The Energy Security Board (ESB) has unveiled its long awaited package of market reform proposals as the industry scrambles to seize the opportunities from the rapidly accelerating shift to renewables, and the anticipated early exit from coal.

The ESB options paper focuses on four different parts of the market: keeping the lights on with enough energy, providing essential grid services, the growth of distributed energy – now seen as a valuable asset rather than a liability – and grid congestion and network planning.

But the most controversial aspect of its proposals will undoubtedly be the options to manage the exit of coal generators, including a so-called “physical certificate scheme” for reliability, described by some as an effective capacity market, or subsidy for coal plants.

ESB chair Kerry Schott says growth in clean energy in Australia is accelerating so quickly it is outpacing even the most bullish scenarios modelled in the Australian Energy Market Operator’s Integrated System Plan, including the ‘step change’ scenario that predicted the market share of renewables could hit 94 per cent by 2040.

“We need to get this right,” Schott declared of the market rules that will help dictate how an energy a system based on traditional, centralised fossil fuel generators transitions to a market dominated by wind, solar, storage and distributed energy spread across the nation’s households and businesses.

“The rapid spread of large-scale wind and solar, along with rooftop PV, across Australia means our energy system is experiencing the fastest and most substantial change in the world,” Schott said.

“We are preparing the advice Ministers need to enable the critical decisions needed for an affordable, reliable and secure electricity system that can ultimately operate at net zero emissions.”

In 2019, the COAG Energy Council tasked the ESB with delivering a proposed redesign of the National Electricity Market to address some of the teething problems emerging from an accelerating shift to clean energy sources and the anticipated closure of Australia’s coal fired power stations.

It was already clear that the existing rules were no longer fit for purpose. The ESB options paper, more than 220 pages long, focuses on four different parts of the market, and three different time frames setting out those considered most urgent and others that can wait longer.

Part of this plan, however, is the controversial option that could effectively pay coal and gas generators to remain operational within the energy market as part of a ‘physical retailer reliability obligation’, that has primarily been designed to prevent the early closure of otherwise unprofitable coal fired power stations.

Schott, in an interview with the Energy Insiders podcast, insisted it was merely an option.

“People should be in no doubt that coal generation is not viable,” Schott said, adding that the proposals put forward were not designed to extend the life of Australia’s ageing coal fleet, at least two-thirds of which will exit the market by 2040.

The progressive think tank The Australia Institute welcomed the package of reforms published by the ESB but took exception with the proposal to effectively subsidise ageing coal plants.

“The Options Paper contains a seriously risky proposal that would prolong the lives of unprofitable, highly polluting coal power stations in Australia,” the Australia Institute’s Dan Cass said, who was appointed by the ESB to a group of expert stakeholders to advise on thermal retirements.

“Agreement to prop up coal power on the grid would be an admission of defeat. The whole purpose of market redesign is to allow coal to retire safely and for consumers to benefit from a smooth transition to cleaner, cheaper sources of electricity and grid security services.”

Others suggested that the ESB was effectively hamstrung because, like the original design of the NEM, climate and the environment are not considered. They say the only way to manage the transition is to set a target based on the science, and work out a plan and a mechanism from there.

“The ESB have been given a hospital pass – you simply can’t resolve the issues facing the electricity market without also considering the need to reduce emissions,” said Tristan Edis, director of analysis at Green Energy Markets.

“The elephant in the room which the ESB couldn’t properly grapple with is that the coal power plants have to go if Australia is to honour its international climate commitments. The market design process should be all about how we facilitate replacement of the coal power plants, not retention of these existing plants or delay of their exit.”

According to the ESB, the proposed reforms are necessary to manage competing, and often conflicting, investment signals within the energy market, including the growth of renewable energy generation, policies being introduced by state governments including renewable energy zones, and the need to address technical differences between variable renewables and traditional thermal generators.

“It is difficult to overstate the scale and pace of change across Australia’s electricity sector as both, large and small scale, renewable generation enters the system rapidly and in volume,” the paper says. “This relatively low-cost power has caused wholesale prices to fall and emissions to reduce.”

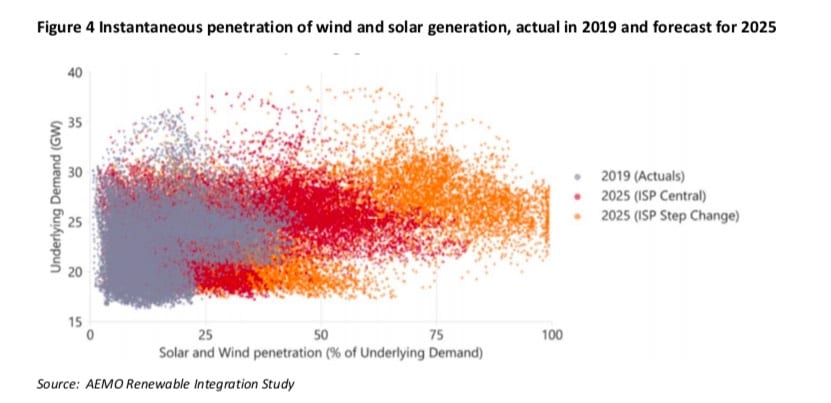

To illustrate the scale of the transition, the ESB notes that by 2025, according to the Step Change scenario that is being rapidly superseded, wind and solar penetration will regularly exceed 75 per cent of demand (it currently reaches just over 50 per cent on some occasions), and also reach 100 per cent of demand.

To illustrate the scale of the transition, the ESB notes that by 2025, according to the Step Change scenario that is being rapidly superseded, wind and solar penetration will regularly exceed 75 per cent of demand (it currently reaches just over 50 per cent on some occasions), and also reach 100 per cent of demand.

It sees another 26 to 50 gigawatts of new large-scale wind and solar and up to 24GW of new distributed rooftop PV being added to the grid over the next two decades, resulting in the need for up to 19GW of new flexible and dispatchable resources.

But already, as the graph below illustrates, the number of proposed wind and solar projects is vastly more than even what the ISP contemplates or what the grid could accommodate.

In the package of market reforms, the ESB calls for greater focus on those four priority areas, including preparation for the retirement of coal plants, boosting energy system security, capturing the benefits of distributed energy resources like solar and storage, and facilitating further investment in lower cost supplies of large-scale renewables and enabling network infrastructure.

One key focus for reform is the increased participation of households and businesses in the energy market, recognising the emergence of a ‘two way’ market where consumers are increasingly becoming their own suppliers of energy.

Breaking down the traditional ‘one-way’ energy market model, where centralised power stations supply power to consumers, the ESB wants to open up the market to allow consumers to participate in both the supply of electricity, as well as participating in demand response measures.

Doing so, the ESB says, will allow households and businesses to be financially rewarded for their role within the energy system and provide greater visibility of how they participate and a greater ability to better integrate them into the larger energy system.

The options paper makes clear that the penetration of solar will continue to grow dramatically, but also that this will not favour only solar households.

“Efficient integration could also significantly benefit non-owners through lower total system costs,” it notes.

The ESB has also proposed the creation of a new ‘operating reserve’ mechanism that would provide a financial reward to generators that are able to provide ‘ramp-up’ capabilities to the market and the ability to make up any short-term supply shortfalls.

The ESB will launch a six-week period of consultation to solicit feedback on the detailed reform options before delivering a final package of recommended reforms to energy ministers mid-year.

“There is no doubt that policy changes are needed to the existing market design and the decisions that Ministers make mid-year, and in the future, are critical to reaching an affordable, reliable and secure electricity system that is able to operate at net zero emissions,” Schott added.

“The physics of power are complicated to manage in practice as the system changes; and every state and territory has different priorities, goals and risks in terms of price, reliability and emissions.”

You can listen to the full interview with Schott on the Energy Insiders podcast here, or your favourite podcast platform.

Note: RenewEconomy welcomes contributions to this important debate, either through opinion pieces or commentary, or simply from some sharp eyed observers who have spotted something interesting. Please email [email protected].