Australia’s growing fleet of big batteries are now entrenching themselves as the major force behind the huge price spikes that have become a regular feature of Australia’s National Electricity Market, and which were the dominant factor in soaring wholesale prices in the June quarter.

Big batteries had been expected to be a softening influence on price spikes on the grid, given their cost of fuel (charging) is significantly lower than peaking gas stations, and based on the assumption that they would bring new competition to the market.

But market power is market power, whatever the technology that is deployed. The costs of battery storage may well have fallen, but their market power has grown, and so has their asking price.

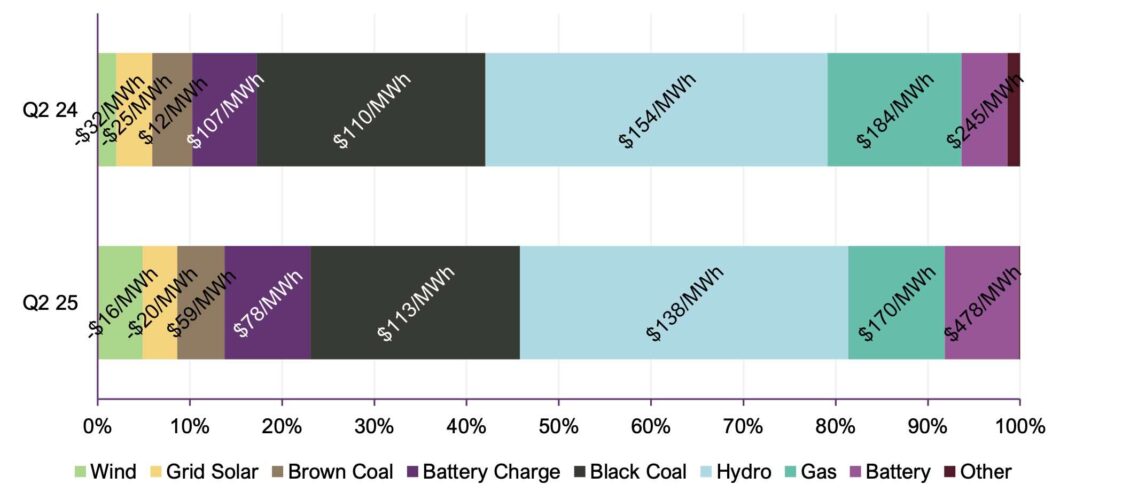

According to the Australian Energy Market Operator, battery discharge set prices at an average of $478/MWh this quarter, almost double the $245/MWh average in same period last year.

That is nearly three times the average price set by gas generators, and 3.5 times that of hydro. The NEM-wide price spread for batteries – the difference between the cost to charge and the price achieved in discharge – rose to $342/MWh, up from $157/MWh in the same quarter last year.

It’s perhaps proof, if any was needed, that the owners of big batteries will not behave any differently from the owners of peaking gas and pumped hydro.

And that’s largely because they are one and the same group, the same oligopolists who have dominated the grid for decades, and they are not about to break their addiction to unchecked market power.

How quickly times change. The owners of the original Tesla big battery at Hornsdale were keen to boast of the significant savings achieved by breaking the fossil fuel cartel’s control of the frequency control market.

It was hoped that more grid batteries could do the same in the overall wholesale market, but the fossil fuel cartel has responded by buying control of the batteries, or building their own. And it is not entirely clear that the independent owners of other batteries are behaving any differently.

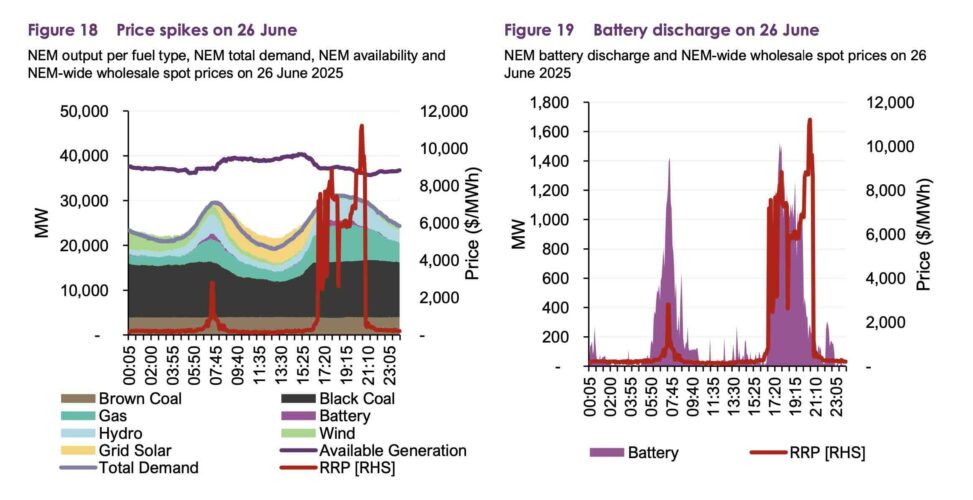

The latest edition of AEMO’s Quarterly Energy Dynamics report, which covers the June quarter, focuses on three very high priced days in the month of June itself, one of them where big batteries were the price setter in 80 per cent of the high priced events above $10,000 MWh.

The domination of big batteries was only diminished when their storage was depleted, AEMO says, and it notes that gas peakers set the price on just 13 per cent of the intervals, and coal fired power for the rest of these high priced events, usually late in the evening.

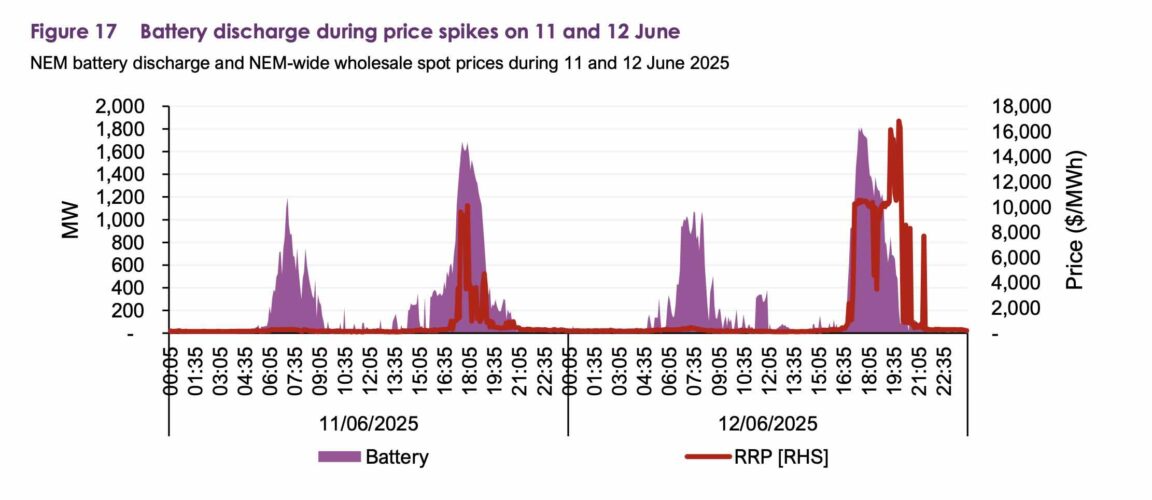

One the other two days of notable price spikes, June 11 and 12, the big batteries set the price on half the occasions that the spot price soared above $10,000/MWh, again in the evening peaks. The average NEM-wide price for June 12 – over the whole day – was $1,610, the highest recorded daily price in NEM history.

And it is important to note here that AEMO insists that these high priced events did not reflect any supply shortfalls.

The battery owners simply took advantage of a lack of competition, multiple coal plant outages, network issues on some occasions, and low wind on other occasions. These high price events usually occurred in the evening peak when the sun had set and solar stopped producing.

Mostly it was about the exercise of market power, and its impact on the market was dramatic. Were it not for these few hours of very high prices, average energy prices would have been lower in the June quarter in all regions, AEMO says, largely because of the growth of low cost renewables in a quarter that saw several records fall for wind and solar output.

“During the quarter there were 2,614 intervals across the five NEM regions where spot prices exceeded $300/MWh, with almost half of these (46%) occurring on 11, 12 and 26 June,” AEMO notes.

“Overall price volatility (spot prices above $300/MWh) contributed $37/MWh, or 26%, to the NEM-wide quarterly average spot price of $140/MWh.” AEMO said the price volatility on the evenings of 11, 12 and 26 June contributing $32/MWh or 23% of the total average spot price.

The batteries themselves enjoyed a near five-fold increase in net revenue from energy arbitrage to $120.8 million in the June quarter. Revenue from frequency control, once the dominant feature of the first battery storage projects, totalled just $9 million.

However, given that it is the big market players that now own or control the output of the bulk of the big battery projects operating on the NEM, it is also important to note that the benefits would have also flowed through to the rest of their portfolio.

All generators receive the same price, so a utility with a big battery and a bunch of coal fired power stations would have enjoyed huge benefits.

The Australian Energy Regulator, which is supposed to be policing the wholesale markets, wrote in its own report – also released on Thursday – that the 66 high priced events (which it defines as 30 minute prices above $5,000/MWh) was the second highest number on record.

“A combination of factors including coal generator outages, low wind output, high demand, interconnector limitations and rebidding behaviours drove these events, pushing prices above the $5,000 per megawatt hour threshold,” said deputy chair Justin Oliver.

The AER report makes only a passing reference to the bidding behaviour of battery storage, noting that it had set the price more often, but did not make any particular remark about their bidding behaviour in the evening peaks.

It did note, however, that the average level of coal generation capacity unavailable in the NEM due to planned and unplanned outages in the June quarter increased by 28 per cent (716 megawatts) compared to the same quarter last year.