Summary

Lower futures prices were the main noticeable move in the NEM this week.

Policy Development

The hype around the Finkel Report’s release this Friday is clearly what most are focused on, but we think it will take some time to see whether the Federal Government will action its recommendations and much longer to see what it would take to push the policy through the Senate.

Details in the Finkel report will be important. In the end distributed generation, and how to achieve energy security are as important as the lowering emission plan.

We could be in favour of a Low emissions technology [LET] scheme if (i) its big; (ii) only applies to new generation; (iii) targets 0.65 T/MWh or lower overall intensity. Jacobs modelling suggests such a scheme would lead to strong wind penetration and as PV costs have fallen faster than anticipated that too could do ok.

Meanwhile, the Queensland Govt’s $150m contribution to a North Queensland electricity transmission plan reinforces the value of renewable energy to be located in marginal electorates and the fact that is in the USA State Govts can do as much or more than Federal policy to decarbonize.

Turning to the weekly action

- Volumes: were flat for the week with NSW up Victoria and QLD down. Overall based on volume growth no one would be building a new power station. In that sense the industry overall can be grateful for the employment to skilled workers, report writers and many others that renewable energy brings. As we have previously mentioned most of this work is regional.

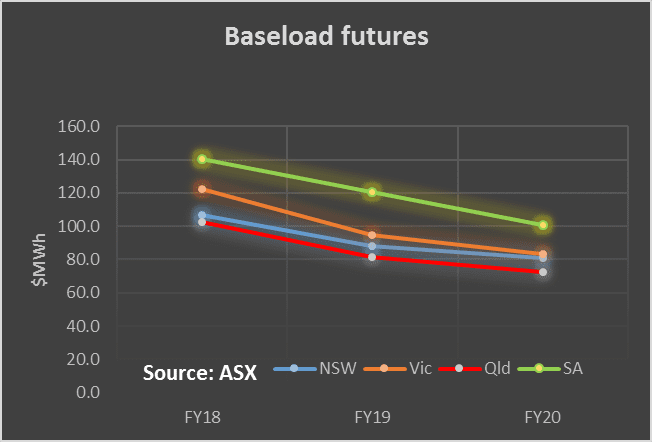

- Future prices Continue the recent decline. Conceptually futures should eventually settle at the LRMC of new generation on the assumption that demand for new generation will be driven by decarbonization policy. Where that price is we have yet to see.

- Spot electricity prices Spot prices were up on last week but actually lower than last year.

- REC prices were flat this week.

- Gas prices . Sydney gas prices were stronger but flat in the other States. We are starting to move to the seasonally strong gas price period.

- Utility share prices Perhaps reflecting the decline in electricity futures AGL shares have underperformed a touch recently. As good as the outlook is for AGL over the next couple of years, an ongoing stream of investment driven by a large quantity Low Emissions Technology [LET] scheme would eventually drive down prices and make firstly the NSW black coal stations and eventually brown coal less required. AST and SKI continue to be well placed in our view and their overall share price performance can often slip below the radar. In short there is a lot more to the electricity value chain than just utility scale generation.

Share Prices

Volumes

Base Load Futures

Gas Prices

David Leitch is principal of ITK. He was formerly a Utility Analyst for leading investment banks over the past 30 years. The views expressed are his own. Please note our new section, Energy Markets, which will include analysis from Leitch on the energy markets and broader energy issues. And also note our live generation widget, and the APVI solar contribution.