− Volumes : In the week ended August 27, volumes rose sharply to be 5% above the previous corresponding period (PCP). In our view, the sharp jump from last week was entirely due to colder weather in the Southern States. Seasonally electricity consumption declines into Spring, but the cold snap brought that to a halt.

− Future prices: were largely unchanged.

− Spot electricity prices:. jumped sharply to be double last year’s level for the week. This reflects the higher demand during the week and in addition relatively low levels of wind generation at times.

− REC prices were unchanged

− Gas prices : were modestly higher

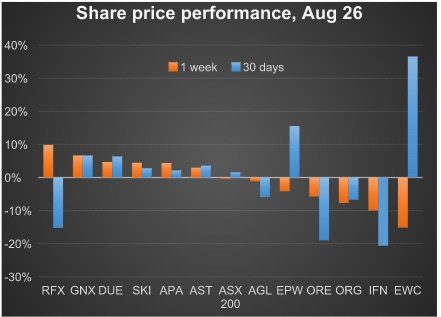

Utility share prices: drifted off for the most part. Most stocks underperformed the broader market index particularly generation and oil related stocks. Network utilities on the other hand continued to perform well.

Company news.

Infigen has just reported its results at $121 m of ebitda this year and guidance of $130m for FY17. Some investors may see the guidance as disappointing although its in line with our expectations. In any event some of the heat has gone out of the share price and its drifted off in the past month.

IFN has itself not announced any new projects despite having the ability to finance at least 100 MW. At current profitability levels the net debt: ebitda level, the key measure of gearing in our opinion, has improved to around 5X. That’s a level equity investors can be comfortable with although the finite life of wind farms means that one eye needs to stay on the remaining $745 m of debt.

ERM Power also reported at the end of the week. ERM investors have hard a tough year. FY16 ebitda fell 11.6% to $89 m on $2.7 bn of revenue and despite the fact that load grew 12% to 18.1 TWh in Australia. The problem for ERM investors is the that gross margin per MWh (around $3 MWh) remains a black box and difficult to forecast going forward. In addition ERM’s expansion into the US although it seems to be going reasonably is difficult to monitor from Australia and so attracts a lower multiple.

In short, ERM is a small company with a big business and lowish margins. It’s the 4th largest retailer by volume, but its all in the low margin, industrial segment. The ebitda margin in FY16 was 2.7%. There is not much debt, but at the same time financial and other guarantees have to be provided that mean the balance sheet has less flexibility than it seems on the surface. The company’s IT systems and customer service are better than those of key competitors but the competitors have balance sheet and market power they can apply to manage their industrial loads somewhat irrespective of profts. 12 month forward load is the same as last year and ERM says customers are contracting shorter in response to higher futures prices. The FY16 trailing ebitda multiple is just 3.6X. The dividend was 12 cents unfranked representing a yield of 11.5% unfranked.

Volumes

Base Load Futures

David Leitch is principal of ITK. He was formerly a Utility Analyst for leading investment banks over the past 30 years. The views expressed are his own. Please note our new section, Energy Markets, which will include analysis from Leitch on the energy markets and broader energy issues. And also note our live generation widget, and the APVI solar contribution.