The prospect of climate change-caused weather making renewables uninsurable is beginning to put the Australian industry on edge, as US insurers rejig their terms following major hail damage.

In 2019, US insurers were on the hook for $70-80 million of losses, following hail storms that damaged some 400,000 solar panels in west Texas.

The result is insurance premiums spiking by more than 50 per cent for solar farms in the US over the last 12 months, according to Bloomberg, and some insurers trying to reclassify all storms as “severe” storms and therefore aren’t covered.

“We’re starting to look at our first solar farms in Australia and what we’re seeing are some trends overseas that we’re fully expecting will be replicated over here [largely around flooding and hail,” says Engie ANZ head of portfolio growth and commercial Anna Hedgcock.

“We’re starting to look at how we manage this. Insurers are getting increasingly tight on what they will cover and there’s a point where the premiums become unpalatable.”

She says many insurers are craving out flood risk entirely and won’t cover projects at all, and although a similar conversation has started in Australia the situation hasn’t moved towards uninsurability, yet.

“But these issues are getting harder to address, because these weather events are just getting more frequent and unpredictable,” she says.

“It must be a holistic discussion. There needs to be more industry discussion. Because if banks and insurers are saying no, I don’t want to take on that risk, it becomes very difficult for us or EPC contractors to take on projects.”

Last year, large scale solar contractor Sterling and Wilson said “torrential” rains were part of the reason why margins were lower than expected.

Uninsured

In Australia, there are murmurs that insurers are climbing aboard the risk-averse trend.

James Butcher, engineering manager for solar panel tracking company Nextracker, says he’s heard of projects here that haven’t been able to get the kind of insurance coverage they’ve wanted, particularly in NSW in areas seen to be more affected by hail storms.

“From that standpoint I think it certainly presents as a real risk to project owners or developers around developing projects, bringing it through to construction and delivery, then facing this insurance hurdle,” he says.

Furthermore the issue raises other questions around who must share the risk of bad weather, particularly in the case of solar panels which are more vulnerable to bad weather: should offtakers bear some of that if a generating asset is knocked offline for longer than expected by a storm?

Insurers know it’s coming

Insurers in Australia are not unaware of what climate change means for the weather. But they haven’t faced the kind of payouts seen in the US yet.

In 2020, insurer IAG produced a 135 page report that outlined the changes in weather caused by a more variable climate, as it tried to push the country into preparing for the worst.

The number of tropical storms is falling, but the ones that do happen are more powerful and, as seen during the floods in NSW and Victoria last year, can be extremely destructive in unexpected ways.

Furthermore, the subtropical zone is expanding poleward as warmer, more energetic air is thrust higher in the atmosphere over the tropics and therefore returns to earth further south than it used to. Combined with warmer oceans off south-east Queensland and New South Wales, cyclones retain their intensities further south and to penetrate further inland.

The IAG report said planning for the inland penetration of tropical cyclones must take into account much more rain, more flooding and flash flooding, and heavier winds driving rainfall, even in places that overall are becoming drier.

“Rainfall intensities across southern Australia have increased up to 14 per cent per degree of increased temperature, and 21 per cent for the tropical regions. Storm rainfall totals from both east coast lows and tropical systems are expected to increase significantly,” the report said.

It’s expecting more bushfires across the country that are of higher severity, during longer bushfire seasons.

And south-eastern Queensland and north-eastern and eastern New South Wales should expect more frequent “large to giant hail events” with these types of storms becoming more common further south.

Last year, the insurer said it expects major hail events to increase in number in every capital in Australia. However, despite spending a decade pelting solar panels with a hail canon, IAG is yet to find a solution to that problem.

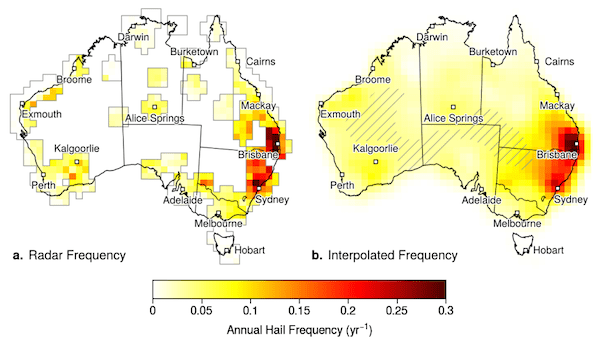

A preprint (a research paper that hasn’t yet been peer-reviewed) published in June by the BOM and the University of Queensland, found that Australia’s most severe hail events are clustered in the coastal and inland region from Sydney to just north of Brisbane.

These zones capture a number of NSW’s Renewable Energy Zones (REZs) and the locations of major wind and solar projects.

What can developers and project owners do?

Engie is looking at parametrics to cover itself for freak events, or carving out events like hail or floods from its regular coverage and getting bespoke cover for those, Hedgcock says.

It’s also looking at technological improvements and changes to manage the risk, such as ideas like that provided by Nextracker which monitors weather and then tells solar panels to tilt away from a storm.

Butcher says his company is trying to convince insurers not to be technology agnostic in this respect and put blanket conditions on projects in specific locations.

One type of equipment may not protect assets to the same degree as another, and projects that spend top dollar ensuring the “survivability” of their solar farm shouldn’t be forced into a riskier insurance catagory.

But there is a case to be made that insurers, banks, off takers and EPCs need to have a higher risk tolerance in order to meet Australia’s high renewables energy targets and requirements given the expected closures of coal-fired power plants.

“You’ve got what you call this cruel irony. Renewable assets including large scale solar have to be built for Australia to meet its net zero transition target and tackle the climate change issue.

“But unfortunately where you can and should locate those projects are in areas where they will be subject to extreme weather as a result of climate change,” Hedgcock says.

“It’s more of a call to arms that we need to come together and address how we will address it because it’s not something we can cover ourselves.”

Note: The issue will be discussed in details at a panel on Day 1 of All Energy, from 11.20am-12.40pm in room 213, titled Big Solar’s Coming, Rain Hail or Shine.