Origin Energy says it is getting close to sealing a deal on its giant Eraring battery in NSW, but has indicated that the planned closure date of the coal plant it is designed to help replace remains in flux.

Origin plans to build a battery of up to 700MW and 2800MWh, which would rank as the biggest in the country, although it will almost certainly be built in stages, with the first stage likely to be 460MW with one or two hours of storage.

“We’re very well advanced on the Eraring battery,” CEO Frank Calabria told analysts in a briefing on Thursday to discuss its half year results.

“We’re in quite advanced negotiations with the selected contractors as we approach the FID (final investment) decision which will be very soon we expect.”

Calabria says while battery costs – particularly lithium – have risen (but not in the most recent times), the business case for the battery has also strengthened given the increased volatility in markets and the anticipated coal closures in the grid over the coming decade.

But while plans for the big battery advance, and it is due to be completed by 2025, the exact closure dates of all four units at the 2800MW Eraring plant – the biggest in the country – look in danger of slipping, particularly given the delays and problems in the Snowy 2.0 pumped hydro project and other large scale renewable projects.

Origin has always described the planned closure date of Eraring as “potentially as early as August 2025.” Its latest report repeats the statement and that it will continue to assess the market, and this will inform the final timing for the closure of all four units.

But there is growing speculation that the timing may slip, as there is, in the words of Calabria, “a lot to digest” in energy markets. The Australian Energy Market Operator will next week release an update of its ESOO, its near term forecasts on whether the grid will have enough supply in future years.

There’s been a couple of big moving events – particularly the problems at Snowy 2.0, which AEMO have finally been officially told about, and the fact Australia’s rate of new wind and solar projects is running at around half that needed to meet AEMO’s, and the federal government’s, forecast of 82 per cent renewables by 2030.

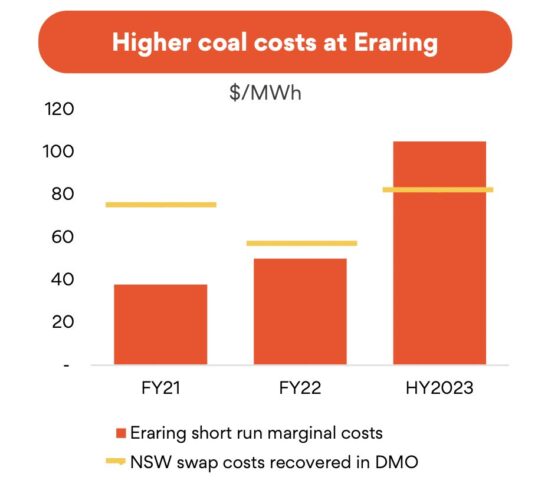

Eraring’s future will also depend on anticipated maintenance costs, and the cost of coal, which has spiked markedly in the last year, and has pushed its short run marginal cost above the $100/MWh mark, more than double what it was two years ago. (See graph above).

Eraring’s future will also depend on anticipated maintenance costs, and the cost of coal, which has spiked markedly in the last year, and has pushed its short run marginal cost above the $100/MWh mark, more than double what it was two years ago. (See graph above).

The country’s biggest coal generator spent $200 million boosting its coal stocks in the last half and actually lost money during the period, although Origin is confident that a re-set of electricity tariffs (which means higher bills for consumers) will allow Eraring to start making money again soon.

The situation is further complicated by the proposed coal price cap, and how much compensation Origin will receive from the state and federal governments given its margins are so close to the cap proposed.

And, of course, there is the fate of the proposed $18.4 billion bid by Brookfield and its US bidding partner EIG (which wants the LNG business). Those talks have dragged on for months longer than expected, but they are continuing.

Origin confirmed in its presentation that it is looking at additional big batteries, particularly next to its gas peaking stations that it says will be crucial as the grid flips from coal to wind and solar, but also confirmed that much of its new renewables capacity will be funded by third parties.

One interesting graph that caught the attention of analysts was that – for all the took of Origin having the best “platform” to transition to renewables – it sees renewables and storage still accounting for a minority of earnings five years out.

This graph above suggests that the growth in earnings from renewables and storage over the next five years will be lower than that of wholesale electricity – its thermal fleet – and wholesale gas markets will continue to be the biggest earner for the company, followed by retail.

Of course, those forecasts may mean little if the takeover from the Brookfield consortium goes ahead, and the asset manager delivers on its pledge to fast track renewables and spend $20 billion by 2030, but time is running out on that pledge too.

Gas was the saviour to the company in the last half, with a windfall distribution of $786 million from its LNG business, and gains in its wholesale gas business in Australia partially offsetting the dramatic slump in electricity earnings, which were hit by the higher cost of fossil fuels and the delay in passing on those costs to consumers.

The company’s underlying profit slumped to just $44 million in the first half, down 84 per cent from $268 million a year earlier, despite a $170 million lift in earnings from its LNG business. It declared an improved dividend of 16.5c, up from 12.5c, citing a better outlook.

A couple of other observations about the Origin presentation:

The company will make an estimated $218 million profit from the deferral of large scale generation certificates, by choosing to pay a shortfall charge now and buying the LGCs at a (hopefully) cheaper market price within the three year grace period.

Origin says it has grown its virtual power plant resource significantly to 449MW, up from 258MW, although it says only around 30-40 per cent of this could be considered “firm”. These resources included demand management, battery storage and EVs.

And it turns out that fossil fuels are weather-dependent too. “Wait on weather” statistics – which reflect the percentage of time a workover rig is stood-down for wet weather on average for that period of time – remained at 24 per cent in the first half, only slightly down from 26 per cent in the last financial year.

This, of course, adds to the delays and coal shortages caused by rain causing mine and train disruptions through much of the last year.