“To consider resource adequacy in this context, the ESB’s overall objective is to encourage the timely entry of required generation and storage, and the orderly exit of ageing thermal generation”.

The leaked recommendations from the Energy Security Board to the state and federal energy ministers, as reported by RenewEconomy, include that

- A NEM wide jurisdictional strategic reserve be procured;

- In principle support for a capacity mechanism. The capacity market is to be decentralised (that is each liable entity gets its own capacity) but the volume may nevertheless be centrally determined.

- Progress locational marginal pricing, which is the congestion management model. (Sigh, that should lead to another 100 academic articles without solving any real world problems).

- Seek further advice from the AEMC on what initial reforms are necessary to current regulatory frameworks to improve the timely and efficient delivery of major transmission projects. (Sigh again, shows how well transmission reform is going).

It is certain that having an energy market, a capacity market and a strategic reserve at the NEM level, plus separate State mandates as there are in NSW, and with the de facto Yallourn subsidy shows exists de facto in Victoria, will guarantee a high cost for reliability.

But unless the capacity market is designed to incentivise new generation it may not solve any problem, except those of the existing coal generators owners not having enough revenue.

Market reforms must be judged against fastest transition

The Step Change scenario in the 2020 Integrated System Plan is the only one consistent with limiting warming to less than 2°C. It’s also an easy scenario to achieve from a technical and overall systems cost perspective.

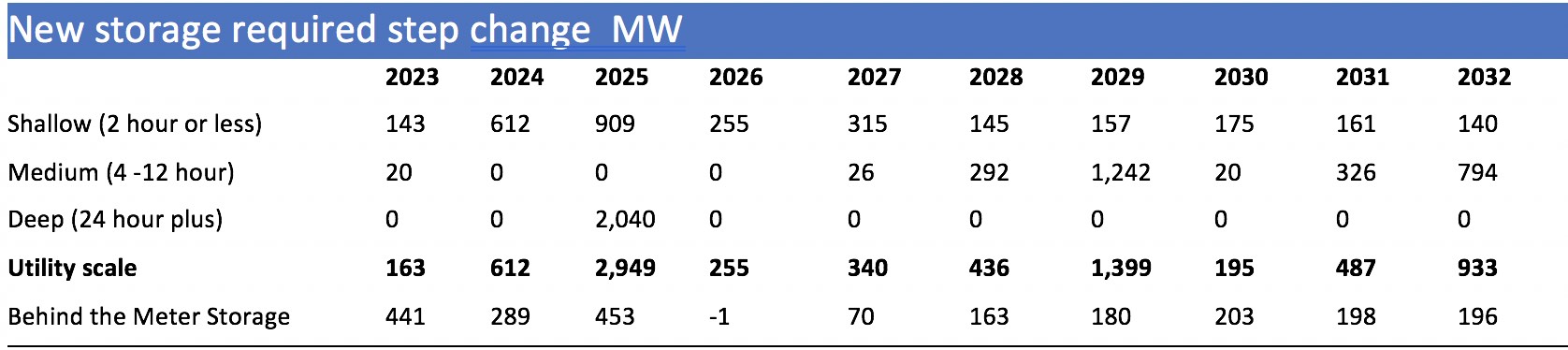

The Step Change scenario sees about 20GW of coal generation retire over the next 15 years and requires about 15GW of new dispatchable capacity (including behind the meter batteries) to replace it.

That is “only” 1GW per year, which in ITK’s opinion is very easy to do if the market is designed in the right way. We need a capacity market, but a capacity auction for new storage at about 1GW per year.

AEMO’s Step Change scenario showed that reliability could be maintained by building lots of wind and solar as coal retired, supplemented by Snowy 2.0 and other modest amounts of storage.

In terms of annual changes we can rearrange Figure 1.

In the context of the importance of a capacity market and what the capacity market is meant to achieve, it seems important to me to show that in the most aggressive view of the transition so far produced by the most reputable modeller – and one with a vested interest in reliability first, price second – suggests that only relatively modest investment in new dispatchable resources is required.

It makes clear that coal retirements can run at a decade long annual average of 1.7GW a year and reliability can still be maintained.

And I would argue that technology advances even in the past two years have mostly increased confidence in that view (and AEMO’s next ISP will include an even faster transition to renewables. So again this needs to be taken into account in capacity market thinking.

And of course not only is Snowy 2.0 going ahead, lots more short term storage (batteries) is already under construction than the Step Change scenario requires just now.

Short term storage (batteries) can be built in a year. Medium, or at least longer than 4 hours, may have much longer lead times and so the capacity market needs to provide the investment signal, say four years in advance, and a revenue horizon of at leat 7-10 years.

My question is whether the ESB and the politicians that the ESB reports to, as represented on the “Energy National Cabinet Reform Committee,” actually pay any attention to AEMO’s modelling, or whether “National Cabinet” just makes it up as they go along.

What is the point of the ISP and the large team of professional modellers that work on it virtually full time if its conclusions are just going to be ignored? If there is better modelling out there, let’s see it.

This modelling has a far lower margin of error than all the Covid-19 modelling, which federal politicians have been so willingly to attach their decision to.

Why do we need a strategic reserve, and a capacity market, and State based security reserves?

Any capacity market will be a dud unless it incentivises new capacity

We argue that the ultimate goal of policy over the next decade is simple. It is to ensure enough new capacity VRE (variable renewable energy) and (low carbon) firming is built and ready to run before and as the coal generation retires.

The new generation has to be built in front of the old generation closing and this will mean that consumers and or taxpayers will have to pay producers for the costs of excess capacity over the decade it takes coal to exit.

In our opinion, all proposals for a capacity market have to be judged against this simple yardstick. Will they incentivise new capacity to be built before the old capacity exits?

If the capacity market is designed as in France, then it can be in two parts, (1) to incentivise new capacity and (2) to keep a by design rapidly declining part of the existing thermal capacity running until the new capacity is built.

Already we have seen that the current energy market required endless arm twisting, subsidies and government ownership to get two fairly bog standard gas generators committed in NSW. Generators that were not needed under the ISP scenarios.

The absolute worst outcome of a capacity market is to keep coal generation going without inducing new capacity. Yet if there is not an explicit new capacity incentive in the capacity market design it’s highly likely that such capacity won’t be built.

That’s because even though coal generation can’t compete with wind and solar on cost it can compete with new gas and possibly with new batteries, if the batteries just depended on capacity payments.

Higher share of variable energy drives interest in capacity markets

There is always debate about whether energy or capacity based markets are “better”. Historically, around the world, some systems have been based on capacity and others on energy. The emerging conclusion is that both designs can and likely will produce similar results.

In a capacity market a central authority determines the amount of capacity required and imposes a contracting obligation on liable parties who purchase spot electricity.

By contrast an energy market relies on price providing a signal to incentivise capacity is built. The “price” is a combination of spot prices and forward contract prices.

As Concept Consulting so aptly put it capacity markets do not assure that capacity will be available when required.

Energy markets do a better job both in theory and practice of assuring availability because spot prices create very strong signals to make resources available. The capacity guy has been paid for turning up, so doesn’t actually need to do anything

ITK believes that around the world, as the share of variable renewable energy has risen, policy makers have become less confident that energy markets will ensure there is enough dispatchable capacity.

As a result there has been renewed interest in capacity markets in Europe and most of the US, other than Texas, has long had a capacity market.

In ITK’s opinion the AEMC’s Greg Williams wrote an excellent summary of the capacity market issues Profiling the capacity market debate, when he wrote:

“Another potential attraction of the quantity-driven approach (particularly a capacity market) is that it appears to provide the promise of a more graceful transition to a low emission generation mix.

“This is because a capacity auction could be designed to calculate the most cost effective mix of resources required three (or more) years in advance, providing the market a firm schedule of generation retirement (ie generation not cleared in a capacity market auction) and making the investment environment more stable”

But Williams went on to say, and this is certainly the main issue in Australia, that there is concern the capacity market is “artificially slowing the transition” by preserving coal generation and not inducing new supply. Williams cited the results in the UK market up to 2018

“Before it was suspended, Michael Grubb and David Newbery (2018) reviewed OFGEM’s Electricity Market Reform package and suggested the outcomes of the auctions had not worked out as planned as the “government really wanted and expected the capacity mechanism to bring forth large flexible gas-fired generation (which it has not)”.

‘The government tinkered with the rules after each auction. After disallowing distributed diesel generators from the auction for environmental reasons, it also had to reduce the assumption about the firmness of batteries.

‘Yet prices continued to be below the level to support a new combined cycle gas turbine (CCGT) power station”

IEEFA observes that the UK capacity market had a cumulative cost of £3.8 billion, but 83% went to operators of existing plants. That is the worry here, a capacity market will simply support existing thermal generation which suffers from “missing money”. Don’t we all.

Williams concluded his note like a true apparatchik by saying that both price and quantity approaches can achieve adequate reliability.

“The global debate today is exploring more effective and less costly options in which governments coordinate and size emissions policies that encourage a pace of change that both supports market-led investment responses to reliability concerns and minimises the amount of central intervention required to then slow it (eg delay thermal retirement).”

In an energy market approach participants presumably would see rising forward prices for dispatchable power and this would provide an investment signal that would allow things like Kidston Pumped Hydro or Snowy 2.0 to be built.

Personally, I think you’d need a fantastic crystal ball to predict as far ahead as Snowy Hydro had to do when forecasting returns for Snowy 2.0. Essentially, that requires a hard-to-defend 10 year forward look, something certainly not available from a 2 year forward contract market.

A capacity market increases role of planning and likely increases costs

The theoretical criticisms of capacity markets are:

- The bodies in charge of requisitioning capacity [AEMO] and State Govts face lop sided incentives. There is less risk in requiring too much capacity than too little. The costs of blackouts are obvious, the costs of over building harder to see

- A capacity market operator influences what capacity is required but doesn’t face the costs. A build to rule approach is adopted by the market. EG will a battery qualify as a capacity credit (see UK and California markets). Or do diesel generators qualify if they are carbon intensive.

- A rule based approach discourages innovation. Eg would compressed air be satisfactory?

The coal fleet has to go

The coal generation fleet is neither low cost, as demonstrated by its increasing lack of competitiveness, or reliable. Nor are the Victorian coal generators nimble enough to cope with severe daily ramping requirements.

The coal generation fleet in Australia is old relative to the average age of the coal fleet around the world and relative to design life.

Individual coal plants are large relative to total supply in the NEM, which means that a failure or exit has a big consequence. That’s been made obvious on many occasions whether it’s Hazelwood closing, Yallourn flooding or Callide exploding.

Renewable generators have lots of issues as well. Paul McArdle at Global Roam has often observed that wind generation tends to fall away on really hot days just when it’s most needed.

At the moment though that is a smaller issue because wind in total is only about 10% of the market compared to coal’s 65%. Still, individual wind farms are not yet critical resources in the way that individual coal plants are.

Thermal energy’s missing money problem in the NEM

In ITK’s view the central issue in the NEM is that the lower operating costs of variable renewable energy mean that the existing thermal generation, and particularly coal generation don’t get enough revenue to cover their full costs.

It’s not just a question of prices at lunchtime but the loss of volume and price combined, such that fixed costs for the sector can’t be covered. This is an obvious problem, and has been obvious for years.

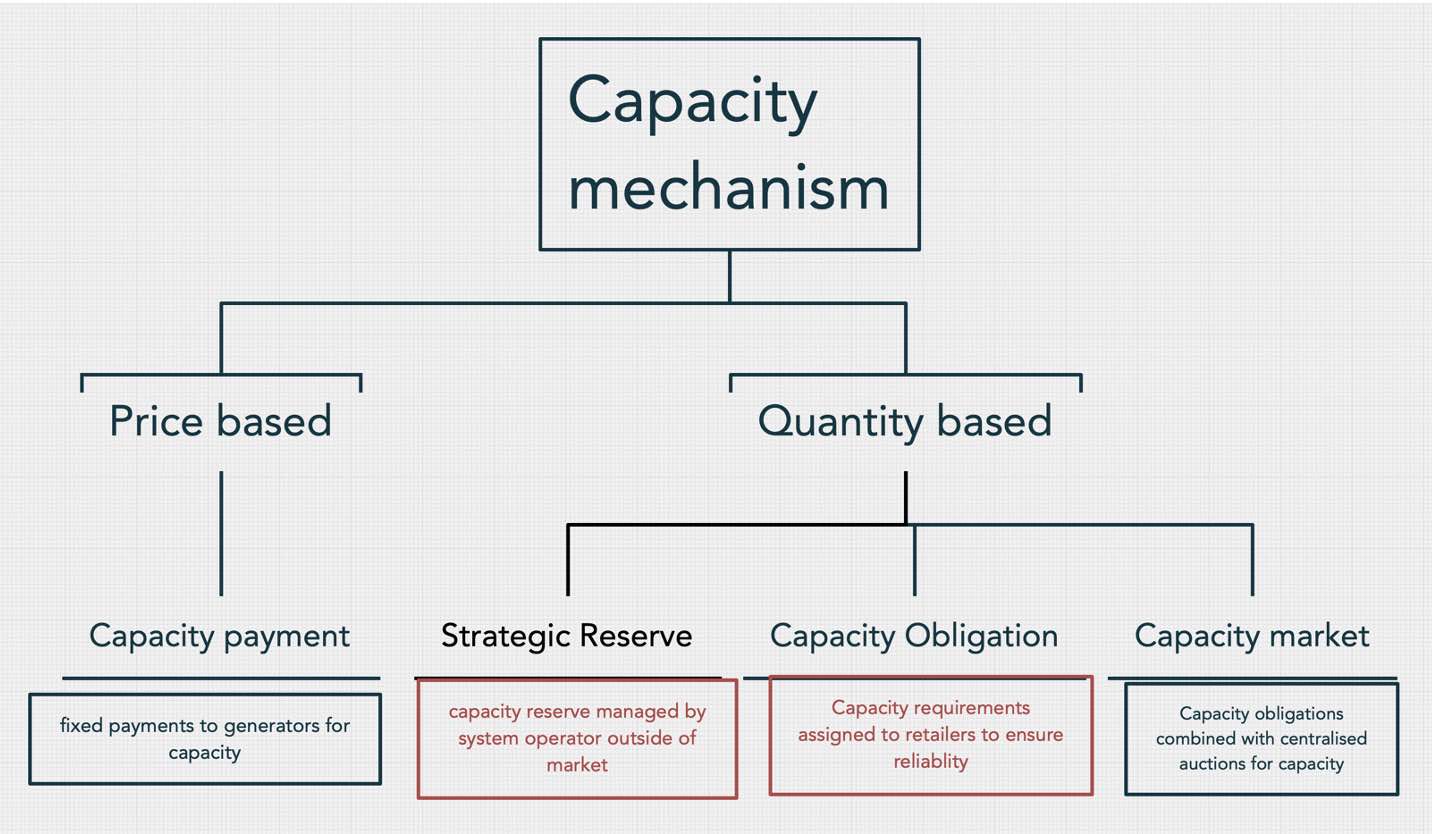

Background capacity market types

The diagram below is based on an MIT categorisation, the coloured boxes are my understanding of what the ESB proposes for the NEM

Based on the French design?

ESB chair Kerry Schott indicated that the French capacity market was a reference point for the ESB’s thinking. The following is taken from the French maket operator ( RTE) site.

Capacity operators (generation and demand response capacity) undertake to ensure availability during peak winter periods. The MW availability commitment over a year is established in a certification contract with RTE and constitutes the certified capacity level (CCL).

RTE issues capacity guarantees (CGs) to the contract holder which it can sell to obligated parties OTC or at EPEX SPOT market sessions.

In the capacity mechanism, the year is referred to as the delivery year (DY) and covers a period of 12 months from 1 January to 31 December.

Obligated parties demonstrate on an annual basis that they are able to cover customer consumption during peak winter periods. To meet this obligation, they must hold enough certificates.

The capacity mechanism begins four years upstream:

Generation capacity operators in service in DY-4 (4 years before the start of the delivery year) are required to certify their generation capacity for year DY by 31 October, DY-4.

Demand response capacity operators are not under obligation to certify their capacity. They may choose to certify their capacity for year DY up to the end of DY-1.

Depending on the evolution of the availability of certified capacity, and under certain conditions, it is possible to increase or decrease the certified capacity level by making adjustment requests until 15 January of year DY+1.

By certifying their capacity with RTE, capacity operators then become holders of certification entities (CE holders). RTE then issues them capacity guarantees on the capacity guarantees register (Rega register of CGs). CE holders sell them on the capacity market.

The trading sessions for exchanging capacity guarantees are held by EPEX. Results of each trading session are published on the website of EPEX.

The auction schedule for capacity guarantees is also available on the «Trading products» page of the EPEX SPOT website under “Capacity”.

The French system allows for new capacity only auctions

Every year, if there has been a benefit identified for social welfare, the minister in charge of energy holds a call for tenders for new capacities, four years ahead of the delivery year.

Aim: to offer visibility and a stable price to facilitate new investments. New capacity providers will be awarded a contract for difference for their capacity revenue for a period of 7 years (set guaranteed price following the call for tenders).

France held a low emissions auction in 2020 and awarded a fairly trivial (relative to the French market size) 253 MW of 7 year storage contracts and 124 MW of demand response. New capacity emissions had to be less than 0.2 t/MW

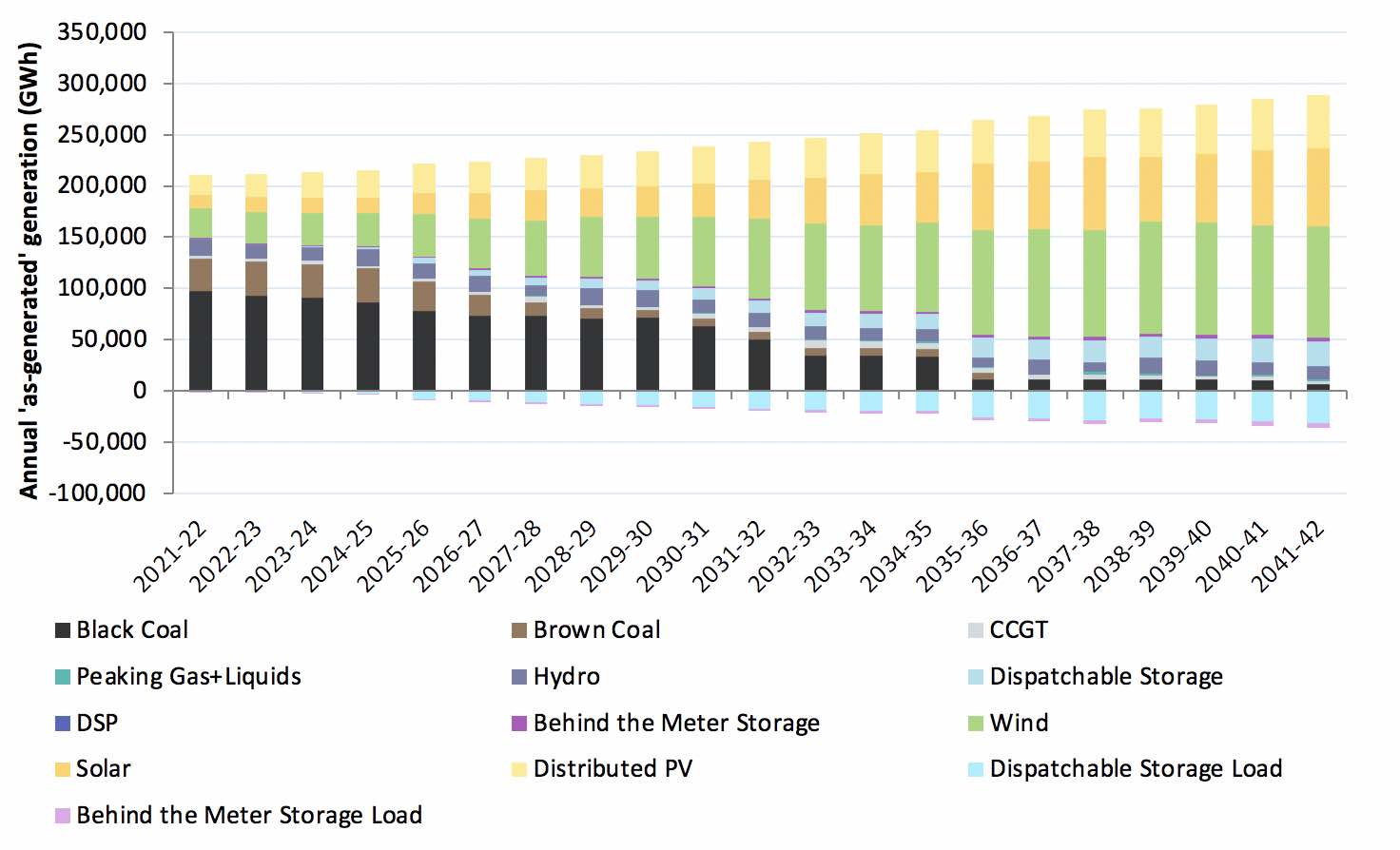

Dispatchible and thermal capacity in ISP Step Change scenario

For the 2020 ISP, the Step Change scenario was the most aggressive in terms of decarbonisation.

It was also the only scenario consistent with Australia doing enough to maintain our Paris commitment and for that reason alone it’s a reasonable case to evaluate capacity market policy against.

In addition, however, Schott has stated that recently the NEM looks like it’s already on, if not ahead, of the Step Change scenario, and indeed the NSW road map is also consistent with that scenario.

AEMO’s modelling process ensures that, for the assumptions made, the NEM reliability study is met. By definition this means there is enough dispatchable capacity.

Yet as the first figure below shows the amount of dispatchable generation actually dispatched falls steadily as the amount of VRE grows. We don’t need that much dispatchable energy.

And if we look at a summarised version of the generation capacity modelled we can observe that:

- Most coal is retired over 15 years

- Gas capacity does not increase and by 2036 is falling

- Storage capacity (which includes utility and behind the meter) increases from around 2 GW to 17 GW

The question I ask myself, and that I think all Goverments should consider is this:

If we are committed to 1.5°C, and the new IPCC report will underline the importance of that, then at least the Step Change scenario is required. Does the post 2025 market provide the right incentives to achieve the ISP plan?

Will the capacity market induce the 15GW of new storage needed and allow for 20GW of coal retirements?