In this note we observe that gas and electricity prices have always been linked, and that that link was super sized in 2022. The super-sizing happened because there was a shortage of bulk energy (namely coal generation) and this increased the demand for gas just at a time when its price was already exceptionally high.

In this note we observe that gas and electricity prices have always been linked, and that that link was super sized in 2022. The super-sizing happened because there was a shortage of bulk energy (namely coal generation) and this increased the demand for gas just at a time when its price was already exceptionally high.

We also argue that just building more wind and solar won’t get rid of gas and make electricity prices go down. Or at least not until lots more wind and solar are in the system.

The reason is that more wind and solar tends to force down lunchtime prices when we don’t use gas anyway. So instead it’s coal generation that suffers and so it’s coal generation that closes. And when it does it creates a new shortage of bulk energy. So it’s only when most of the coal is gone that building more wind and solar will lead to a permanent decline in average prices.

In the medium term, building more storage based firming generation will provide competition for gas. However, in the next couple of years it’s only batteries that can be built, installed, commissed and ready to impact prices.

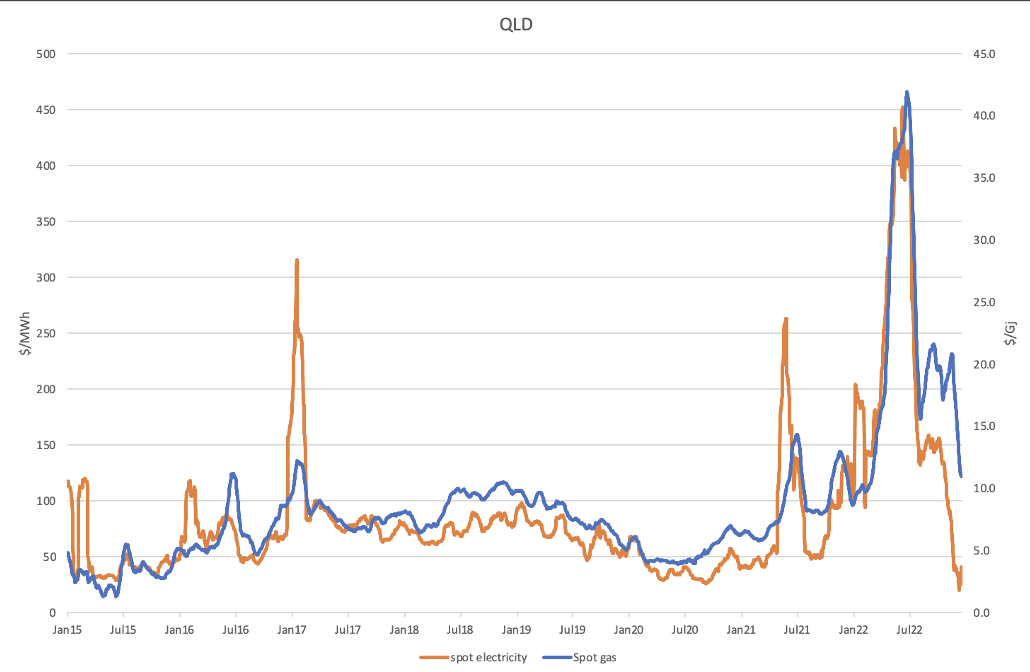

The following figures show for these markets – NSW, QLD and South Australia – a comparison of the spot electricity price and the STTM [short term trading market ex post] gas price. Both sets of data are shown using a 30 day moving average to smooth out random daily variance.

The correlations between the two prices are high – 79% for South Australia, 86% for Qld and 93% for NSW.

There are clearly significant periods historically where the average electricity price was driven by factors other than gas, but the graphs and the correlations are centred on what happened in 2022.

The points to be made, in my view, are that firstly that coal also drove prices higher in 2022 and the lack of coal provided a requirement to use gas and that this in turn drove both electricity and gas prices higher.

Secondly, and putting 2022 aside, the broader view remains that if Australians are to consistently enjoy the benefits of all the wind and solar we produce at relatively low marginal cost then we need to get away from having gas as the marginal price setter at peak periods.

There are two ways of getting rid of gas, and they mostly work in close partnership.

Firstly is to build enough wind and solar so that any kind of firming is needed less and less. That is what happens in the AEMO Intergrated System Plan, where wind and solar end up having total annual output significantly higher than forecast demand.

Of course, we are a long way short of that right now: Coal is still providing the largest share of bulk electricity in the NEM. And it may be that building more wind and solar will lead to earlier closure of coal generators and this in turn will provide in the short room even more opportunity and, indeed need for gas generation and as such will tend to lead to higher prices.

Secondly, we can build lower LCOE firming, and this principally is batteries and pumped hydro, although there are some other fringe technologies.

However, this method too has some difficulties at least in the next few years. Firstly, it takes ages to build pumped hydro and pumped hydro often needs supporting transmission infrastructure because it tends to be located in previously transmission free areas.

Batteries have higher capital costs but can generally be installed much closer to demand and take advantage of existing transmission and indeed help alleviate constraints. Even today batteries can still be ordered and installed far more quickly than pumped hydro.

The other difference between pumped hydro/batteriess = storage based firming [SBF] is that SBF makes money using a different spread to gas. SBF basically relies on prices in the middle of the day when the SBF charges being lower than prices in the evening. By contrast gas relies on and indeed won’t run unless the electricity price is high enough to cover the gas and other variable costs.

Firming technology comparative required revenue 2023

The following figure is ITK’s assessment of the marginal revenue different firming technologies require. Its an analyst’s practical figure rather than an academic approach.

For instance it compares the marginal cost of existing coal and gas generation with the required daily spread of dollars per MWh for new batteries and pumped hydro to earn their assumed WACC. Also the gas generation costs assume 90% operation at best heat rate and 10% at worst heat rate.

I used an $A11/GJ gas price because that’s what the government is forcing on the industry. Naturally this makes it harder for new technology to compete.

Note that this is a the required price. But neither a battery nor a pumped hydro will get a constant hourly spread. A four hour spread for a battery is, I think, a reasonable assumption, that is you can operate a battery for fours a day and expect to earn peak revenue (most in the evening and some in the morning) but you can’t really expect a pumped hydro plant to easily operate for 8 hours a day (and pump for over 10 hours) and earn “peak” revenue and pay only “lunchtime prices to charge)

In other words, in my view the pumped hydro LCOE does not fully reflect the available daily revenue position only the calculated required cost for that many hours of daily operation. Again this is a chart about cost not revenue.

That said pumped hydro can clearly already undercut open cycle gas and we expect a four hour battery used solely for daily load balancing, and without any system services revenue, to be able to undercut existing open cycle gas in about 5 years time.

More batteries will keep electricity prices down in the next few years

It’s unlikely that any substantial pumped hydro will arrive on the market in the next three years other than the Kidston project, and it’s too small to have much of an impact.

However, lots of new batteries can be installed. They can earn system services revenue as well as trading revenues, but a certain amount of optimism will still be required to justify a four hour merchant battery. Optimism about trading opportunities and optimism about the growth of system services revenues.

New wind and solar will have a saw tooth impact on electricity prices. Initally they will cause prices to fall as output rises faster than demand, but then a coal generator will close leading to a reduction in supply relative to demand and prices will rise.

If the coal price was low enough then it could force gas out of the system by being able to operate even when wind and solar output was high, covering the fixed costs and outcompeting gas in the evening. But, I think that unlikely.

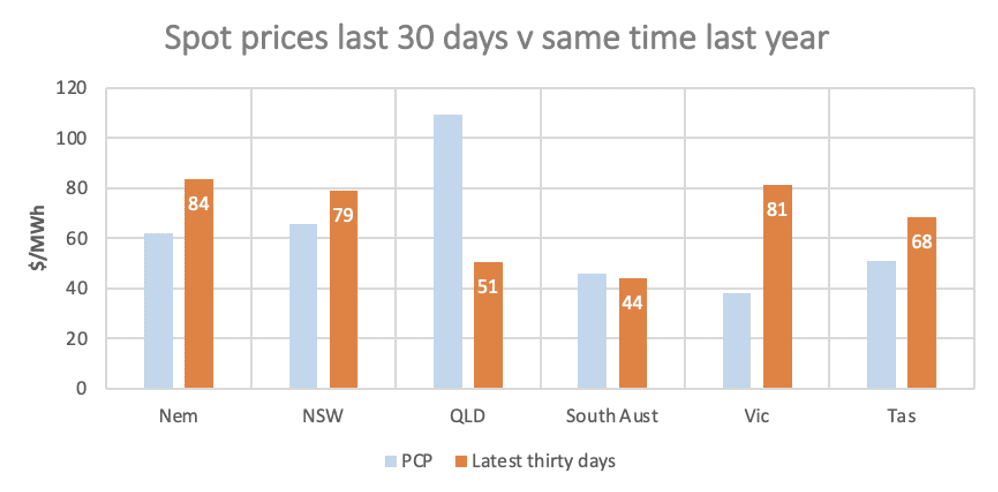

Other data

Relative to last year spot prices are mixed, higher in Victoria, lower in Qld.

Futures prices are still sending a strong new investment signal for all regions although less so in Victoria.

And gas prices have fallen but are still above this time last year.