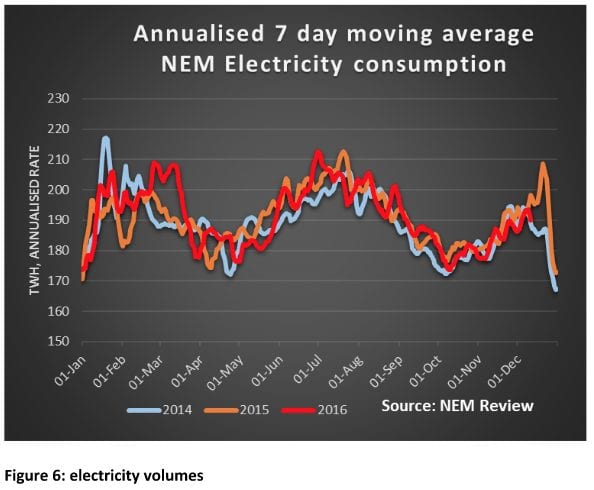

Volumes in week ending Dec 9 were down 5 per cent across the NEM. Two factors accounted for this: (i) weather wasn’t as hot, and more importantly; (ii) damage to Portland smelter meant that one of its two potlines isn’t running. At full capacity Portland consumes something like 600 MW of baseload (always on) power. So one potline out is about 300MW less demand. We can see this doing nothing but hastening the likely full closure of Portland.

Future prices: For FY17 actually weakened about 1 per cent, reflecting the Portland news, but in the FY18 year prices continued their typical 1-2 per cent per week upwards movement. As is becoming front page news, electricity prices – not just in South Australia – are going up. More supply is needed and the fight is about what form that supply should take. The higher prices will encourage greater take-up of ever-cheaper rooftop PV and perhaps this will spread out more rapidly into the commercial world.

Spot electricity prices: Softened up as the week went on and Victoria prices ended at just a $28/MWh for the week down 35 per cent on PCP. Prices in other states at around $55-$60/MWh were well up on last year.

REC: Actually fell slightly although the market remains amazingly thin.

Gas prices: Rose strongly in South Australia where they averaged around $10/GJ for the week. Gas prices have doubled since last year and the higher oil prices we are now seeing internationally are only going to force gas prices higher still. There are undeveloped CSG reserves in QLD but we don’t think the economics are yet good enough to justify their development. The key resource in our view is the Surat basin (around Chinchilla). The problem with this resource is its in the shallowest part of the CSG basin and generally speaking on better agricultural land. This increases landowner resistance.

Utility share prices: The ASX 200 rose by 2 per cent during the week. DUE and ORG both substantially outperformed, DUE on the back of a takeover proposal from CKI and ORG as a result of both the oil price increasing and the company announcing a calendar 2017 IPO [initial public offering] of its upstream oil and gas interests. The investment in 37.5% of APLNG will stay with ORG

Industry news.

Industry news: The main industry news is that bipartisan policy around new electricity supply and decarbonisation remains as remote as ever. Fear uncertainty and doubt [FUD] remains the operative factor. Small amounts of progress towards the LRET target continue to be made but even in Victoria new projects to replace Hazelwood will lag the plant’s closure and, in our view, more is needed.

The cost of capital will continue to stay high and Australia will remain one of the most expensive places in the world to develop renewable energy when we should be one of the cheapest. We will look at Origin Energy’s (ORG) upstream IPO in more detail in a separate note. Here we will just point out that a the likely $1.5 billion reduction in ORG’s debt and getting the upstream assets away from management will significantly increase ORG’s focus on its domestic electricity and gas business. Over time this will likely increase ORG’s efficiency, and see more new renewable investment.

David Leitch is principal of ITK. He was formerly a Utility Analyst for leading investment banks over the past 30 years. The views expressed are his own. Please note our new section, Energy Markets, which will include analysis from Leitch on the energy markets and broader energy issues. And also note our live generation widget, and the APVI solar contribution.