Norway’s ‘oil fund’ will invest directly in offshore wind, in a first for the key global investor. The $A2 trillion fund will pay 1.375 billion euros for a 50% stake in the 752 MW Borssele 1 & 2 offshore wind farm located in the Netherlands, the world’s second largest offshore wind farm. The project is owned by Danish renewable energy giant Ørsted A/S, and Ørsted will remain co-owner and operator of the project.

The fund owes its size to the Norwegian government’s decision to funnel the revenues of the sales of oil and gas into the wealth fund. Until recently, it only owned public securities, but has recently expanded into property and infrastructure such as renewable energy.

In a strategy report also released yesterday, the fund detailed its plans for energy. “We will gradually build up the renewable energy portfolio. We will primarily aim to invest in wind and solar power. We will focus on projects with reduced power price risk, stable cash flow and limited risk to the principal investment”, wrote the fund’s managers.

Norway’s oil fund recently found that much of the cash flowing into the fund from fossil fuels was lost due to subsequent investment in poorly performing oil an gas investments. It has worked to decrease its exposure to climate-sensitive investments, particularly coal, and last year divested from Australia’s AGL Energy.

Recently, head of the fund Nicolai Tangen cautioned against describing the influx of recent investment in renewable energy as a ‘bubble’. “What is interesting is, if you compare the situation now with, for example, the situation before the year 2000, then the stock market was right that technology companies were going to do well in the future,” Tangen told Bloomberg. “But the valuation went a little high, so it came down again, but the technological development continued.”

“Unlisted renewable energy infrastructure is a new asset class for the fund, which we invest in to improve the overall diversification of the fund. We look forward to continuing to execute on our investment strategy for unlisted renewable energy infrastructure”, said Tangen, regarding the recent offshore wind announcement.

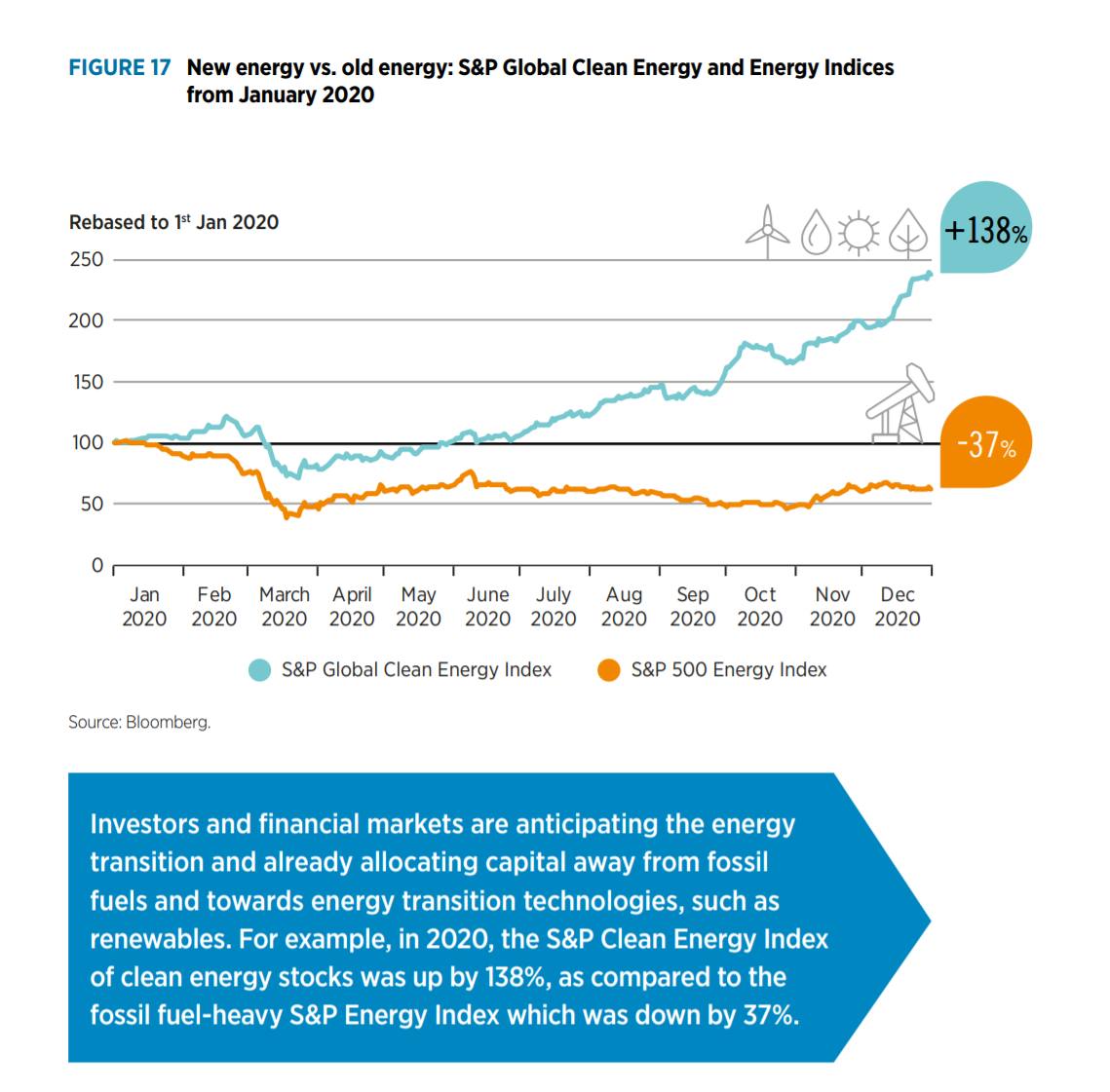

In a recently released report from the International Renewable Energy Agency (IRENA), the stark differences between the performance of renewable energy and fossil fuel investments was highlighted. Many key global investors are noticing this trend and shifting their decision making accordingly.

The Norwegian oil fund was granted the right to invest in unlisted renewable energy projects two years ago, in a move that pre-empted what has since become a major global influx of investment in renewable energy.

The Norwegian oil fund was granted the right to invest in unlisted renewable energy projects two years ago, in a move that pre-empted what has since become a major global influx of investment in renewable energy.