Major Australian gentailer AGL Energy has closed the chapter on a year of “significant challenges,” including a significant dint to underlying profits, with a view to focus growth and spending on big batteries and flexible generation.

In its results for the financial year ended June 30, 2022, AGL reported an underlying profit after tax of $225 million for the period, down 58 per cent on the 2021 financial year.

AGL managing director and CEO Graeme Hunt detailed a year of challenging energy industry and market conditions, including a scuppered demerger plan, attempted takeover bid, an unprecedented energy market suspension, and an overall “material elevation in volatility” since mid-2021.

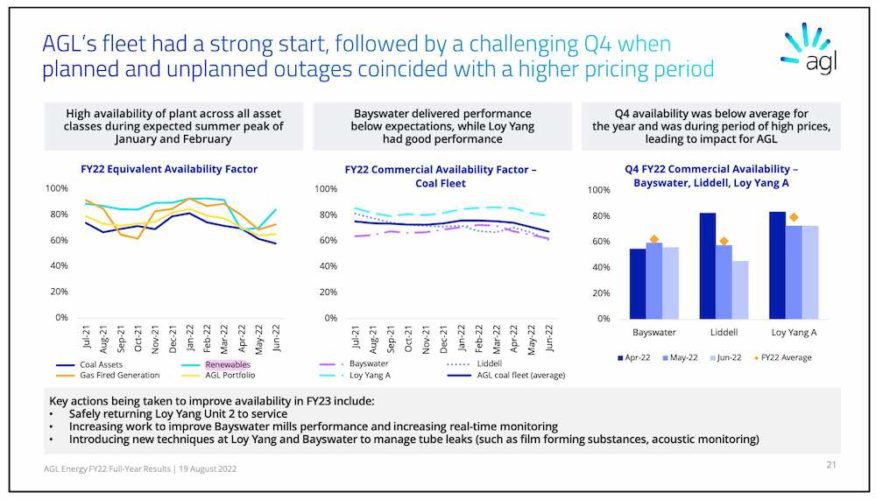

Hunt said AGL’s earnings were buffetted by a mix of planned and unplanned thermal generation outages, unprecedented market conditions, and increased residential solar volumes, among other factors.

But he says the underlying fundamentals of the business remain strong and resilient, and a big part of the company’s plan for the new financial year is to bolster this resilience with the development of AGL’s grid scale battery portfolio.

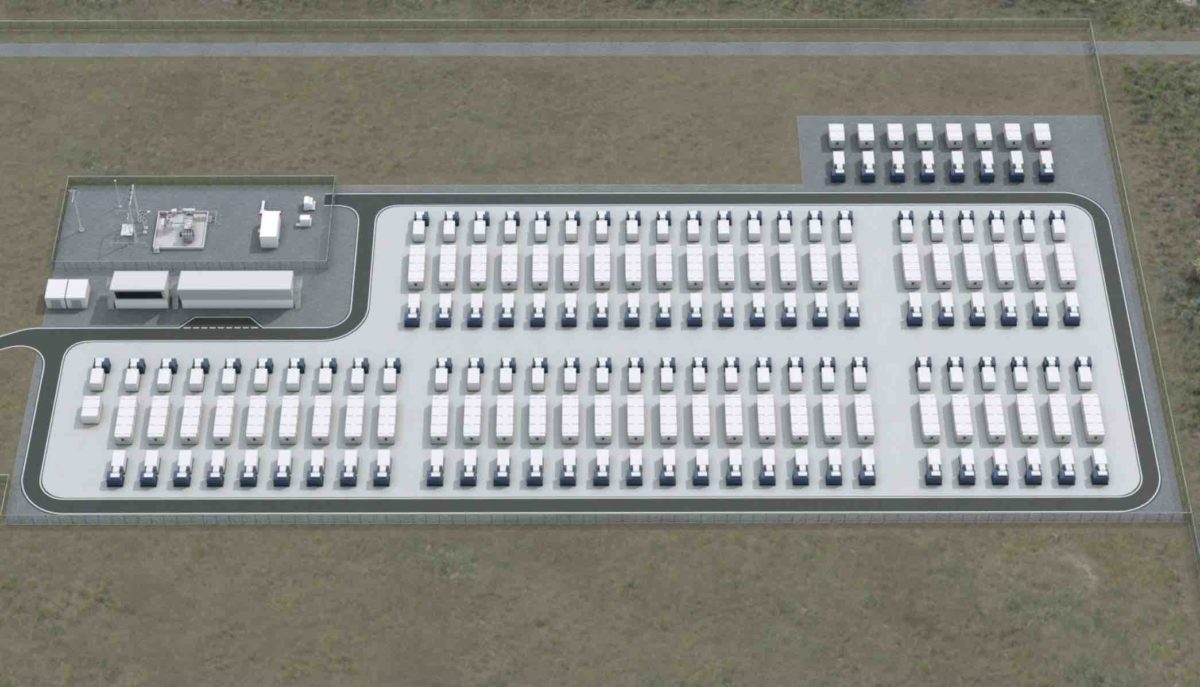

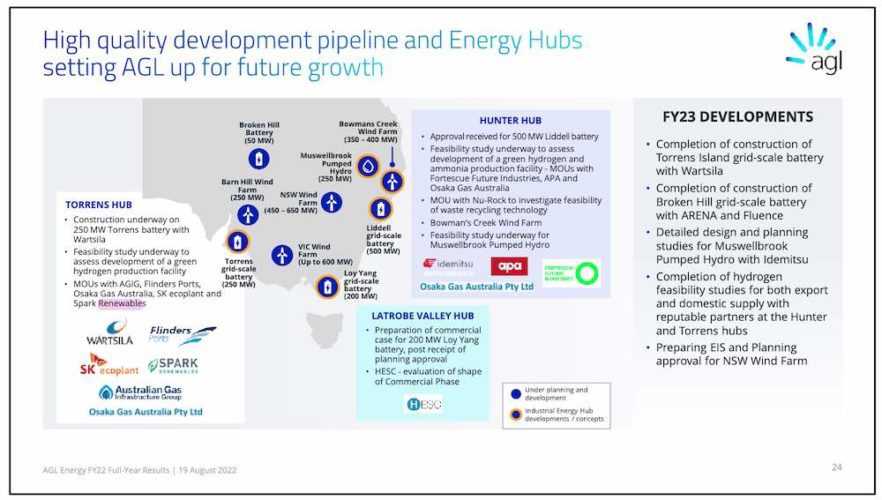

AGL is currently developing the Torrens Island big battery – expected to be operational in the first half of 2023; the Broken Hill battery, which recently reached a final investment decision; and big batteries at Liddell and Loy Yang, both of which have state government planning approvals.

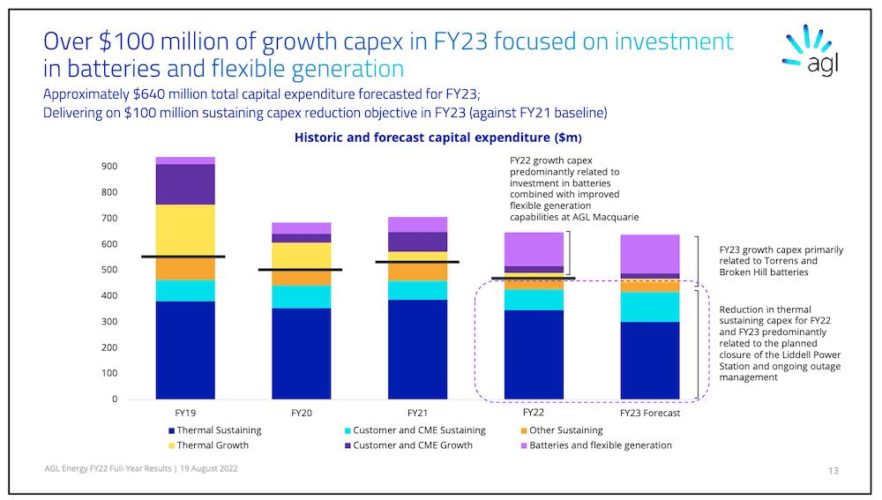

“Growth capex this year is focused on flexible storage including the Torrens Island and Broken Hill batteries, as well as smaller flexible generation investments,” said AGL chief financial officer Damien Nicks, pointing to the below chart, which puts more than $100 million aside for batteries investment in these areas.

At the start of the new financial year, AGL says it has around 2.9GW of wind, battery, pumped hydro and other “low carbon firming projects” in active planning and development, as well as access to the 3.5GW Tilt Renewables development pipeline.

Of course, AGL still has a large fleet of coal and gas power generation assets, including the Bayswater and Liddell coal plants in New South Wales, Loy Yang A in Victoria, and the Torrens Island gas plant in South Australia.

In February, AGL announced it was bringing forward the closure of Bayswater and Loy Yang A to 2030-33 from 2035 and 2040-2045 from 2048, respectively. And while this outraged the Coalition Morrison government at the time, it has been criticised elsewhere as not nearly fast enough.

Indeed, shareholder pressure on AGL to get out of coal within the coming decade – led by billionaire stakeholder Mike Cannon-Brookers, ultimately led it to dramatically abandon its controversial plan to split its business in two.

Apart from the climate imperative to slash emissions in line with Paris targets to prevent dangerous global warming, shareholder activists like Cannon-Brookes, and more recently Oliver Yates, argue that AGL’s coal fleet is increasingly unreliable and unfit for purpose on a rapidly changing grid.

As the company’s COO Markus Brokhof noted in the results announcement on Friday, the final quarter of the 2022 financial year was marked by a “confluence of prolonged planned outages such as Bayswater Unit 3, with long and short duration unplanned outages including but not limited to Liddell.”

Brokhof says the key causes of the forced outages included a generator earth fault in Loy Yang Unit 2 that has taken it out of action entirely (due to return to service late September) and a rise in boiler tube leaks across Liddell, Bayswater, and Loy Yang.

“The unplanned outage at Loy Yang Unit 2 has resulted in a revised earnings guidance which was released to the market in May,” Brokhof said, adding that the “boiler tube leaks are a critical area for AGL to contain and manage into the future, particularly in Bayswater, which underperformed relative to expectations in FY22.”

But Brokhof says a key achievement of the past financial year has been the continued progress on AGL’s 2.9 gigawatts renewable and energy storage project pipeline and its strategy to decarbonise its existing thermal generation fleet.

“Our focus has been on adding more renewable and low-carbon flexible capacity into our portfolio and gaining partners to join us in our plan to transition our thermal sites into low carbon industrial Energy Hubs,” Brokhof said.

“The development of our Energy Hubs in the Latrobe Valley, Hunter Valley and Torrens Island is crucial to

enabling our growth while continuing to provide for the low-carbon energy demand.

“One of our priority focus areas has been developing partnerships with organisations that share our interest in driving the energy future, and these partnerships are critical to our development pipeline,” he said.

“FY23 will see a number of new projects and developments for AGL as we look to continue to add flexible capacity and renewables to our portfolio. Hydrogen is in important industrial cluster as well targeting domestic and international markets.”