Having brought 2017 to a close on a comparatively stable note, the VEEC market began 2018 in a far more spectacular fashion, with early price movements and volatility along the way. While the passing of the deadline for VEEC submission to ensure eligibility for 2017 compliance occurred without a massive spike in uploads, the numbers remained strong across the period. The big issue for the market is now what impact the two-step changes to commercial lighting will have on supply in the short to medium term.

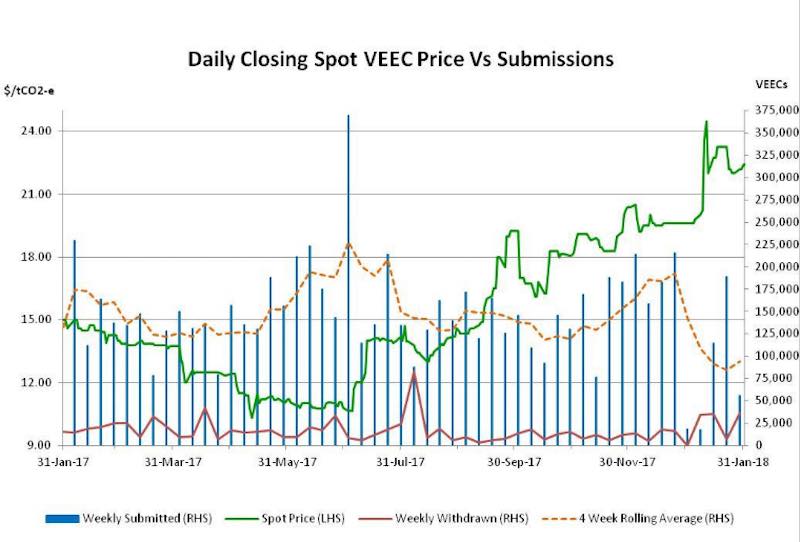

As the chart below illustrates, 2017 was a big year in the VEEC market. A surge in installations associated with high bay lighting technology allowed the VEEC surplus to grow, despite a substantial reduction in price across the first half of the year. With the news that regulatory changes were on the way a recovery ensued, bringing the spot market back up to the $20 mark by late November.

While the market did soften back into the $19s in December it was fairly stable during that month with most of the activity in the spot taking place between $19.50 and $20.00. Unsurprisingly, VEEC submissions were strong during this period with the usual rush to get installations completed by Christmas compounded by expectations that the cut-off date before the commercial lighting rule changes commenced would be 31st December. As noted previously this timeline was eventually delayed by a month making the cut-off 31st January instead.

The New Year brought with it a sense of urgency amongst some participants which was evidenced by an early return to trading and some hefty price movements. Early in the month the spot market broke through $20.00 and took off shortly afterwards, reaching a high of $24.60 in the second week of January. The forward market was particularly busy during this time with the market surpassing the $25.00 mark for settlements in the second half of 2018.

The run, however, did not last as the spot and forward markets began to soften in a bumpy and sometimes confusing fashion. The spot market ended January at $22.40, a gain of 13% on December’s close of $19.90.

January’s exploits, whilst exciting, may yet prove a modest entree before the tantalising main course. The months ahead will see the impact of both the first and second rounds of commercial lighting discount factor reductions (10% for T8 and T12s and 15% for high intensity discharge lamps from 1st Feb and 20% for T8 or T12s and 30% for high intensity discharge lamps from 1st May). Whilst the VEEC market has already rallied substantially across the last six months, there are those that believe a combination of the changes and saturation of the high bay market will require prices to be higher in order to sustain creation.

On the flip side of this is the fact that by late January, once the 2017 target was taken into consideration, there were already 5.9m VEECs either registered or pending registration against the 2018 target of 6.1m. Many participants look to the size of this over supply and wonder why the market is even where it is today.

An increase in ESC registrations in the back end of 2017 was not enough to weigh on the market, nor to prevent it from starting 2018 in a positive frame of mind. The bigger issue in the medium to long term for the ESC market is the impact the proposed changes to the commercial lighting methodology will have one they take effect late in the year.

In a more exaggerated manner than its southern counterpart, 2017 in the ESC market was a tale of two halves. The first half of the year saw very strong ESC registration volumes and softening prices, while the latter part of the year brought talk of potential changes to commercial lighting, a clear reduction in registrations and a sharp improvement in prices. The back end of the year did see a steady recovery in ESC registrations, yet this was not enough to significantly impact on the spot price, which sat between the high $21s and low $22s across the month.

Whilst a little slower to get moving, the ESC market eventually found its way, opening at $21.80 in the spot and trading progressively higher across the month with delays in audits resulting in some creators being forced back into the market to buy, whilst also restricted supply. By month’s end the spot had reached $24.35, an increase of 12% above December’s closing price of $21.75.

Forward activity was initially patchy across January, though as the price rose above the $24 mark liquidity returned with sellers more prepared to engage at the improved levels.

Looking forward there are two important factors that have harnessed participants’ attention. The first is the rate of registrations across the next few months. The volatile nature of ESC registrations makes it harder to discern underlying trends with last year being a great eample of that. After a typically slow January particiapnts are wndering whether the coming 3-4 months will yield the stronger numbers that have been seen in the past, or whether the reduced registrations seen across the second hal fof 2017 will be a better indictation of where the market is at.

The second is the impact of the proposed changes to the commercial lighting methodology which are expected to take place in October and will see considerable reductions in the number of ESCs produced from installations in most building categories. Whilst in anticipation of these changes its possible there may be a rush for customers to sign up to ensure they take advantage of the more generous existing circumstances, after the changes its likely for to be harder to create as many ESCs as what had been before. As outlined previously, determining the underlying level of activity at present is hard enough, before assumptions need to be made about the potential for these changes to impact supply. Participants have their work cut out for them this year.

Marco Stella is Senior Broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services, across all domestic and international renewable energy, energy efficiency and carbon markets.