On my estimates Eraring will likely be profitable for Origin Energy until it closes. The cash flows will depend on the maintenance capex actually required, the electricity price contracted, the coal price paid and how much fixed cost is incurred relative to the normal level when Eraring is operating at reduced output levels.

The Ebitda (earnings before interest, tax, depreciation and amortisation) and cash flow outcomes are sensitive to each of these variables. In any event the NSW government doesn’t pay anything unless the station is losing money under the agreed formula. Or at least that’s the way I read the announcement.

If Eraring is, in fact, profitable, the deal is good for the NSW government as they effectively get a 20% net profits tax. Of course, it’s obviously a bad deal for the environment, but that outcome was locked in by the failure to get new capacity built in time.

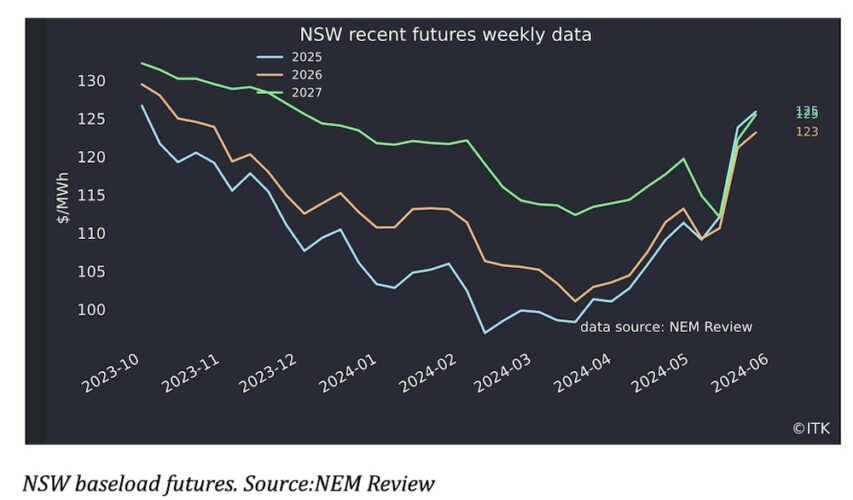

In fact, I see the deal as a win for the NSW government as much as it is for Origin. That’s because even if the station does lose money, its power and output will act to put downward pressure on NSW electricity prices. Not that you can see much of that pressure in the futures market. I suspect the futures market may be pricing in delays to Energy Connect and Humelink as much as anything else.

In any event, for NSW consumers, the government and Origin, Eraring is just a red herring. Eraring is going to close and has to be replaced. NSW consumers need replacement power and energy, but so do Origin shareholders.

As in all things electricity in Australia, there is only one way to lower prices: Approve and build more wind and solar farms and simultaneously build the required transmission. More supply, lower prices. Wind and solar have low operating costs. It’s easy. Just gotta do it.

Origin will delay closure of the Eraring Power Station

Under the “Generator Engagement Project Agreement (GEPA)” Origin has agreed to extend operations at Eraring to 19 August 2027. Under the terms of the GEPA:

Origin may receive compensation from the State to help cover the cost of Eraring’s operations and will endeavour to generate at least 6 TWh of electricity during each of the extension periods of FY2026 and FY2027. To be eligible to receive compensation, Origin must advise the State by March whether it will trigger the GEPA for the coming financial year.

If the GEPA is triggered, Origin may recover a portion of Eraring losses calculated for that financial year using an agreed formula that takes into consideration the extent to which the plant’s operating and capital costs exceed an agreed revenue profile, capped at $225 million per annum. In the event Eraring operations are profitable during that period, Origin will pay the NSW Government 20 per cent of Eraring’s agreed profit, capped at $40 million per annum.

Origin retains the right to determine the final timeline for retirement of all four units of Eraring Power Station. However, under the terms of the GEPA, no State compensation will be payable after FY2027, and the plant must retire in full no later than April 2029.

There are a couple of things that were, arguably, overlooked in some of the initial commentary.

First, the announcement explicitly states that Origin can only recover a portion of any losses. So there has to be a loss before Origin gets any money. And Origin can only recover a portion of the losses.

Second, there is a formula. However, that formula hasn’t been disclosed. On the other hand the amount paid to the State Government in the event the GEPA is activated and Eraring makes a profit (as defined) has been stated at 20% capped at $40 million. It is natural to wonder why the upside formula is disclosed but the downside formula is not.

Other information is that if capex exceeds $50 million, ORG is responsible for the first $10 million and the NSW Govt the remainder.

In my opinion the downside formula will likely allow ORG to recover virtually all its losses up to the $240 million cap. The reason is that Origin management have announced the station is closing and there was time to get new capacity up.

If the plant is to be kept running there is no reason for shareholders to carry the can for the NSW Govt’s inability to get replacement capacity built. The NSW Govt could have shaken up its planning Dept years ago. It could have got on with the transmission building a lot faster.

“Equally”, as ex ORG investor relations supremo Angus Guthrie was so fond of saying, ORG has done nothing to replace the Eraring capacity, so in my opinion, there must still be some incentive to keep Eraring running even at a loss.

ORG woud likely cover this by just buying power out of the market and passing it on to consumers at a margin. Its a fairly useless policy that doesn’t really consider what the customers would like but it makes the shareholders less restless.

Not disclosed in the ORG annnouncement is that the NSW coal agreement under which NSW coal generators had to supply thermal coal to NSW generators at an agreed price and quantity will not be continued beyond 30 June 2024.

Probably the best way to look at the transaction is as an option. If ORG feels it will be unprofitable in a year it can exercise the GEPA. The NSW Govt can then only benefit from the option if ORG is wrong and it makes a profit and not a loss.

ORG might also trigger the option if expensive capex ie well above $50 million is anticipated. In that case it’s only responsible for the first $60 million.

A sketch of Eraring’s profit outlook

Operating mode. Eraring has four units in the total 2880 MW of capacity or 720 MW each and output has been around 14 TWh. An immediate question is how many units will be operated from 2025 through 2027.

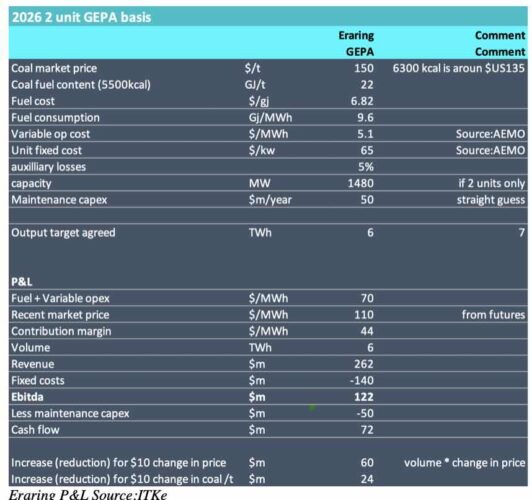

In the following model I assume that two units are put on a cold-start basis but not mothballed. In my mind, the idea is that two units provide the 6 TWh of energy and two units, capable of providing 1440 MW, are expected to be available most, if not all, of the time.

I expect the other two units to be maintained on a cold-start basis. That is, there are people to run them, coal supply to fuel them, and maintenance provided to enable them to start up if, for instance, there is a breakdown at Bayswater or a major transmission outage or whatever.

To maintain units on that basis will require expenditure, but the question is how much? AEMO provides an estimate something like $65/kw or around $90 million for the two units to be maintained in cold-start condition. Obviously whether that $90 million is or is not incurred makes quite a difference to the profits.

In the following table I’ve allowed for $45 million of fixed cost to keep two units available on cold-start basis. The point is, without more detailed knowledge, you can come up with any number you like.

Three months ago, NSW baseload futures were around $100, now they are around $123. Origin is unlikely to be taking spot price, it will have sold some output forward. Because I don’t know any better I’ve used $110/MWh.

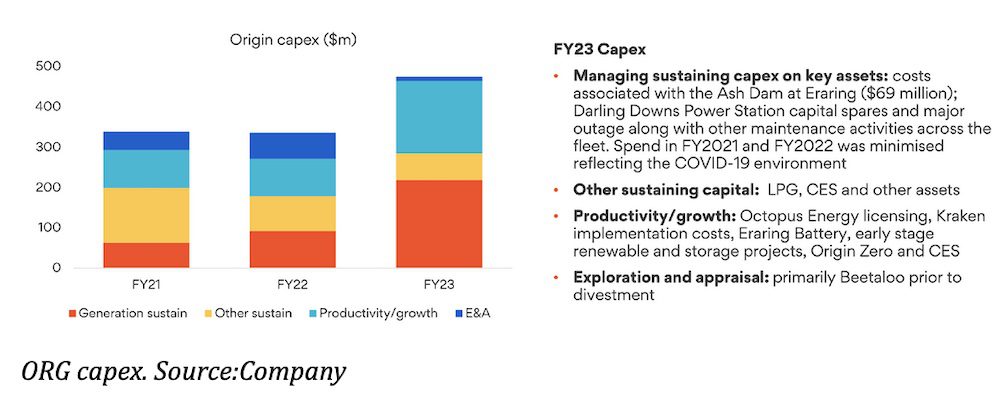

Origin spent $70 million on Eraring’s ash dam in the year to June 2023 and total mainteance capex across the generation fleet was over $200 million in FY23. In the six months to Dec 23, Eraring-related capex was $79 million.

Expenditure on the ash dam will be less with less volume, but I think an allowance of $75 million per year is, if conservative, not unreasonable.

In my opinion it’s certain that the GEPA includes capex in the “profitability” formula. Unfortunately, capex is lumpy, hard to forecast and somewhat discretionary, particularly as to timing. Clearly Origin will try to minimise the spend prior to closing and yet it’s spent more in the past 12 months than the two years prior.

ORG may not trigger the GEPA and continue operating

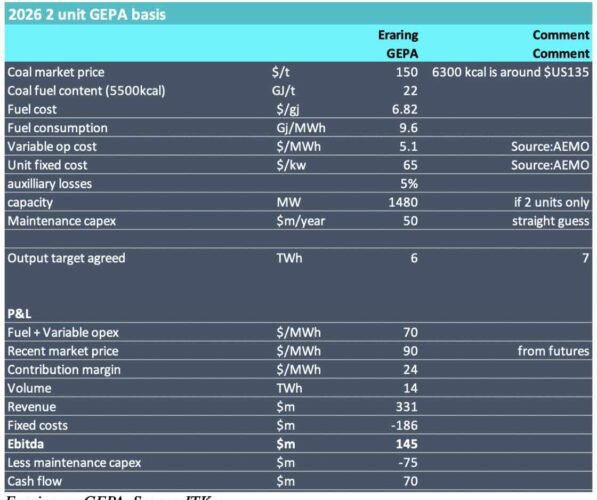

In the case that Origin chooses not to activate the GEPA, Eraring will likely continue as at present, producing 12-15 TWh. In that case on my model things look as follows:

The only caveat to this is that the coal is available and my guess is that it absolutely is.

In the case the GEPA is not exercised:

Electricity prices would I think be significantly lower. The table above shows $90. I hope to have a model that can estimate the impact more closely, but right now I have just plucked a $20 /MWh number out of thin air. If the impact was only $10 then Eraring makes another $140 million. My numbers are clearly gross estimates at best.

Origin shareholders seem to do well but not as well as all that. Origin still has to wean itself off Eraring which must close by 2029.

then