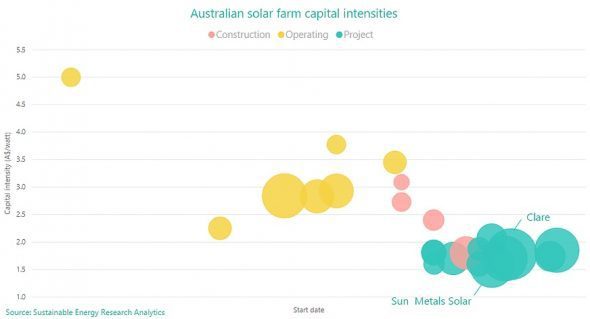

The capital intensity per watt of the utility scale solar plants in the current development pipeline in Australia is about half that of those that are already operational.

The stark and rapid improvement in the economics of big solar in the country is due to global declines in component costs, but also importantly declining EPC (construction) costs and the deployment of yield-boosting technology like tracking.

With the pipeline of utility scale PV projects growing seemingly on a daily basis, Sustainable Energy Research Analytics (SERA) believes that solar’s increasing competitiveness is due to a large part to a more competitive and efficiency EPC landscape.

“A couple of years ago in Australia, there was only one solar EPC contractor, and now we are looking at close to 15,” says SERA Managing Director Gero Farruggio. “So it is the increasing competition but also the increasing knowledge and experience gains which are allowing them to deliver a lower cost here in Australia.”

Farruggio notes that as more companies more into the solar EPC business and hire grow their solar teams and expertise, economies of scale are the result.

A reasonably flat construction market, particularly in the wake of the receding mining boom, has additionally resulted in an EPC landscape in which companies are hungry for new project business.

One further consequence of the sector’s experience gains beyond lowering cost is that the next wave of PV power plants in Australia will deliver improved yields.

“It is falling cost but it is also better output and better installations as well,” says Farruggio.

SERA’s project database reveals that of the 202MW of utility scale that it expects to be completed in 2017, around 87% of that will deploy tracking technology.

Alongside tracking, more efficient park design and installation techniques, and higher efficiency modules are all driving costs down. Next generation technologies such as intelligent weather monitoring and forecasting also have the ability to improve future project economics, SERA notes.

SERA believes that given solar’s rapidly increasing competitiveness, a pipeline of some 4GW of utility scale PV is conceivable over the next five years, with 2018 marking the inflection point, when over 800MW likely to be installed.

“Australia has benefitted from a number of grants over the last couple of years that has allowed some projects to get off the ground,” says Farruggio.

“The intention of those grants was to stimulate the industry and to build the momentum and to reduce costs and it has achieved that. What has surprised people is the rate of change of these cost reductions. We always expected that the solar cost would be coming down but it is the rate of change [that has been surprising].”

As impressive solar’s increasing competitiveness has been, big PV’s capital intensity in Australia, as calculated by SERA, remains around double that of leading projects in the Dubai and Chile.

SERA deploys the B1 breakeven metric, the merchant power or PPA price required to cover all costs and deliver a positive net-present value, for its calculations. The B1 metric takes into account government grants and financing, and any subsidies that can often apply to such headline-capturing projects.

Nonetheless, the outlook for large scale PV is, in SERA’s opinion, bright.

“It is a step forward, and that in itself is going to be an incredible catalyst for the industry.”