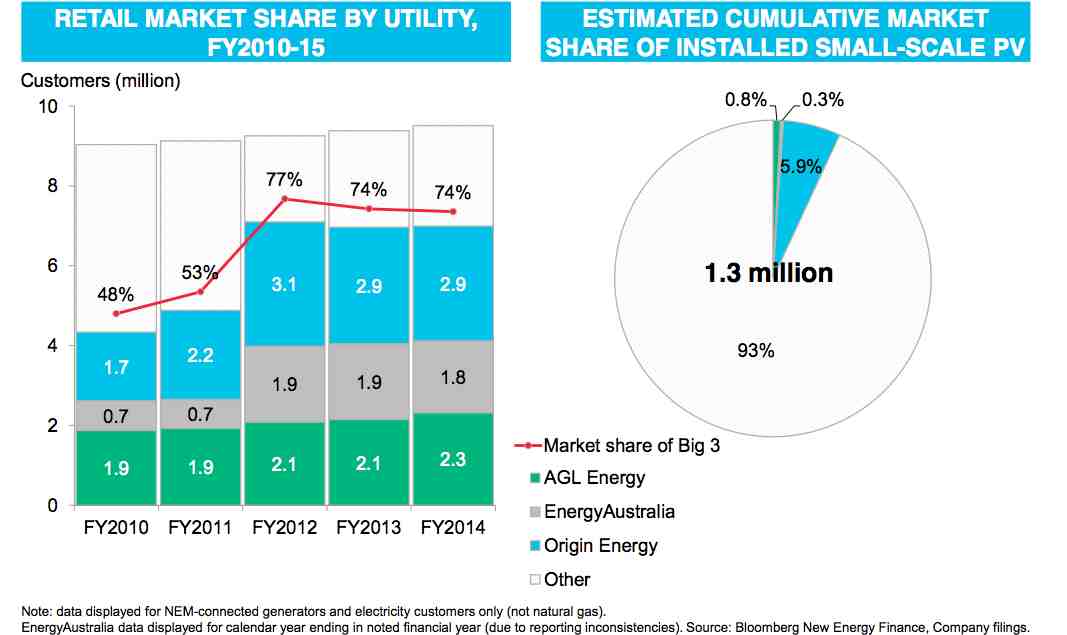

Here are two graphs that illustrate the pickle that Australia’s major electricity retailers find themselves in. For the past five years the big three retailers increased their market share by more than half, they almost completely missed the biggest trend in the energy markets in the last 100 years – the emergence of rooftop solar.

The charts from Bloomberg New Energy Finance show just how. On the left is the increase is market share – from 48 per cent in 2010 to 74 per cent in 2014, after the big three bought out smaller rivals and stamped their dominance on the market.

But to the right is their accumulated market share of installed small-scale solar PV. Only Origin Energy, which briefly ranked as the biggest installer in the country, has any meaningful share, with 5.9 per cent. AGL held less than one per cent of the installed PV market, and Energy Australia even less, with 0.3 per cent.

The data is remarkably similar to the experience in Germany, the one country that rivals Australia in the penetration of rooftop solar.

The big German utilities also spurned the boom in rooftop solar, accounting for little of the installed capacity.

The result was that the major utilities, E.ON and RWE, eventually had to do an about-face as the cost of rooftop solar continued to fall, and the arrival of battery storage made it clear that the future lay in distributed generation.

E.ON is now catching up by announcing a split in its assets, with the old centralized, fossil fuel generation to be parked in one company, while the new focus will be put on solar, storage, electric vehicles and micro-grids.

RWE is making a similar transition, without the split in assets so far.

Australia’s big utilities are yet to take such radical measures to their structure, but have announced a push into the solar and more recently the battery storage sector, with the rollout of leasing models and power purchase agreements that will see the retailers own the hardware on the roof and sell the output to its customers, presumably in the hope of retaining them for the long term.