The bill for construction of the first stage of Marinus Link, including the cost of the onshore transmission line needed to connect it to the grid in Tasmania, will come to just over $5 billion dollars, according to a major new assessment of the project.

The revised figure for the undersea cable project linking Tasmania and Victoria was released by the project’s developers on Friday, as part of an update to the Regulatory Investment Test for Transmission (RIT-T) that is required by the Australian Energy Regulator.

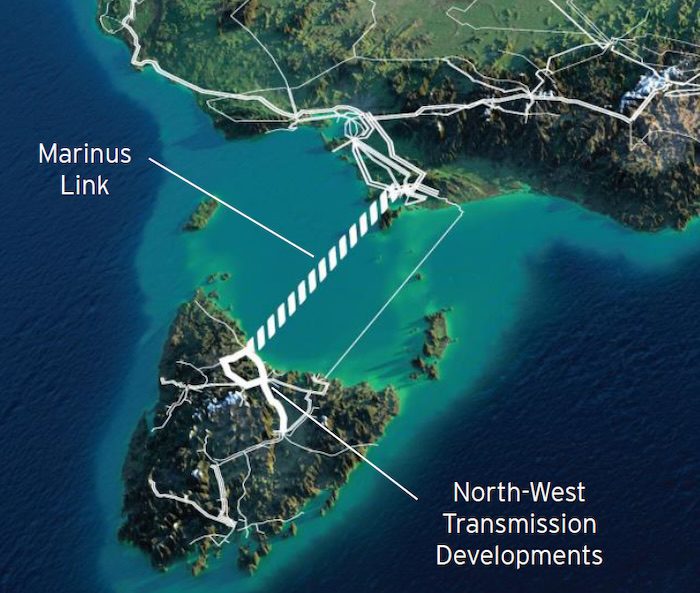

Marinus Link Pty Ltd (MLPL) and TasNetworks said on Friday that costs for the contentious project had been “market tested and further refined” to $3.89 billion for the now single 750 MW DC transmission link and telecommunications connector, and $1.14 billion for the North West Transmission Developments (NWTD).

TasNetworks describes the NWTD is a “once in a generation upgrade” that allows for an alignment between Palmerston and Burnie, Burnie and Hampshire Hills, and a line between Stowport and Heybridge to connect Marinus Link.

According to a project fact sheet, this puts total costs around $230 million higher than the previous estimate, adding $30 million to the previously estimated cost of the undersea transmission line and $200 million to the cost of the associated onshore infrastructure.

MLPL says the reassessment process was supported independent experts EY Parthenon, who updated their market benefit analysis of future scenarios with and without Project Marinus.

EY also considered the emissions benefits of Marinus Link, in line with the requirements of the AER’s new guidelines, putting them at $1.06 billion.

“Emissions benefits are a byproduct of reduced thermal (emissions-heavy) generation,” the fact sheet says. “Due to Marinus Link, hydropower that would have otherwise been spilled in Tasmania can be exported to meet mainland demand, thereby reducing thermal generation and emissions.”

A further independent report by FTI Consulting found that Project Marinus could provide substantial consumer benefits by reducing wholesale electricity prices across the National Electricity Market (NEM) – although this modelling has been criticised as having “serious limitations.”

According to the fact sheet published on Friday, the FTI report finds that “consumer benefits from lower electricity prices across the NEM will significantly exceed the costs of construction.”

This includes an average annual electricity bill reduction for a typical Tasmanian household of $113 and $68 for a household in Victoria. Typical small businesses could expect to see $512 shaved off their annual power bill in Tasmania, and $171 in Victoria.

The fact sheet says it is important to note that wholesale electricity price reductions will be reflected in energy bills alongside increases in transmission network charges resulting from Project Marinus, which are not factored in to the estimated savings.

“The updated modelling draws from the Australian Energy Market Operator’s latest input assumptions and future scenarios data, which show an increased need for Project Marinus in meeting future electricity demand across the grid,” MLPL CEO Stephanie McGregor said.

“These findings show that as the energy market continues to evolve, Project Marinus remains crucial for energy affordability, security, and decarbonisation.”

The updated costings and analyses come just over a week before the July 19 Tasmania election, the state’s fourth in seven years and second within 16 months, called after Liberal Premier Jeremy Rockliff lost a no-confidence motion at the start of the month.

Marinus Link has been a regular feature of debate in the lead-up to the election, in particular over delays to the release of treasury’s whole-of-state business case for the project, which will reveal the full costs of the project, including to Tasmanian energy consumers.

The Liberal Rockliff government is said to have been sitting on the completed treasury report since the end of May, but has now decided not to release it until after the state election. A final investment decision (FiD) on the project had also been expected to be made in July.

Tasmania’s Labor Party is also said to be supportive of Marinus, although to what degree is unclear. In March, the leader of Tasmanian Labor, Dean Winter described Marinus as “a critical project for the nation, and …too important to stuff up.”

But Winter also said, “Labor took a policy to the last state election to get Tasmania off the hook for Marinus, and we stand by it.”

Craig Garland, the independent member for Braddon who is running for re-election in the state’s north west, has called for “clear answers from all current and hopeful members of Parliament around whether they support Marinus Link – and on what basis.”

Garland, who opposes the project, is also calling for the release of the whole-of-state business case.

“Tasmanians deserve a genuine debate on the merits of this … project. If the major parties are prepared to lock in higher power bills for Tasmanians, they must explain why,” he said in June.

Debate over the merits and costs of Marinus Link is not new. Since its inception, the project has been decried by opponents as is “an expensive risk” for energy consumers, a white elephant of the energy transition, and a “boondoggle” that will offer “virtually no benefit to Tasmanians.”

The project was first proposed as two cables with a combined capacity of 1500 megawatts (MW), but the Marinus Link was cut in half in late 2023, in a deal between federal Labor and the Victoria and Tasmania state governments, in response to ballooning costs.

A 2023 EY report put the costs of the dual cable Marinus Link at $5.9 billion with a further $0.8 billion for the NWTD, between 2025 and 2030.

Late last month, a decision on federal EPBC Act approval for the undersea transmission cable was pushed out to July 25, marking the third time respective Labor environment ministers have sought more time to make a call on the huge and contentious project.

The federal and state governments – Tasmania and Victoria – will undertake their own detailed analysis, due diligence and risk assessments before determining a formal final investment decision.