Australian companies continue to turn to wind and solar to cut their energy costs, with the market for corporate power purchase agreements (PPA) setting new records in 2020, according to consultancy Energetics.

Energetics has been tracking Australia’s corporate PPA market since 2016, and while the market had been relatively subdued in 2019, it has enjoyed a staggering recovery, setting a new record with almost 3,500MW of new wind and solar projects securing corporate PPAs so far in 2020.

This is a huge jump from around 700MW of corporate PPAs signed in 2019, which had been a much slower year following a strong 2018, as the market hit headwinds caused by grid connection difficulties for new projects and policy uncertainty contributed to sluggish investment.

Corporate PPAs have emerged as an effective way for corporations to manage their electricity costs, by entering into off-take agreements directly with wind and solar projects, taking advantage of lower wholesale electricity prices. It’s also been a saviour for the wind and solar industry.

While companies can be constrained by the amount of solar and wind projects that can be located directly on-site, power purchase agreements allow companies to purchase renewable electricity from large-scale projects built anywhere within the electricity system.

Energetic’s lead advisor on corporate renewable PPAs, Anita Stadler, told RenewEconomy that companies were motivated to seek out supplies of renewable electricity as a way to both manage their energy costs, to shield themselves from energy price volatility while at the same time working to reduce their emissions footprint.

Stadler said that there had been minimal slowdown in interest for corporate renewable PPAs during the recent period impacted by Covid-19, with both company staff and shareholders upping the pressure on bigger companies to actively manage their climate change risk exposure.

According to the Energetics tracker, almost 7,500MW of electricity generation capacity has secured corporate off-take agreements since 2016, with more than four-fifths of this capacity being sourced from wind and solar projects.

The strong uptake of corporate renewable PPAs throughout 2020 saw records broken for both the amount of new capacity secured under off-take contracts, as well as the total amount of deliverable electricity generation contracted.

In 2020, around 2,200GWh of wind and solar supplies were secured under corporate PPAs, beating the previous record set in 2017, which was just below 2,000 GWh.

Different purchase arrangements are available, allowing companies to either purchase electricity directly from projects or allowing companies to enter into hedging, or contract-for-difference, contracts that help companies lock in fixed prices for their electricity.

Contracts may or may not include rights to renewable energy certificates created by a wind or solar project, which can raise questions around the additionality of the investment in terms of renewable energy targets.

The corporate PPA market in Australia has grown considerably, with companies seeking to both directly manage their energy costs, as well as working towards meeting clean energy commitments under initiatives like RE100, which encourages larger corporations to commit to sourcing 100 per cent of their electricity use from renewable sources.

Companies including BHP, Telstra, Coles, the Commonwealth Bank and Transurban, along with the CSIRO, local councils and a number of universities have all secured renewable energy PPAs in the last few years.

Stadler added that there was a growing maturity in the way that corporate renewable PPAs were being structured, including an increased role for electricity retailers to act as an intermediary between large energy users and wind and solar projects.

Energetics tracks Australian corporate PPAs as they are announced, observing a resurgence of interest across 2020, led by a major deal struck by resources giant BHP and and supermarket chain Coles to purchase power from the Macintyre wind farm and the Western Downs solar project. The deals had been facilitated by Queensland government owned CleanCo.

“From just one deal concluded in 2016, corporate PPAs have supported projects with a combined capacity of nearly 7500 MW, of which more than 6000 MW enabled new wind and solar projects to be developed. This is an extraordinary contribution,” Energetics associate Anita Stadler said.

“To provide some perspective of the importance of corporates in the growth in renewable energy, the Clean Energy Regulator (CER) in their most recent annual Renewable Energy Target (RET) report noted ‘77% of the total large-scale renewable project pipeline” was underpinned by corporate PPAs’.”

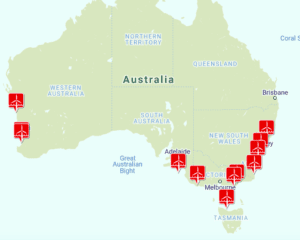

Energetics said that New South Wales had overtaken Victoria has the host of the highest proportion of corporate PPAs, with around 32 per cent, or 2,400MW of projects under contract. Victoria and Queensland each shared a similar proportion of corporate PPAs with around 29 per cent of corporate PPA capacity in each state.

Energetics said that around 50 per cent of the projects that have been signed under a corporate PPA have been large-scale solar projects, 45 per cent have been wind projects and the remaining 5 per cent of corporate PPAs have been a mix of the two technologies.