Origin Energy this week announced its intention to retire the 2,880 megawatt central New South Wales based Eraring coal fired power station in 2025, seven years earlier than scheduled.

ITP Renewables has used its openCEM model to assess the impact of this early closure. openCEM is a capacity expansion model of the National Electricity Market (NEM) and it optimises for a least-cost solution that maintains energy security and policy targets.

We compared two scenarios:

Base Case: This scenario draws input assumptions from the “Step Change” scenario of the Australian Energy Market Operator’s (AEMO) 2020 Integrated System Plan (ISP). We have selected the ISP’s Step Change scenario as our Base Case because recent AEMO consultation in relation to the next ISP suggests this pathway is now more likely than the previous “Central” scenario.

Eraring Retired in 2025: This scenario is the same as the Base Case except that Eraring’s coal-fired capacity is retired in 2025 rather than 2032.

Key conclusions are that the early retirement of Eraring:

- is unlikely to lead to energy security challenges;

- increases investment in solar PV (350MW in northern South Australia) and battery energy storage (240MW in northern South Australia);

- brings forward opportunities to invest in solar PV, wind, and batteries from 2032 to 2025;

- is likely to reduce the NEM’s reliance on gas-fired power;

- has a less than 1% overall impact on electricity prices;

- reduces greenhouse gas emissions by 15.5 million tons over the period from 2022 to 2040.

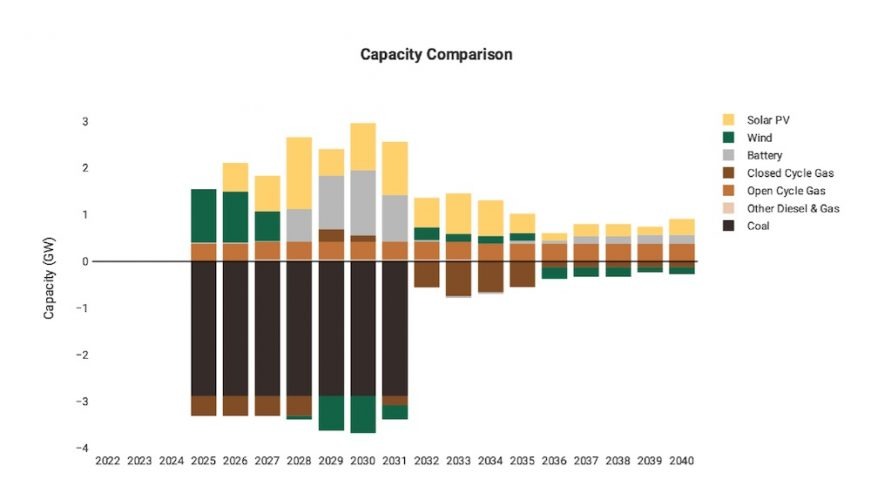

The following comparison graphs reveal the difference between the Base Case and the Eraring Retirement scenario.

This graph reveals the retirement of old generation capacity and the construction of new capacity. Eraring’s 2.88 GW of coal generation is retired in 2025, and openCEM responds to this change by:

- bringing forward the construction of wind and gas-fired generation;

- building a small amount more of open cycle gas turbines for peak events, and less closed cycle gas turbines to provide a base load, retaining the same amount of gas generation overall;

- building more solar and battery capacity.

Illustrating the redundancy of the Eraring power plant, much less than its 2.8GW of generation capacity needs to be replaced to maintain energy security.

This graph reveals how the amount of electricity dispatched from different sources will change. It shows that because of the early retirement of Eraring, compared to the Base Case:

- Less gas-fired electricity will be dispatched out to 2040. This is because early retirement of coal could, and should in an effective market, attract additional investment in solar and battery storage (as seen in the Capacity Comparison graph above). Once it exists in the NEM, this additional solar and battery capacity displaces gas-fired generation.

- Less coal-fired electricity will be dispatched in the early years, but there will be a bit more in 2029 and 2030, mainly from Queensland and to a lesser extent Victoria.

- Overall, the reduced reliance on coal and gas-fired generation is replaced by an increased reliance on wind, especially initially, and then solar and batteries.

- openCEM builds a 788 MW 4-hour battery in 2028, in Northern New South Wales, close to where Origin Energy proposes to build a 700 MW battery on the Eraring site.

From 2022 to 2040, the total system cost is $244.09 billion, $163 million (0.07 per cent) more in the early retirement scenario than the base case. The retirement cost of Eraring is brought forward, but fuel and maintenance costs of over $200 million a year are avoided, replaced by repayment costs for the renewables that replace Eraring.

These repayment costs go towards paying for jobs in renewables construction and maintenance, and infrastructure to support a high-renewables grid. This contrasts with fuel costs for coal that are sunk into increasingly expensive and diminishing fossil resources, and maintenance costs for a coal plant with a shorter remaining lifetime than wind and solar generation.

Retiring Eraring in 2025 results in a 15.5 million ton reduction in carbon dioxide equivalent emissions over the period from 2022 to 2040, and an increased renewable energy fraction in every year after 2025.

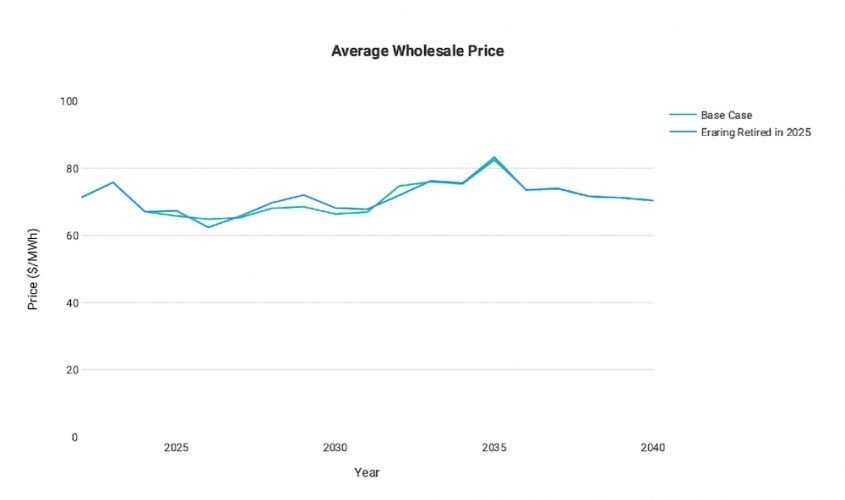

Differences in the wholesale price are in line with the changes in system costs illustrated above. After the retirement of Eraring, investment and repayment costs increase due to bringing investments forward, but this is almost completely offset by reduced fuel and operation and maintenance costs. Overall, there is no substantive impact in the short or long-term.

These final two graphs break down the wholesale price forecasts by state. The Base Case scenario suggests the small peak in NSW wholesale prices that would have occurred in 2032 now occurs with Eraring’s retirement in 2025. No other substantive change is apparent.

About openCEM

openCEM is a freely available open-source electricity grid modelling tool which was developed by ITP. It was funded by the Australian Government (ARENA) and the Governments of NSW, Victoria and South Australia and is available at opencem.org.au.

It is a techno-economic tool used by decision makers, energy system planners, regulators, project developers and investors to determine how policy objectives (such as electrification, renewable energy, or emission reductions targets) can be achieved at least-cost, while maintaining energy security. For a given policy objective it reveals, for example:

- when, where, what type and how much generation, storage and transmission capacity should be added;

- how new generation and storage need to be operated in coordination with existing generation capacity to satisfy demand at the least cost.

Model outputs include all capacity and dispatch decisions for the system under consideration, as well a breakdown of capital and operating costs, utilisation, capacity, energy and transmission statistics.

An earlier RenewEconomy article about openCEM discussed the model’s operation in more detail and is available here.

Dr Jose Zapata, Joel Davey and Oliver Woldring are from ITP Renewables