The electricity price chaos afflicting Australia’s energy markets continued over the weekend and into the new week, as new data showed how multiple outages has pushed coal generation to a record low in the country’s main grid.

Energy authorities and analysts say the blame for Australia’s record high electricity prices reflect a mix of international events, such as Russia’s invasion of Ukraine, the resulting high price of coal and gas in the Australian market, and added local problems such as multiple coal outages and coal supply shortfalls.

Coal output in the National Electricity Market has hit a record low – both in rolling seven day average and 24 hour average – highlighting the supply, maintenance and production problems at the country’s ageing coal fleet.

According to Geoff Eldridge from NEMLog, the average coal share in the NEM fell to 52 per cent over a 24 hour period, and to 55 per cent over a rolling seven day average. Both figures are record lows.

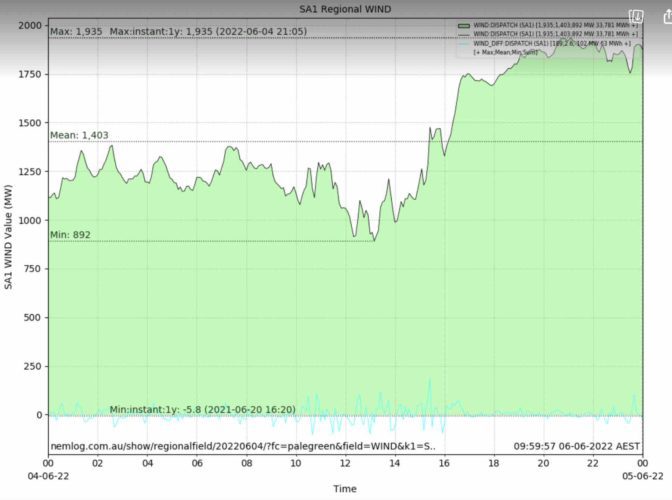

Around the same time, wind energy is also posting new records – this time for maximum rather than minimum output – although the boost has offered only temporary reprieves from the high prices because of the domineering influence of expensive coal and gas which generally control the price settings.

According to the NEMLog data, wind achieved a record share of 25.2 per cent of the NEM output for the 24 hours to 1830 AEST on Sunday, while both South Australia and Victoria posted state records as a result of the big front that swept through on the weekend.

South Australia, which went from feat to famine last week (its wind output fell to less than one megawatt last Tuesday evening) posted a new record peak of 1,934MW at 2105 AESTbon Saturday, and the 24 hour output through to 1630 AEST on Sunday was a record average of 96.1 per cent.

Prices in the state remained volatile, however, after the Australian Energy Market Operator declared a “Protected Event” for the potential “loss of multiple transmission” lines due to destructive winds.

Its intervention changed the generation mix and was designed to avoid any chance of a repeat of the 2016 statewide blackout.

However, as WattClarity documented, there were numerous different outages across a range of generators – both gas and wind – which added complexity to the situation.

In Victoria, a new maximum Instantaneous output of wind energy was also recorded at 0030 AEST on Sunday, when the output reached 2,970.9MW, more than 242MW above its previous record set on May 156 this year.

That blast of wind – averaging more than 2,500MW for more than 12 hours – was enough to push prices into negative territory in that state before the gas generators pushed it back up above $400/MWh to cover their newly inflated cost of generation.

Average wholesale prices in NSW so far in June have been an eye-watering $470/MWh, up nearly 50 per cent from the already sky-high level of $320/MWh averaged over May.

In Queensland, they have jumped to $443/MWh, up from $347MWh in May, and even in South Australia they have jumped to $320/MWh.

Coal outages in the last seven days have included Loy Yang A Unit 2, Yallourn Unit 1 and Loy Yang Unit 1 in Victoria, plus Callide B Unit 2, Callide Unit 4, Gladstone Units 3 and 4, and Millmerran Unit 1 have been out-of-service for the whole period in Queensland.

Eldridge says Tarong Unit 2 came out-of-service on Saturday, and there also appears to be a significant reduction of output at Kogan Creek on both Thursday and Saturday.

In NSW, Bayswater Unit 3 and Liddell Unit 4 have been out of service for the whole period. During the week Eraring Unit 3 returned to service last Tuesday and Mt Piper Unit 2 on Saturday.

AGL said unit 4 at Liddell power station was taken out of service 3 weeks ago due to a malfunction with a generator transformer, and the unit is expected to return to service second half of July.

“We’re also carrying out some planned major maintenance and an upgrade Unit 3 at Bayswater power station,” a spokesperson said.

“This type of work is planned well in advance and is upgrading mainly the turbine and the Digital Control System. It means there is a unit out of service, but we expect it to return to service in the coming weeks.”

Origin last week reported that output of the country’s biggest generator, Eraring, would be severely curtailed by mine problems at its main supplier of coal, Centennial.