Transmission giant Transgrid says it believes the development of floating offshore wind in NSW – the country’s biggest demand centre – is unlikely, and suggests that building huge remote inland renewable energy zones might be a better idea.

The suggestion comes from Transgrid’s newly released Transition annual planning report (TAPR), which describes an energy transition in “vertical takeoff”, and outlines the infrastructure and technologies needed to replace coal, and also deal with the surge in new demand from electric vehicles, data centres, and electrification.

Transgrid’s observations on offshore wind are particularly interesting, given that it has emerged as a contentious issue and a lightning rod for renewable critics in nearly every state where offshore wind has been proposed.

In Victoria, where the state government sees it as essential to replace its ageing brown coal generator, the technology has specific targets of 2GW by 2032 and 9GW by 2040.

In NSW, however, because of the depth of the sea in the two planned zones around Newcastle and Wollongong, any offshore wind will have to use floating, rather than fixed bottom, systems. And that means added costs, to the point where some analysts wonder whether it will stack up compared to alternatives.

Transgrid is in that camp. It says the costs of fixed bottom offshore wind is around two to three times that of onshore wind and solar alternatives, and floating offshore wind technology will be even more expensive.

“With the pace of global offshore wind development slowing, the timing of its introduction in NSW is uncertain,” Transgrid CEO Brett Redman says in the report. “We are therefore planning for a scenario where offshore wind does not play a critical role in preserving the security of the NSW system.

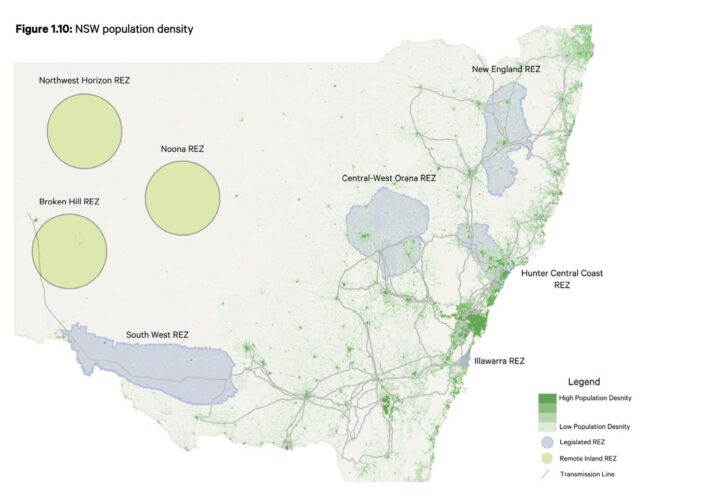

“Remote inland REZs are emerging as a more likely source of additional renewable power in the mid-2030s. To ensure we plan for the long term, Transgrid is exploring how and where these remote inland REZs could be developed to build out our future grid.

“We believe one location with excellent potential is the western portion of NSW, which has excellent solar

and wind resources on under-utilised, low-density land.”

To be sure, like everyone else in the energy industry, Transgrid has reasons for saying so and an interest in the outcome. Creating big inland renewable zones further away from population and demand centres would require lengthy transmission lines – which Transgrid would naturally build.

But the idea is favoured by many in the renewable energy development industry, who have been quietly looking at options, arguing that the better wind and solar resources and smaller populations will outweigh the added costs of transmission.

The report identifies three potential “remote” renewable energy zones in NSW – around Broken Hill, Noona, and the north-west, which it says it would connect with HVDC lines, and which could have the advantage of offering solar later in the day, and into the evening peaks, and wind energy at favourable times.

“These regions have some of the best solar and wind resources available anywhere in the NEM (National Electricity Market),” it says. “The high capacity factors and favourable solar-wind correlations, present an opportunity to diversify generation supply in NSW.”

Transgrid is already running into major local opposition for some of its key transmission projects – Humelink and VNI West – and its part of the Project EnergyConnect link from South Australia to NSW is running late and over budget.

Transgrid says it is also looking at “non-network” solutions, such as big batteries, that are potentially innovative, faster and lower‑cost because they avoid the need to erect more poles and wires. But the regulatory framework is difficult and it is proposing a series of changes to fix that problem.

The biggest of these “non-network” solutions is the Waratah Super Battery, the 850 MW, 1680 MWh project that will act as a kind of giant “shock absorber” to the system to allow the existing lines into major load centres such as Sydney and Newcastle to operate at full capacity.

But Transgrid is also developing battery solutions to issues that are emerging in the north, south and west of the state, and is conducting trials at the Wallgrove battery in western Sydney to deliver “synthetic inertia.”

It says it is worried about “system security”, which relates to the so-called “heart-beat” of the grid and the inertia and system strength that are crucial to keeping the lights on. Again, the likely solution lies in the form of battery storage, and grid forming inverters, but again this requires changes to the regulatory and operating system.

“These shortfalls (of inertia and system strength) and voltage issues will need to be mitigated before the grid

approaches 100% instantaneous renewables for the system to continue to operate within its secure operating envelope,” the report says.

Even when this has been addressed, our renewable grid will still have a higher rate of voltage fluctuations and new phenomena, including low system strength, small signal oscillations and harmonics, all of which also need rapid responses.

“Control room operators will need sophisticated tools to enable the required 24/7 situational awareness and rapid actions to keep the network stable.”

These are similar to some of the issues that have been raised in the Australian Energy Market Operator’s latest engineering roadmap, which lays out the technology issues to be resolved as the country’s main grid approaches times when wind and solar could – at least in theory – meet all demand needs.

But the speed of the change in technologies, and the thinking about the grid, is highlighted by Transgrid’s summary of what has changed just in the last year since its last TAPR.

Transgrid has lowered its minimum demand forecasts for both the near and medium turn, boosted its estimates of rooftop solar and EV charging, and its estimates of new data centre load over the next decade.