Electric vehicles sales are taking off around the world: Plug-in electric car sales in May were up about 200% over the previous year to 442,000, which translates to an annualised rate of about 5 million.

EVs now represent 6.6% of total global passenger vehicle sales. Just a few years ago the share was about one per cent. And we would argue the growth has a long, long way to run yet.

Australia’s present exposure to this is through the resources sector, where we can identify about $38 billion of current market value related to EV raw materials (lithium, rare earths, copper) and through charging infrastructure, where Tritium has an eye watering valuation. You have to hand it to coal barons Trevor St Baker and Brian Flannery, those boys know where the $ are.

This EV sales growth and market share is essentially being achieved without any real contribution from the world’s largest car manufacturer, Toyota. Indeed, there is no Japanese electric car brand in the top 10 for YTD (year to date) sales. Toyota did make it to No 10 for the month of May, but is No. 20 for YTD.

The figures do show the rise of China in EV sales.

ITK doesn’t expect Japan to show up in this list for a few years. Japan has been very slow out of the blocks and is only now realising that EVs are the real deal.

On the other hand, Hyundai and Kia aren’t in the charts yet but they are virtually certain to be right up there over the next couple of years.

I’d argue that their new models – Ioniq 5 and Kia EV6 – are among the best mass produced EVs ever built to date, winning for instance the 2021 “Auto Express design award”. And the thing about the Hyundai platform, like the VW platform, is that it’s relatively easy to change the body shape and make smaller or bigger cars once the power platform is sorted.

Although a 240 volt plug attached to the Hyundai is much talked about, I’d argue that its most future proofed element is the 350 KW charging capacity about which more in a moment. Equally, the Kia – which might be my next car – has a heads up display without which I would argue no modern car is complete.

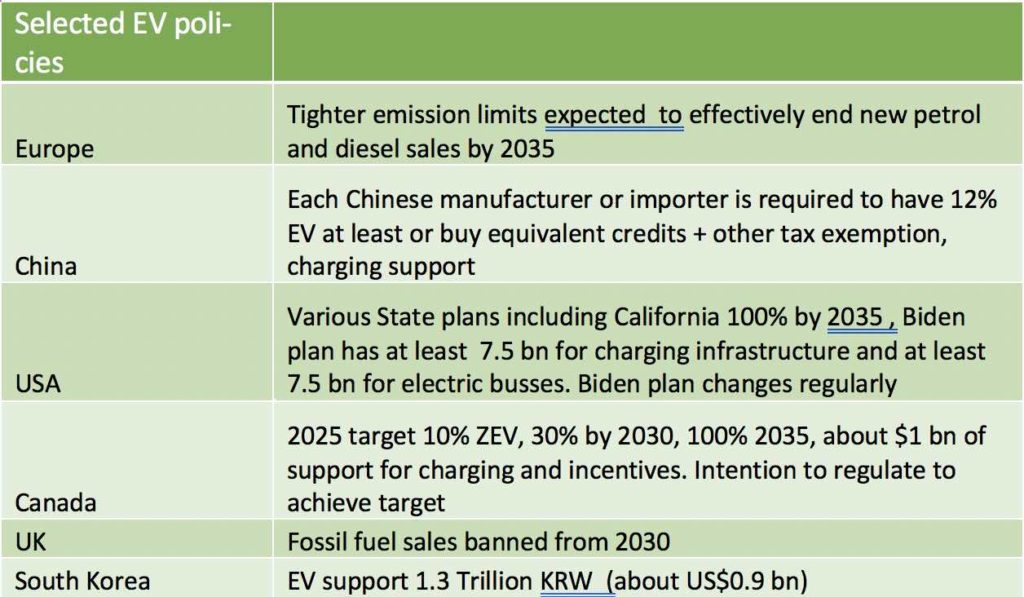

There is a clear policy path to a 20 million EV market by 2035

World wide car sales are about 70 million in an average year, of which Europe accounts for around 12 million and maybe another 2 million in the UK, maybe 0.8 million in California and 2 million in Canada.

All these markets (totalling 17 million) have policies aiming for 100% EV (or maybe hydrogen) by 2035 and China has a 12% target, but let’s say 15% when other rules are added in to its 21 million market or another 3 million EVs minimum.

So there is a reasonably clear pathway to a 20m market by 2035. ITK expects that to be reached sooner than 2035. Our guess would be 20m by 2030, maybe 25m. But that’s a lot of growth and a lot of things that could go wrong.

Lots of batteries required

If you are selling 5m plug in cars a year, of which 2/3 and growing share is fully electric, you are going to need a lot of batteries.

A conservative estimate of 5kWh capacity (and that will grow as battery costs come down) times five million is about 250GWh of battery manufacturing capacity, and that will likely 1TWh of capacity in say 5 years. So how’s the factory build going?

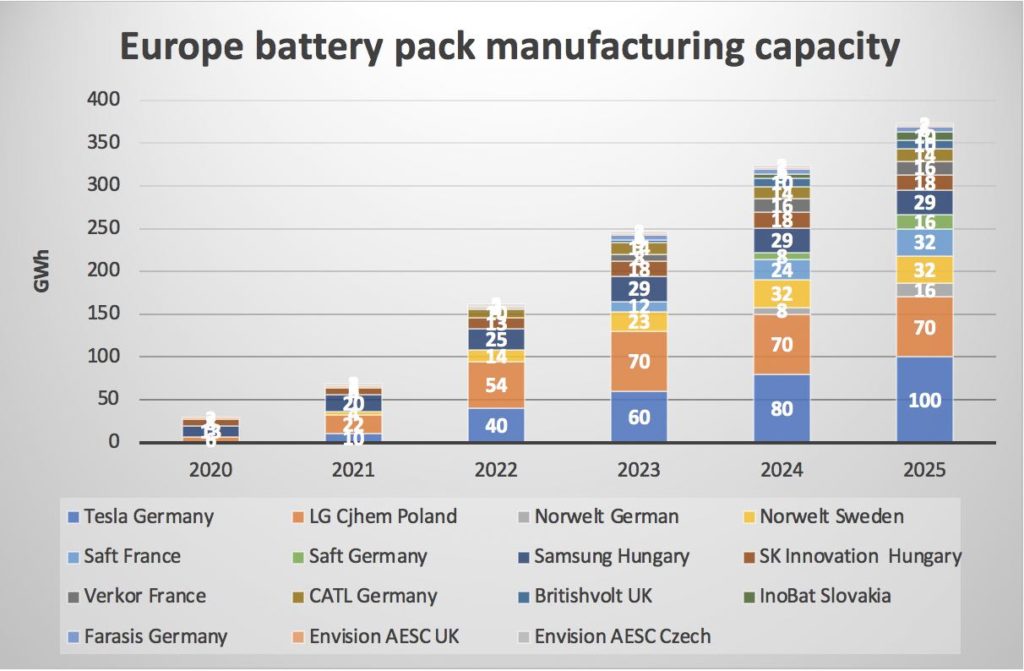

In Europe, it’s gone from 11GWh in 2018 to a projected 368GWh in 2025, according to data put together by S&P Global. So 30x growth in 6 years. How’s that for investing in manufacturing!

Employment? LG Energy solutions, the battery division spun off from LG Chemicals last December, employs 22,000 people.

But that’s only Europe.

Globally, S&P looks for about 1.4 TWh of manufacturing capacity by 2025, over half of which is located in China to feed an expected 10m plug in vehicle sales.

But actually S&P’s numbers, aggressive as they are, look conservative and imply it will take 4 more years to go from 5m global sales to 10m, when the current global instantaneous monthly year on year growth rate is 200%.

LG Energy is investing US$4.5 billion over the next four years in the US to increase its annual capacity in the US to 70GWh. LG will also build a new cathode factory in South Korea.

More broadly, South Korea President Moon Jae-In has announced a US$35bn 10 year investment program in the South Korean battery industry. South Korea sees itself in strong competition with China, again Japan isn’t even on the same lap.

“The global competition is just getting started, as the US, Europe and China are making moves to establish their own manufacturing infrastructure, battery technologies and supply chains,” an industry ministry official added. “The next five years will decide the standing of each country in the global battery market.”” Source: Electrive.

How can Australians get exposure?

Good luck buying an electric car in Australia. We are generally at the back end of the field for EVs. VW doesn’t sell EVs in Australia, Hyundai will likely roll out its models to NZ before Australia, the Chinese brands are generally not available.

What about Federal Govt policy support?

There are two main reasons, in my opinion, that would justify Federal Govt policy:

- Transport is responsible for 19% of Australia’s carbon emissions, and at least for road transport EVs represent a viable, economic way to reduce those emissions. Australia has nothing to lose from supporting EVs, that’s what I can’t understand. We don’t have a car industry, the Govt killed that. We don’t really have an oil industry. It’s not like the coal or gas industry which are large export owners. Not supporting EVs is indescribably dumb. It’s the Federal Nationals cutting off the Liberal noses to spite their faces.

- It’s in our national interest. EV’s provide a degree of energy dependence. Australia has a net oil import bill of about $30bn per year. Should there be any significant Asian conflict an immediate strategic aim of any Australian opponent would be to cut off our oil supply. EVs provide a natural defence against that. Once we have a fleet of EVs we could care less about oil imports. Again I can’t understand why the Australian Govt is so keen to spend $50bn or more on 12 submarines badly designed and out of date before the first one enters the water, never mind the last one in the 2050 and yet won’t take a more immediate and very low risk chance to reduce our oil import bill and oil import strategic risk.

Still the current Federal Govt specialises in looking and acting dumb, at least when it comes to energy policy. So I guess the Federal EV policy is in line with expectations.

Fortunately, the NSW Govt has come up with a sensible policy. As a reminder:

1: A rebate of $3k for the first 25 k EVs sold under $68,750. (so that’s about 4%) but 25k is not a lot of cars, about 1 months of sales of all cars in NSW.

2: Removal of stamp duty on EV’s priced under $78k, that should reduce costs by about 4% (3% on the first $45 k and 5% on the balance). That’s a very handy saving.

3: EVs can use T1 and T2 transit lanes (that alone will encourage purchases in Sydney in my view)

4: Investing $170m in charging infrastructure which is supposed to include “ultra fast” chargers at 100 km intervals on major NSW highways and 5 km intervals across Sydney and off street parking infrastructure. In addition charging infrastructure at commuter (train and bus) parking stops.

As usual from the current NSW Govt when it comes to energy policy, this is all sensible. You have to say since Matt Kean became Minister for Energy in NSW, the state’s energy policy has advanced from very backward to up there with the best in the world. It’s such a change to be able to write positively about policy and leaves one longing for a Federal Govt that got it the same way. If only.

There is also support in Victoria, space does not permit a run through.

Charging , charge rates and Tritium

There are about 2,400 charging stations, quite a lot relative to the size of the EV fleet and relative to the 6,500 petrol stations (down from 25,000 in the 1970s)

However, new models will increasingly be capable of faster charge rates. For instance the new Hyundai/Kia models can do 350kW, which takes the battery from 10% to 80% in about 10 minutes. Sure you wouldn’t want to do that every day, but it’s surely convenient when you are in a hurry.

Although Tesla is arguably the dominant charging supplier in Australia, in the fullness of time interoperability – as with bank ATMs – will surely be the way forward.

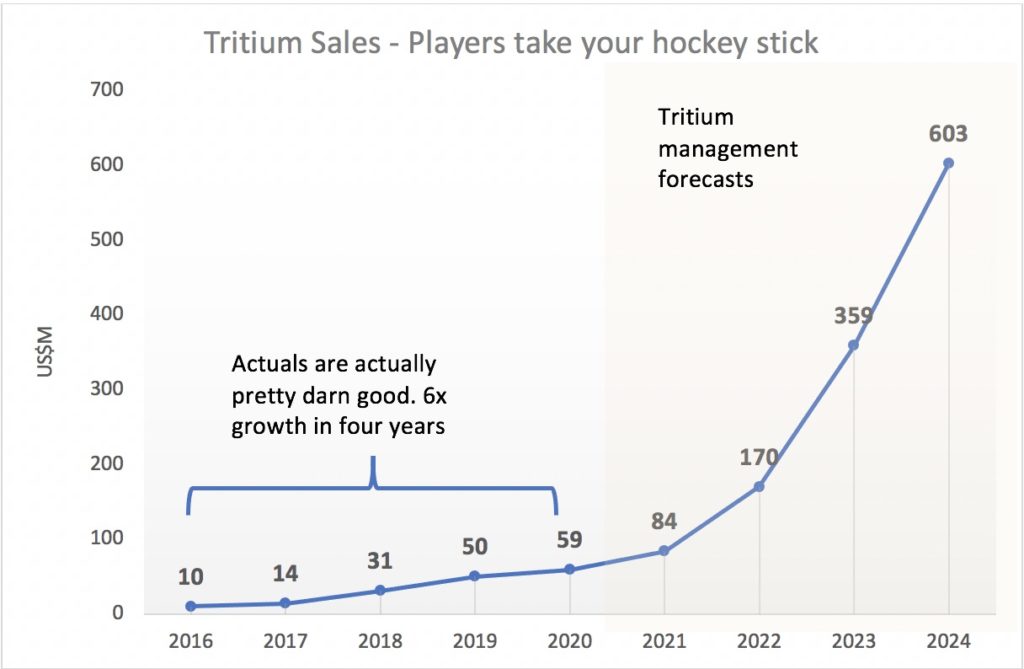

Tritium recently made financial disclosures as part of a transaction with a US cash box termed [SPAC] where “investors” give money to managers in the hope the manager can make them some money buy buying an asset.

Historically, cash boxes didn’t work so well in Australia but in the current easy money climate they go ok in the US. To this conservative investor it’s a bit like giving your teenage kids a lot of money and telling them to spend it wisely on your behalf. Never mind.

To be fair the cashbox in Tritiums case has a CEO with a track record (EG docusign)

I don’t want to dwell on Tritium although the point of this section is what you can invest in and management forecasts of what’s going to happen five years out in such a fast moving industry should be treated with due caution.

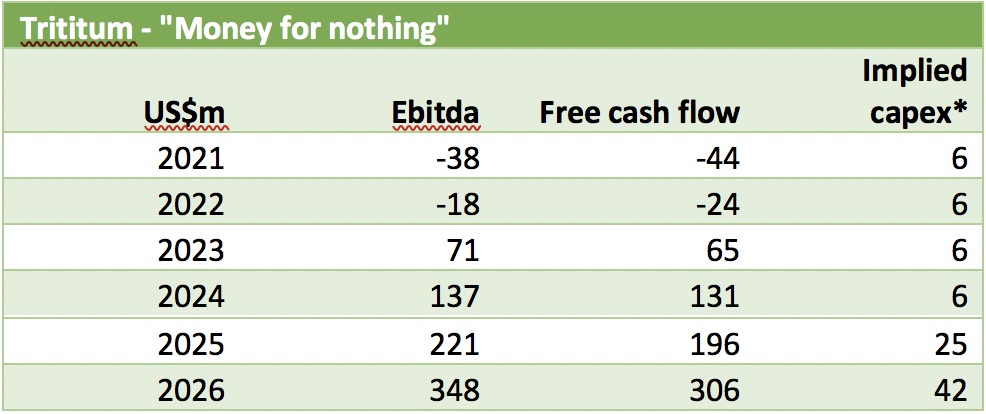

But, but, but …. the analyst in me can’t help observing from the numbers Tritium discloses, that all this fantastic cash flow growth is going to be accomplished with next to no capex. Wonderful things them electrons.

Figure 4 Source: Company, ITK estimate

Come on digger, pass the shovel. Raw materials is what we do

Historically, as far as the share market goes Australia basically does two things.

First we lend money so all the punters can own a house or big punters can own an office block or shopping centre (that’s the banking sector).

Second, we dig things out of the ground which we sell mostly to China and Japan and some to South Korea.

It turns out that Australia is going to be able to dig things out of the ground for the EV industry. Those things include:

- Lithium extraction and maybe processing

- Rare earths mining. The rare earths are used for electric motor magnets.

- Copper and nickel mining and processing (though there isn’t as much of that anymore as we would like).

I thought I was keeping an eye on the EV raw materials sector, but I was wrong. About 2/3 of the stocks in the list I hadn’t heard of until I went looking.

Many are exploration companies and many will never progress beyond exploration, even so right now it’s a $38 billion sector that in terms of share market performance is on fire.

Over the past two years the median share price performance is 218%. The total market cap is $38 bn so two years ago might have been say $10 bn.

Note that Mineral resources does a lot more than mine Lithium and I included Oz Minerals as a copper exposure. Lynas does the rare earths and is one of the few global exposures to rare earths outside of China.

Rare earths are used to make magnets for electric motors. (Disclosure ITK Super fund owns Lynas and Orocobre).

Most of the rest of the list are lithium miners or would be lithium miners. Space does not permit a description of the big difference beteen Australian spodumene, lithium exposure v South American lithium brine, nor of the difference between Lithium Carbonate and Lithium Hydroxide. Suffice to say Australia has enough raw material resources that “investors” have fallen hard for the sector.

It might seem a shame that Australia does the raw material extraction and not the value added processing, cell manufacturing, pack manufacturing or car manufacture/car design etc.

However, that would be to underestimate the advantages of specialisation, and to underestimate the skill required to be good at mining.

In the same way that battery pack manufacturers will have a range of related manufactures located close by, so the mining sector can call on the suppliers of materials, labour, project management, environmental services, legal and finance skills.

Don’t underestimate the value add of resource extraction in Australia.

Check out more EV news and analysis at our EV-focused sister site, The Driven.

Policy