-Spot electricity prices shot up and continue to be well above PCP

– Volumes continued to be soft this week despite a return to cooler weather. NSW volumes were 5% below PCP and VIC 2%

– Futures prices continue to increase

– REC prices increased – Gas prices increased particularly in NSW

– Share prices went up, particularly that of Infigen

Share prices

What a run it’s been lately for Infigen and Redflow. Infigen is conceptually comparatively simple to value as it has a bunch of operating wind farms, some development options and a known balance sheet. The value of the company including its debt can be compared with the cost of building new wind farms of equivalent size.

Of course, Infigen’s wind farms are operating today and some have very attractive PPAs. Battery storage developer Redflow is far more immature and value is essentially in the eye of the beholder. We will have a closer look in the future. We also plan to add Genex to this list when time permits. Still, it’s a great time to be a utility investor.

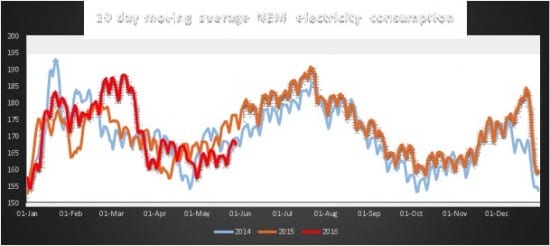

Volumes

Are currently below 2015 but steady with 2014. Weather has a major influence on week to week trends.

Base load futures by State

The most noticeable shift in the futures curve over the past six weeks is in Victoria where possibly the potential closure of Hazelwood has moved the curve up. It seems that traders are not that concerned at the moment that Portland smelter will close. Closure of Hazelwood would likely be taken as a positive for the AGL share price.

Spot prices have risen more than expected – particularly in NSW

Figure 6: Pool prices calendar year to date averages

Spot prices continue to be 50% and more above levels of PCP despite demand being little changed. In our view, and particularly in NSW the existing suppliers, primarily AGL and ORG have bargaining power and they are using it. The spot prices this year make the ACCC’s opposition to AGL’s bid for Macquarie Generation much more reasonable.

This was yet another example where the Australian Competition Tribunal, no doubt upholding the letter of the law, ended up providing a result that at least in the short run ends up disadvantaging consumers.

That said the absolute CYTD averages in NSW and South Australia of $52 MWh are not that unreasonable, and in fact still cheaper than in China! Spot prices in the USA though have been averaging $23 MWh for the current quarter.

The spot price in QLD is very close to justifying new renewable generation on an unsubsidized basis. In this sense the market is working the way it is supposed to, higher prices send a signal justifying new investment, or not.

Gas prices also increasing particularly in NSW

Gas prices have been up in year on year terms for some time, but in NSW have taken a big jump up in the past week.

David Leitch is principal of ITK. He was formerly a Utility Analyst for leading investment banks over the past 30 years. The views expressed are his own. Please note our new section, Energy Markets, which will include analysis from Leitch on the energy markets and broader energy issues. And also note our live generation widget, and the APVI solar contribution.