.”

Recommendations will then be provided to the Queensland energy minister, who will then issue a market and community notice to engage with industry and community on the investigation areas and test the locational feasibility.

That process with then inform Powerlink on assessing and recommending the areas and QREZ infrastructure to be progressed for further development – and based on this, the energy minister would declare a REZ, ahead of the release of a draft REZ Management Report (RMP).

For now, the government wants to hear from industry players, regulators and stakeholders, about their thoughts on the QREZ model, in particular the planning, community and market notice processes; connection and access; funding arrangements, and; the mechanism for application of the framework.

Submissions are open until January 14, 2022.