Australia could avoid a potential $13 billion blow out in the already enormous cost of upgrading the national electricity grid, a new report has found, if it opens up the transmission sector to competition.

The report from Nexa Advisory says a lack of competition and contestability for transmission projects in Australia’s National Electricity Market (NEM) is delaying the progress of crucial grid upgrades and driving up costs at a time that households and businesses can least afford it.

“Unfortunately, we have a system that protects a small group of transmission network service providers from competition. Energy users pay for that, to the tune of $13 billion,” says Nexa CEO Stephanie Bashir.

“With rising energy bills and cost of living, we need the savings greater competition will provide.”

The $13 billion figure comes from modelling commissioned by Nexa and conducted by economic consultancy, Tahu, which totes up the savings that might come from allowing contestability in Australia’s transmission market.

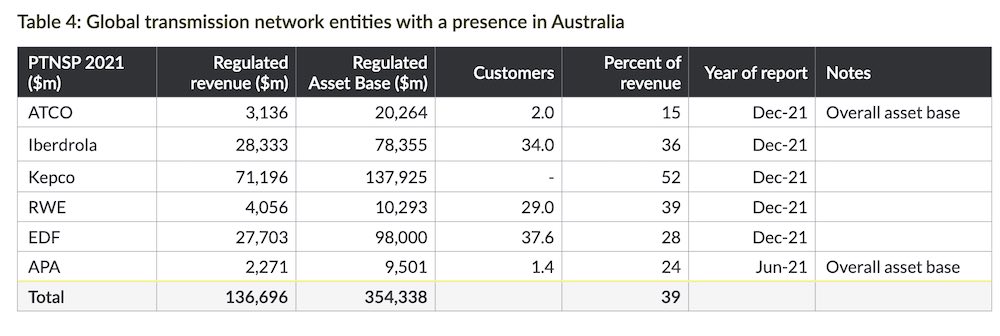

The modelling finds a saving of nearly $1 billion ($952m) in capital cost reductions from bringing globally-proven non-incumbent transmission entities into the mix, with established scale and procurement partnerships.

Another nearly $3 billion ($2.98bn) could come through avoiding excess regulated returns on equity, by opening markets to ownership as well as construction of new transmission.

Finally, the modelling points to money saved through reduced delays in delivering new transmission, where a time saving of just three months is estimated to avoid a massive $9.2 billion increase in wholesale electricity costs.

A regulated monopoly

The report says Australia’s transmission markets are uncompetitive due to “complex and fragmentated regulation,” which serve as barriers to entry for new operators with experience and global supply chain bargaining power.

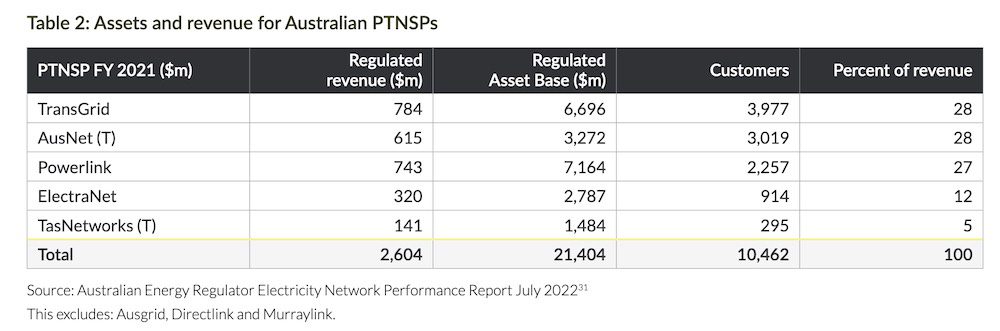

There are currently nine transmission asset owning entities in the NEM, encompassing the five primary transmission network service providers on the market.

“There is no reason to believe that the current number of transmission entities, one per state, is optimal,” says Bashir.

“Australia must compete on the international stage for highly specialised assets and skilled labour, such as project management of large infrastructure projects.”

According to the report, the regulated monopoly model for funding transmission in the NEM ensures that customers foot the bill, while offering “weak incentives” for companies to minimise capital costs, ensure timely energisation, or to maximise innovation.

The report also criticises the much maligned regulatory investment test for transmission (RIT-T) for, among other things, failing to guarantee the lowest-cost grid upgrade option, whether network or non-network options are selected.

Down to the wire

The call for transmission contestability in Australia comes at a crucial point in Australia’s transition to a net zero grid, as renewable energy “super highways” and major network upgrades are called upon to accommodate huge amounts more of large-scale wind and solar.

Transmission projects, in particular, are a hotly debated topic, due to their high costs, their potential environmental impact, and their overweight impact on the regions which will host the majority of the massive new towers and associated infrastructure.

Critics of one of the more controversial transmission projects, VNI West in Victoria, claim the project’s economic, social and ecological impacts far outweigh any benefit the new energy infrastructure would deliver for consumers or for the shift to renewable energy.

On the flip-side, supporters of the final preferred route for VNI as laid out last week by the Australian Energy Market Operator and network company Transgrid, say it is essential to optimise the transmission of solar and wind energy generation between Victoria and New South Wales.

Nexa’s Bashir falls on the side of VNI West supporters, describing the decision on the final route as a major breakthrough.

“The decision will ensure we can get on with the build of this key piece of infrastructure. And it will have the ripple effect of enabling the investment in renewables generation which is needed ahead of the Yallourn closure in 2028,” she said last week.

“New transmission infrastructure is the missing link in Australia’s transition to clean energy, and sustainable energy security and supply stability.”

Competition is crucial

But as momentum in the transmission project pipeline builds, Bashir and others are now also pushing for an opening up of the market in Australia to competition as another crucial ingredient to the shift to renewables.

Simon Corbell, CEO of the Clean Energy Investor Group says the adoption of competitive frameworks for transmission projects will be instrumental in achieving a fair and efficient transition.

“CEIG supports contestability in transmission markets; it can play a pivotal role in driving the energy transition by allowing for competitive procurement of grid augmentation services,” Corbell said on Tuesday.

“Today, our island thinking means that transmission is costing Australians far more than it should and it is not being built fast enough,” adds Bashir.

Bashir says a possible solution to this is for the Albanese government to embed competition as a prerequisite for accessing the Rewiring the Nation funds.

Nexa also suggests that jurisdictional competitive tenders should be triggered for transmission build where it is applicable.