Australia has the potential to secure its position as a world leader in value-added critical minerals supply that underpins the energy transition, and export embodied decarbonisation to assist our trade partners in their own energy transition objectives.

The Australian Critical Minerals Strategy 2023-2030 released on Tuesday by Federal Resources Minister Madeleine King provides a much needed framework to grow Australia’s critical mineral sector.

It proposes to do this by establishing value onshore, leveraging renewable energy, and creating diverse, sustainable supply chains through strong international partnerships.

Minister King acknowledges global competition is fierce, and we need ambition and speed to win.

While this is a good step forward in terms of strategic planning, we need to see the federal government rise to financing our massive energy transition opportunity at the scale, speed and level of ambition required.

Climate Energy Finance (CEF) estimates the federal government needs to mobilise in the order of $100 billion of strategic, national interest public capital – grant, debt, VC, infrastructure and most importantly patient equity (from the Future Fund).

This would to crowd-in the $200-300 billion of private capital required to capture our decarbonisation opportunity, including in value-added critical minerals.

A key takeout of the new strategy is that the government has earmarked $500 million for the Northern Australia Infrastructure Facility (NAIF) to support projects that scale downstream processing of critical minerals onshore.

This is a good step, but 100 more similar steps are needed urgently to build the sovereign mining and processing capacity that King calls for, and to deliver the 262,600 new jobs by 2040 and the $134 billion uplift in Australia’s GDP on offer.

CEF is focused on mobilising capital at the speed and scale the global energy transition requires. And on this front, there is little of substance to be found in the new Critical Minerals Strategy document.

While the National Reconstruction Fund has earmarked $1 billion for “value-add in resources,” and $3 billion for renewables and low emission technologies, it will take years to be staffed-up and effective.

The Albanese government inherited and reconfirmed the Morrison government’s $2 billion EFA critical minerals facility in 2021, with $1.5 billion already committed.

These were good early first steps to get things moving. The May 2023 federal budget added only $57 million over four years to “foster international critical minerals partnerships” and a further $23m on critical minerals policy development.

The critical minerals sector will be disappointed with the Strategy’s lack of tangible steps to facilitate the ambition, falling well short of proposals put forward by industry leaders. In this sense, the Strategy is a missed opportunity.

We needed a bold, nation-building vision to leverage Australia’s world leading opportunity and respond to global initiatives like the ~$US800 billion Inflation Reduction Act (IRA).

The IRA is triggering a massive influx of energy transition capital into the US, turbocharging critical minerals value adding, battery and EV production, and renewable energy generation, and dramatically accelerating decarbonisation as it serves national interests by securing a clean energy supply chain.

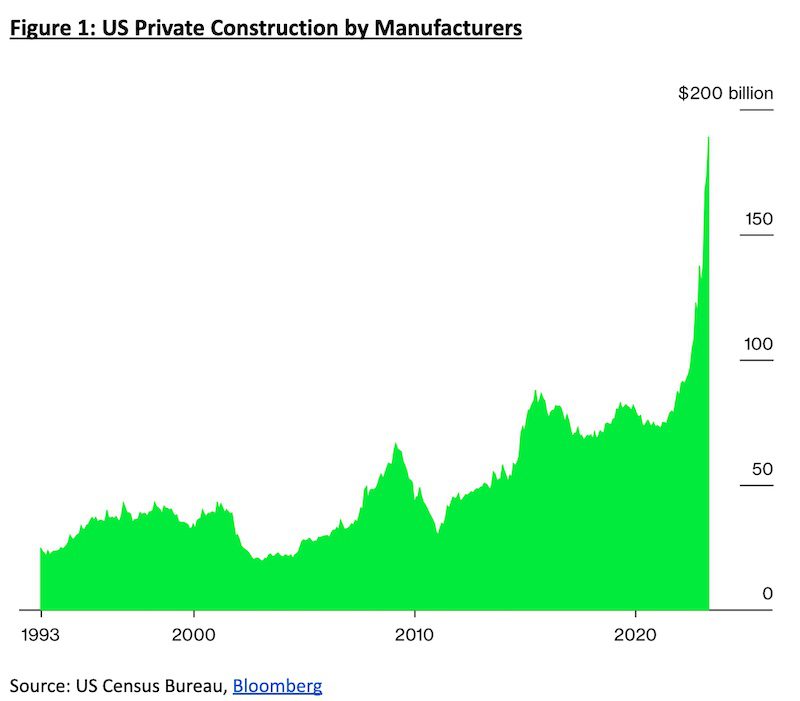

President Biden has catalysed an onshore manufacturing and jobs boom – refer Figure 1. Since the IRA was introduced just 10 months ago, a domestic investment pipeline of $US50bn into batteries and $US2.8 billion into EV charging infrastructure has been announced.

Elsewhere, landmark initiatives are dramatically reshaping global energy geopolitics as governments and trade blocs jostle for position.

The EU’s flagship Net Zero Industry Act and Critical Raw Materials Acts are designed to bolster European manufacturing capacity of net-zero technologies, overcome barriers to scaling up manufacturing capacity in Europe, and secure access to value-added critical minerals. The Japanese GX Roadmap does likewise.

Australia needs to think and act commensurate with the scale of the opportunity, and to understand we are in a global investment and technology race.

Governments world-wide recognise that landmark subsidies and incentives are required at this pivotal moment in global decarbonisation.

There is no level playing field in the energy transition, and governments are responding to global supply chain risks, the energy security threats Putin’s invasion of Ukraine has illuminated, and the size of the investment opportunity, at breakneck speed and matching investment commitments.

Australia is the number one exporter of iron ore globally, (38% share), number one in coking coal (55% share) and number one in lithium (50% share). There is nothing ‘proportionate’ about these world leading positions.

Besides lithium, Australia also has some of the world’s leading geological reserves of critical minerals and is among the top exporters globally of other key energy transition materials including cobalt, copper, nickel and rare earths.

We have abundant sun and wind potential to power processing of these minerals and metals onshore pre-export on global scale using our clean energy, thereby ‘embodying decarbonisation’ in our exports.

As one of the world’s top three petro-states, alongside Russia and Saudi Arabia, currently exporting climate change to the rest of the world in our coal and LNG, it is high time to flip the script.

We must decisively carve a new path that will set Australia up for transition, generating an export and investment opportunity in the order of hundreds of billions of dollars, creating jobs, and transforming the regions.

The impetus is clear to act fast and double down on our unrealised potential – and the opportunity cost of not doing so with sufficient ambition is profound.

CEF has argued for key reforms to mobilise this capital, including creating a new $20 billion public interest critical minerals processing equities fund, administered by the Future Fund; and reforming superannuation benchmarks to trigger massive private capital inflow into zero carbon investments, leveraging Australia’s world leading $3.5 trillion of pension capital.

On NAIF, we propose that its investment mandate be revised to be fully aligned with responsible climate action.

A key priority for NAIF should be enhancing enabling common user infrastructure for critical minerals and decarbonising our electricity supply to drive lower cost zero emissions power supply for onshore value-adding. A $5bn commitment would be more appropriate than $500m, commensurate with the scale of the opportunity.

A key positive outcome of the new Critical Minerals Strategy is the attention on leveraging trade agreements, foreign investment and export diversification through co-investment between respective countries’ financing agencies to establish joint ventures. CEF applauds this focus.

Building partnerships in critical mineral value chains with our key trade allies should be central to Australia’s vision, and the federal government clearly recognises the importance of international strategy cooperation in developing and value-adding our critical minerals at speed and scale.

But the $40 millon Critical Minerals International Partnerships program is insufficient to fund one project, let alone the 10-20 such projects available to Australia with, for example, South Korea alone.

We will soon release our CEF blueprint calling for a joint South Korea-Australia collaborative effort to jointly leverage the US IRA and potential domestic supplier competitive advantage PM Albanese has secured under the Australia-US Climate, Critical Minerals and Clean Energy Transformation Compact.

We await with interest Congress consideration of the Compact. If approved, Australian companies and projects will be treated as domestic suppliers under the IRA, making them eligible for subsidies and tax breaks under that unprecedented pool of US capital.

The US is seeking to crowd-in cleantech supply chain investment and capacity from allied countries, such as Korea and Australia, with which it has free-trade agreements, as nations the world over seek to leverage the US$800bn stimulus.

South Korea has much of the manufacturing capacity and expertise in place for key technologies across battery production and is already supplying into the US.

Australia has a strong history of working constructively with Korea, and brings our world-best reserves of critical minerals and an abundance of renewable power potential.

Our analysis shows that scaling the capacity and cooperation between Korea and Australia’s export credit agencies and private industry can bring substantial material gain to each nation’s GDP and job market.

Our nations’ complementary capabilities and expertise have the potential to diversify global supply chains at competitive prices while maintaining world-leading ESG standards.

But while we talk, South Korea is already implementing this strategy in partnership with Canada. We need strategic thinking and material action now. Time is of the essence. A similar India-Australia Compact is needed.

The Strategy is correct in focussing on embedding world’s best ESG practice into our mining sector.

Community buy-in is required to avoid the mistakes of the past, to position social and environmental considerations, including social licence, as central to planning, and to ensure cutting red tape to progress projects in a timely way doesn’t trigger court challenges.

And CEF applauds the Strategy’s elevation of genuine engagement and collaboration with First Nations communities to promote benefit sharing and respect of land and water rights and interests – a critical consideration to chart a path to reconciliation, and as part of broader initiatives such as the Voice.

However, critical minerals sit in the context of the broader energy transition, and the driver of the energy transition is to solve the accelerating climate crisis.

Australia needs to think in terms of net zero by 2038, in line with the science; we need more than a gentle glide to 43% emissions reduction by 2030.

On renewables, we need federal commitments that reflect Victorian Energy Minister D’Ambrosio’s target of 95% renewables by 2035, and WA Energy Minister Johnston’s 50GW of new firmed renewables by 2042. This requires a massive stepchange in effort, as AEMO CEO Daniel Westerman notes.

The energy transition, and the impetus to take our place as a critical minerals world leader, are all of a piece.

Momentum and actions to-date are insufficient. Ambition is required – including strategic national-interest capital investment at scale – or Australia risks forgoing its once in a hundred year opportunity for multigenerational prosperity and global leadership in a rapidly transforming world.

Tim Buckley, Annemarie Jonson and Matt Pollard, Climate Energy Finance