Victorian Energy Efficiency Certificates (VEECs)

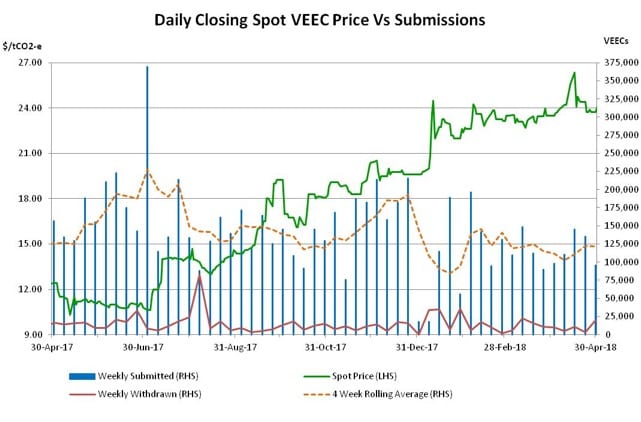

As has been seen time and again, transitions rarely happen in a steady, predictable fashion. With the changes underway for the VEEC market’s dominant creation methodology, VEEC submissions actually climbed across April with prices experiencing volatility along the way.

Change is afoot in the commercial lighting methodology which has completely dominated VEEC supply for over two years. All installs completed from 1stFebruary saw either a 10 or 15% (depending on the type of lighting replaced) reduction in the number of VEECs created per install.

On 1stMay, that amount doubles to 20 or 30%. Whilst there is usually a significant lag between installation date and VEEC submission date, it appeared during March that these changes we having both a sizable and prompt impact on VEEC supply.

As is so often the case though that trend reversed or at least was halted across April with the 4 week rolling average submissions climbing back above 120k.

In this context and despite significant volatility, VEEC prices increased across April with a notable mid month surge and subsequent reversal the main highlights. The general trend over recent months in the VEEC market has been positive and April began the same way.

The spot market progressed steadily through the high $23s and $24s to reach the $25 mark in gradual and liquid trade conditions in the second week of the month.

The increasing price was the product of strong buying interest combined with thin forward sell volumes which saw demand forced to focus on the relatively limited spot supply.

With the market above the $25 mark more forward volume emerged and monthly strips for settlement across the second half 2018 and into early 2019 traded in large volume. This wasn’t enough to halt the rise though with the market continuing to rally, with the spot at one point reaching a high of $26.35 (a level not seen since Jan 2016).

At this point the forward curve flattened out with large volumes agreed at $26.15 for settlements in early 2019.

Support then evaporated with the spot dropping sharply to close the same day $2 lower at $24.10. The rest of the month saw the price move within a $23.50-$24.50 range before ultimately closing at $24.00.

While a hiatus in the decline of VEEC submission numbers took place during April, there are many who believe that as time passes the proportion of 1stFebruary and 1stMay activity date commercial lighting VEECs being submitted will increase and naturally drive down VEEC supply, causing further increases in the price.

Outside of the election uncertainty, the main argument levelled against that point of view remains the size of the VEEC surplus and the fact that it continues to grow.

Following the passage of the 2017 compliance date of 30thApril, a total of 7.38m VEECs remain either registered or pending registration. This is sufficient to meet the 2018 target of 6.1m and take a significant chunk out of 2019 target as well.

Those on this side of the fence argue that given the size of the surplus there is plenty of time to determine whether VEEC supply will fall or not and to what level, before prices need to start moving up to the level required to encourage the next cheapest alternative on the cost curve. So far however, it appears as if this argument is not winning out.

New South Wales Energy Savings Certificates (ESCs)

Persistently strong registration numbers across April coincided with generally stable ESC prices and intermittent periods of good liquidity. The month also saw the gazettal of the 2017-2018 scheme rule changes.

A generally stable start to the month saw the spot ESC market trading in the mid $23s for several weeks until an abrupt mid month spike saw the price briefly reach a high of $24.50. The level wasn’t sustained and the market then retraced back into the $23s reaching a low of $23.00.

The forward market was busy across the month with settlements for the second half of 2018 seeing the greatest volumes.

One of the main talking points across the month was the ongoing strength in ESC registration numbers. The February-June period is often a period of significant ESC registration as creators push to register ESCs, first in order to meet forward agreement delivery requirements ahead of the final compliance date on 30thApril and then ahead of the deadline for registration of the previous year’s certificates (30thJune).

There were many who believed that the pipeline of certificates in 2018 was smaller than in 2017, but across April the solid run of registrations (4 week rolling average sitting around 120k) meant that the February-April registration numbers for 2017 and 2018 were roughly the same.

A big factor in the drop in ESC pricing in 2017 was the epic 728k week produced at the 30 June deadline for 2016 vintage creation.

The 30thJune 2017 however was also a cut off for registration of ESCs before a new, more rigorous set of compliance requirements were introduced and hence it brought forward a lot of creation that would have otherwise come later.

It appears unlikely that such an enormous number of ESCs will come through this time around, but it may not be necessary to maintain a the relatively subdued sentiment in the ESC market over the coming months.

Similar to its southern neighbour, the gazettal of the 2017-2018 scheme rule changes ensure an adjustment is in store for ESC market. Principally the area of greatest impact will be in the commercial lighting methodology which, as planned, will see significant reductions in ESC creations for installs in the vast majority of building categories from 1stNovember.

This is important for two reasons. On the one hand the changes will likely reduce medium to long term ESC supply, with less ESCs per install resulting in a drop in supply even if install numbers are maintained. On the other hand the looming changes may cause an increase in installs in the short to medium term with the relative cost of an install likely to increase after the changes.

But the gazetted changes also change the eligibility threshold for small business eligibility under the Home Energy Efficiency Retrofit program, from a spatial threshold to one based upon electricity consumption.

This appears set to increase the number of eligible premises under this more favourable methodology. With activity in the residential market having been nonexistent until recently, the HEERs methodology will be an important one to watch over the coming year.

Marco Stella is Senior Broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services, across all domestic and international renewable energy, energy efficiency and carbon markets.