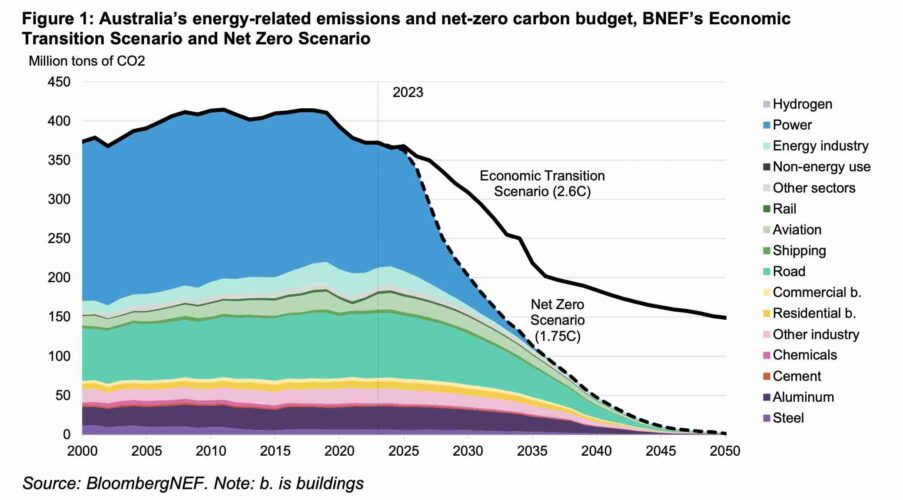

Bloomberg NEF has warned that Australia’s window to achieving its 2050 net zero targets is closing fast, and the “heavy lifting” in investment in new wind, solar and storage must be done this decade. Coal, and unabated fossil gas generation, must also end by 2035.

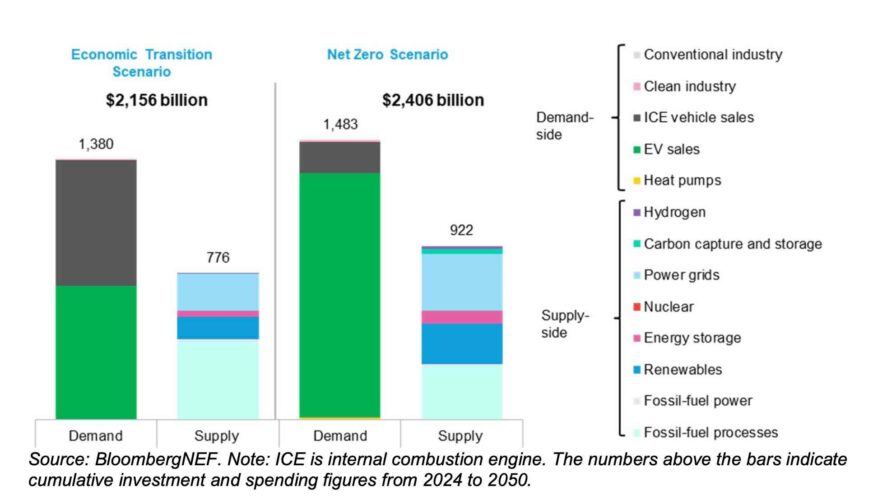

The latest version of BNEF’s New Energy Outlook for Australia quantifies the cost of the transition to net zero over the next two and a half decades out to 2050 at $2.4 trillion, which sounds a lot.

But BNEF points out that it is only 12 per cent above the business as usual, and more than half of this cost ($1.3 trillion) comes in the form of electric vehicles.

But Australians are expected to spend nearly that much anyway on internal combustion engine cars in the business as usual scenario. The actual extra spending on “supply side” technologies such as renewables, storage and power grids, is just $150 billion more, spread over 26 years.

The net zero scenario, however, is at least consistent with capping average global warming at around 1.7°C, but the business as usual, or what BNEF calls the economic transition scenario, is consistent with a 2.6°C outcomes, which climate scientists say could be catastrophic.

“Australia’s window to stay on a well-below-two-degree pathway is closing, fast,” Leonard Quong, the head of BNEF in Australia said in a statement accompanying the report.

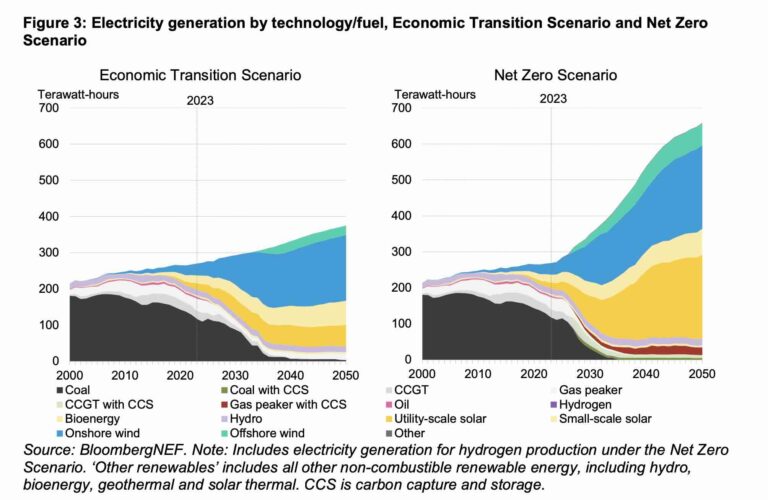

“Rapidly moving to a clean power system based on wind, solar and storage will be essential to cost-effectively reduce carbon emissions in line with our existing decarbonization targets.

“But the heavy lifting must be done this decade. A low-carbon power sector will also serve as a bedrock for future emissions reduction efforts in other areas of the economy in the years to come.”

BNEF’s comments are important given the current political debate, and the efforts by the federal Coalition to delay or even stop investment in renewables and transmission, and invest in new gas generation and coal plant extensions in the hope that nuclear generation might be built, which most analysts say would be decades away.

Energy experts have pointed out that the nuclear scenario would be even more costly, lock in much higher power bills and pose a bigger risk to energy reliability given the dependence on ageing coal plants.

The BNEF report says that Australia needs to scale up its emission reductions targets – it suggests 71 per cent reduction from 2005 levels by 2035, and it makes clear that the investment and spending also needs to treble, from a record $18 billion in 2023 to around $55 billion a year now and to $83 billion in the 2030s.

“This includes capital investment in renewable energy, power grids, energy storage, carbon capture and storage, hydrogen and clean industry, alongside consumer spending on electrified transport,” the report says.

“All sectors require investment and spending to scale up quickly. Electrified transport will call for 2023’s total to increase by a multiple of 11 on an annual basis to 2050.

“Power grid spending will have to double annually, compared to the levels seen in 2023, while investment into renewable energy will have to see a 23% increase. Energy storage investment will need to increase from $1 billion in 2023, to $5 billion on average from now to 2030, before dropping to $2 billion a year in 2030.

“Australia will always need to invest in its energy system, irrespective of whether it reduces its carbon emissions,” says Caroline Chua, an energy transition specialist at BNEF and a lead author of the report.

“The challenge of getting to net zero is going to be making sure capital flows into the right type of technologies, at the right time.”

“Australia will always need to invest in its energy system, irrespective of whether it reduces its carbon emissions” said Caroline Chua, BNEF Energy Transition Specialist and lead author of the report. “The challenge of getting to net zero is going to be making sure capital flows into the right type of technologies, at the right time.”

The report says Australia’s abundance of world-leading wind and solar resources gives it an advantage in decarbonisation, and represent a $213 billion investment opportunity by 2050.” s

However, the grid will also need flexible demand from smart electric vehicle charging and hydrogen electrolyzers, along with battery storage, flexible generators, and investment in the power network.

The BNEF report says that because technology is changing anyway, Australia is likely to get to around 62 per cent renewably by 2030. It says the country could reach 87 per cent renewables by 2030 under its modelling, but just to reach the official 82 per cent target would require a significant scaling up of policies.

“The federal Capacity Investment Scheme and New South Wales’ Long-Term Energy Service Agreement are likely to support new generation and storage projects to 2030,” it says.

However, both mechanisms will need increased support beyond their current levels to stay on a net zero pathway, and to reach their capacity targets.

“Additionally, Australia’s long and stringy grid, originally designed to support centrally located coal assets, will also need to undergo a drastic transformation. Network development has failed to keep pace with the energy transition so far and must ramp up to meet 2030 renewable energy targets and aid Australia’s decarbonisation trajectory.”