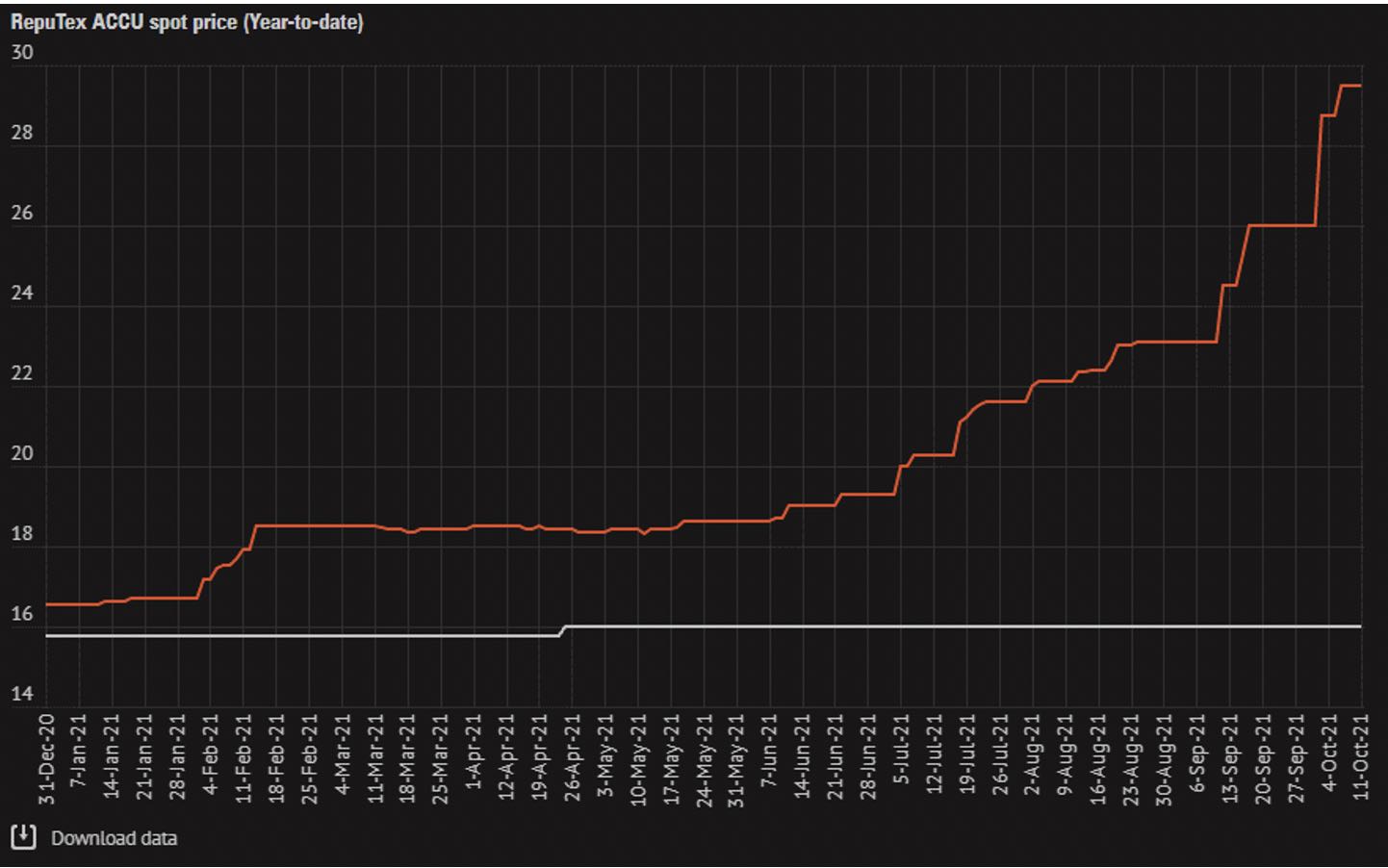

The spot price for Australian Carbon Credit Units (ACCUs) continued its recent uptrend over the past fortnight, growing 13% to $29.50/t, a new record high.

The recent surge in the spot price is yet to flow through to the forward market, with Feb-22 (CAL 21) prices sitting at $30/t, an increase of 13%, while Feb-23 (CAL 22) prices remained flat at $27/t.

RepuTex’s ACCU spot price assessment is now up 79% calendar year-to-date, with recent activity underpinned by smaller parcel sizes of around 5,000 units as new participants enter the market, particularly investors and intermediaries.

As noted in our recent Carbon Market Outlook, increased demand from investors and intermediaries is expected to strongly influence price development over the medium- and long-term.

This demand, along with compliance buying under the Safeguard Mechanism, is increasingly shifting to the forward market – and bilateral contracting with project developers – with direct contracting seeing the lion’s share of larger transactions (>100,000 units) for both spot and forward delivery.

As a result, we attribute the current supply squeeze in the spot market to new issuance being set aside to fulfill larger bilateral contracts, with lower volumes of excess issuance trickling down to the spot market.

This has created a bullish environment for spot prices, where demand continues to outweigh supply, even at much smaller volumes.

While the supply squeeze in the spot market is therefore real, larger volumes remain available via direct contracting. While we forecast the high spot price environment to continue, the ACCU spot market therefore remains more of a side-pot, with key players transacting for larger volumes over longer delivery periods via direct offtake agreements.

ACCU issuance is strong, but is already assigned

Fourteen new projects were registered over the period, with soil carbon and new Human-Induced Regeneration (HIR) methods making up the majority of new registrations. 1.2 million ACCUs were issued, bringing FY22 issuance to almost 4.5 million and over 101 million in total.

As noted in earlier updates, the bulk of new issuance is expected to be delivered to existing Fixed Delivery contracts under the Emissions Reduction Fund, or set aside to fulfill larger bilateral contracts, with limited supply expected to be made available to smaller spot buyers.

We continue to anticipate an uptick in issuance over the December quarter, potentially supporting the spot market, however, it remains a seller’s market underpinned by (increasingly less) un-contracted supply.

Voluntary cancellations surpass 8 million for 2021

191,146 offsets were voluntarily cancelled over the period, with 134,667 (70%) in the form of Certified Emissions Reductions (CERs) and the balance in the form of ACCUs (56,479). This reflects an increase in the cancellation of ACCUs relative to CERs, albeit from a low base.

Australia has now surpassed 8 million voluntary cancellations for the 2021 calendar year, reaching 8,101,964, 26% ahead of CY20 levels. 92% of all CY21 cancellations have been in the form of CERs, which, while prices have grown to almost US$3, remain the cheapest form of voluntary offset.

This extract of the Australian Carbon Offset Market Report is published under RepuTex’s Carbon Market Intelligence service. To learn more please click here.