Earlier in January I noted on Linkedin that batteries were clearly impacting evening peak spot prices and that this resulted in lower average spot prices. I also said that coal station spot revenue was down as much as $1 billion at some stations.

Many commentators told me to look at retail prices, others said that spot prices are not relevant.

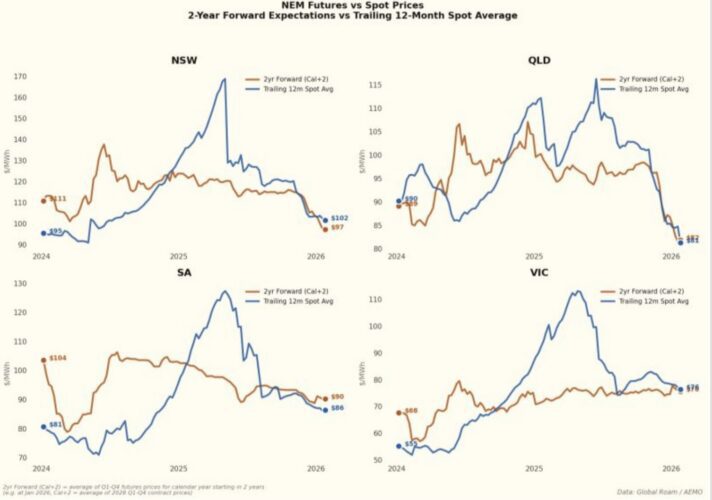

But those of us who follow this stuff for many years know that spot prices are relevant both to contract prices and through them to retail prices.

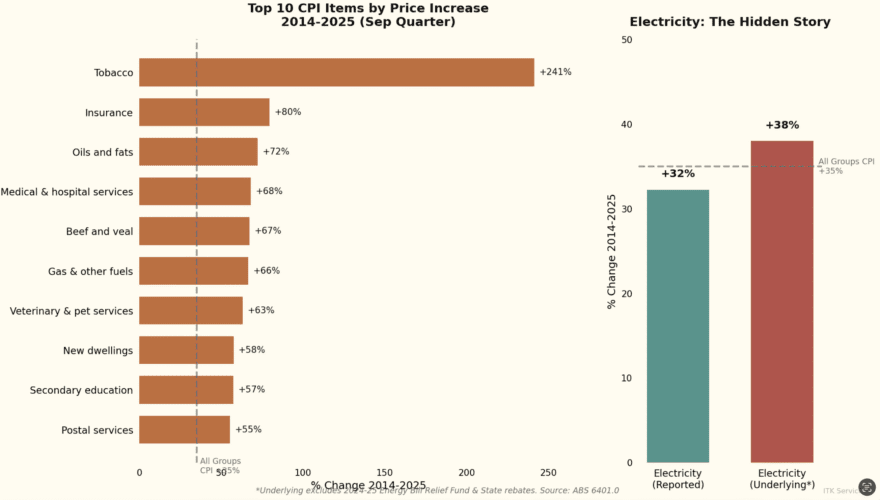

My concern is not with retail prices though. They might be relevant to politics but with 40% of houses having rooftop solar and increasingly many now with batteries and with retail prices in any event only having increased about the same as inflation over a decade its such a yesterday story.

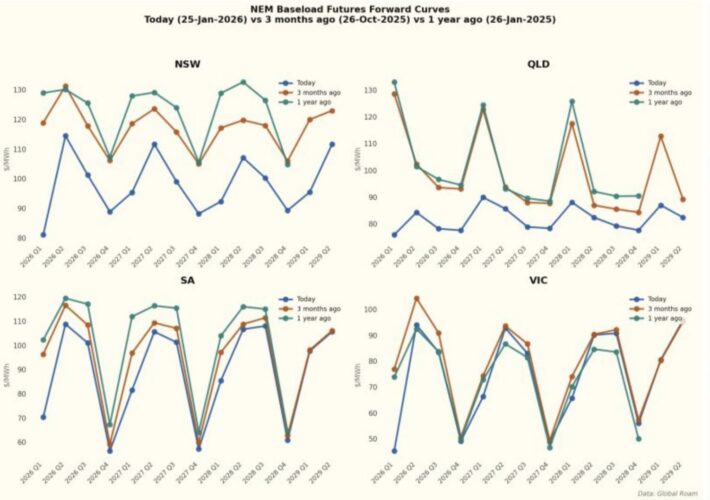

The following two plots show baseload futures. They clearly show that in Queensland and NSW expected prices have fallen. They also show, in my interpretation that broadly futures prices are related to spot. This is no surprise to anyone that studies price theory.

And furthermore, you hear a lot about rising retail electricity prices, but let’s put them in the context of other items and expenses. It doesn’t even rate in the top ten over the past decade.

If you would like to join more than 29,000 others and get the latest clean energy news delivered straight to your inbox, for free, please click here to subscribe to our free daily newsletter.