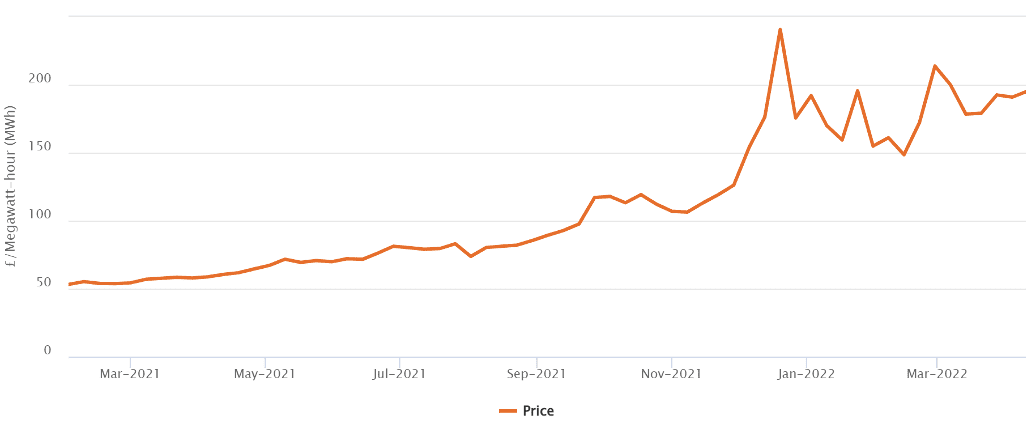

These are unprecedented conditions for the National Electricity Market (NEM). Wholesale electricity and gas prices are at record levels and the futures’ markets suggest these conditions will persist for a while yet.

Following an announcement that an emergency meeting of the Energy Ministers has been called, there have been continued calls for the introduction of a ‘capacity mechanism’ as a means to solve the crisis.

The introduction of a mechanism requiring consumers to pay for all the ‘firm’ capacity in the NEM might sound like a good idea on paper, but it would be complex and costly, and wouldn’t provide protection against our current predicament.

If our goal is a reliable, affordable transition, we should focus on the most cost-effective solutions for decreasing our dependence on fossil fuels: demand-side solutions, renewables and storage.

If a clear case is made for additional mechanisms to support firm capacity, the focus should be on encouraging new investments and only at times where the market is not already delivering these investments. It should not be designed to pay the existing coal and gas fleets.

The extreme market conditions

Wholesale electricity prices have reached record levels, with average spot prices in New South Wales, Queensland and South Australia exceeding $300/MWh in May. Futures’ prices are also at record levels, with FY23 contract prices climbing above $200/MWh in New South Wales and Queensland. Gas spot markets have also been at such high levels that AEMO is capping prices at $40/GJ in Brisbane, Sydney and Victoria.

The cause for these prices can mostly be attributed to a combination of exceptionally high fossil fuel costs and large portions of the generation fleet being offline.

Swathes of coal-fired power stations are out of service, significantly reducing supply. Almost 25% of the coal capacity in the NEM, approximately 5GW, has been offline at points in time over May. These reductions in capacity are due to technical faults and difficulties accessing coal.

At the same time, the remaining coal and gas generators, who still generate most of the electricity in Australia, have some exposure to the global shocks to coal and gas markets, depending on their levels of contract cover.

This is driving up their fuel costs, flowing through to higher bids in the wholesale market. How exposed each generation portfolio is remains a bit opaque (analysts pour over ASX market updates to glean any insight into hedge positions), but with the price set based on the last generator required, even some exposure to these global forces is having a big impact domestically.

Unsurprisingly, the turmoil in energy markets is leading to calls for intervention and regulatory changes. These calls include support for the fast-tracking of a capacity mechanism being developed by the Energy Security Board (ESB).

A capacity mechanism wouldn’t have provided relief

A capacity mechanism would require retailers and energy consumers to pay explicitly for capacity. However, it’s not clear how a capacity mechanism would have provided consumers with any protection from the current market conditions.

A capacity market couldn’t have guaranteed the offline coal capacity would be available to generate, particularly if the outages are due to technical failures or reduced fuel availability. Instead, it creates risks that consumers would be paying for this capacity only for it to sit offline.

Careful and sophisticated design choices can try to protect against this, but it would mean much higher administrative complexity and risks for the sellers of capacity, which increases costs if energy users are obligated to pay for capacity in advance.

Even if we pay for capacity through a capacity mechanism, the proposed mechanism does not provide a buffer against the elevated wholesale prices.

Generators will still seek to recover their short-run costs and while coal and gas fuel costs are at such elevated prices, these short-run costs are high. There is evidence of this in other markets, where European capacity markets have not provided customers with protection from escalating prices.

Effective investment frameworks are crucial

It is clear we are going to need significant investment in the NEM over the energy transition, but what is not clear is whether a capacity mechanism is the best way to achieve this. Capacity markets provide price signals for capacity, not necessarily the flexibility needed to move to higher penetrations of renewables. Crucially, it also risks extending our dependence on coal generation by providing them with capacity payments.

While a capacity mechanism is being developed, it creates regulatory uncertainty, which will be damaging for new investments. For renewables, it will impact negotiations relating to long-term energy offtakes, particularly if a capacity mechanism means a reduced market price cap. There is also new uncertainty for storage investors, unsure how capacity will be derated.

If a capacity market is introduced that creates revenue for all capacity, there’s no guarantee it will help investments in new storage. The value for new investments depends on how capacity certificates are valued by project financers.

With no history on how “capacity” will be priced and uncertainty regarding the ability for generators to sign long term capacity offtakes, financiers are likely to heavily discount forward estimates of capacity revenue. A capacity mechanism also creates new downside risks for investors if it ends up prolonging the operation of coal-fired power stations. And as mentioned above, projects are at risk of having their capacity derated, significantly influencing project revenues.

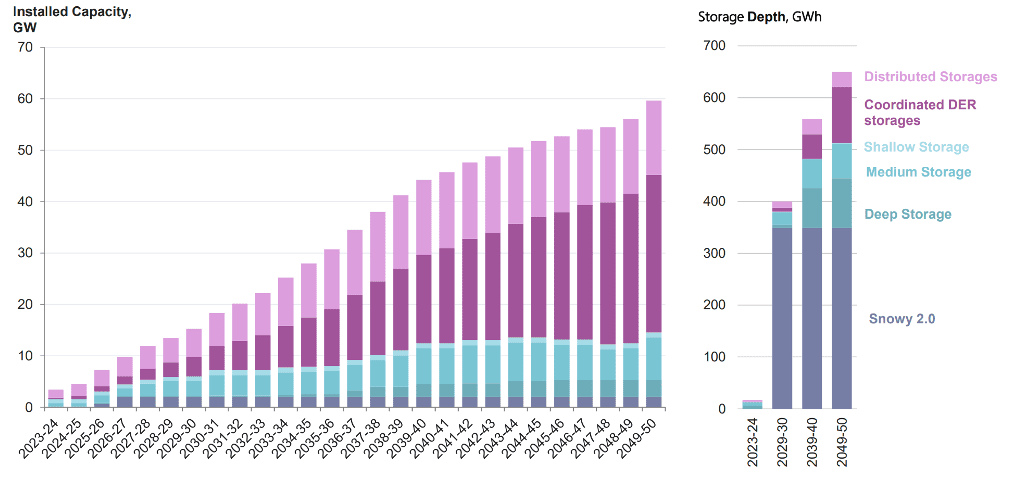

Capacity markets also don’t deal well with distributed energy resources. Significant amounts of storage forecast by AEMO in its Draft ISP comes from distributed energy resources (three quarters of the dispatchable capacity in AEMO’s Step Change scenario by 2050).

Most of this storage will be in the form of electric vehicles or home batteries coupled with rooftop PV. These won’t be investment decisions made based on the capacity price, so to make sure this storage is used when its most valuable, we need strong short term price signals i.e. an energy only market!

On top of all of this, a capacity mechanism would create significant headwinds for retail competition and innovation by favouring vertically-integrated gentailers with physical capacity in their portfolios.

What should we be doing instead?

The overarching challenge is reducing our dependence on fossil fuel generation. Continuing to develop renewables and storage will help. There should also be a renewed focus on demand-side solutions.

Energy efficiency and demand management will be fundamental to progressing the energy transition at a lower cost. There are huge opportunities for Australia to improve the energy efficiency of our buildings, particularly at the residential level. This is good for those customer’s bills, but also for their quality of life.

For investment in new supply, the first thing should be evidence of the need for reform. If there is compelling evidence, the right mechanisms should be designed that support new investment and protect consumers from unnecessary risk and cost, and this should not create new revenue streams for existing generators.

Declan Kelly is regulatory policy manager at energy retailer Flow Power.